Supplementary unemployment benefit plan (SUBP)

- CPP contributions. Payments received under a supplementary unemployment benefit plan (SUBP) that does not qualify as a SUBP under the Income Tax Act, such as maternity and parental top-up amounts ...

- EI premiums

- Income tax. ...

- Reporting. ...

What are the benefits of a PPO plan?

- Preferred provider organization plans offer more flexibility than other types of plans.

- PPOs are the most common type of employer-sponsored health insurance plans.

- Getting out-of-network care usually costs more and may mean more paperwork for you.

- PPOs have higher premiums than other types of plans.

Should you have a supplemental retirement plan?

A supplemental retirement plan gives your top employees a chance to save more once they’ve maxed out their contribution to a qualified plan, which can increase engagement and retention. As the employer, you’ll have the flexibility to choose either a fixed-dollar benefit amount or a formula-based benefit amount for your employees, based on ...

Will This supplemental benefit be taxable?

Supplemental Unemployment Benefit Plans are legally defined as a tax-exempt, Section 501 (c) (17) plan or trust. SUB plan benefits are not considered wages, which qualify for Federal Insurance Contributions Act (FICA) tax. However, while SUB plans are exempt from FICA tax, they are generally subject to federal and state income tax.

Which pension plan is the best plan?

Those include:

- Railroad employee benefits

- Thrift Savings Plans (TSP)

- Defined benefit pension plans

What is supplemental benefit mean?

Supplemental Benefits means benefits, other than Health Benefits, provided to Employees, including, but not limited to: fair and reasonable vacation allowances, sick leave, holiday, jury duty, birthday, welfare, retirement and non-occupational disability benefits, life, accident, or other such types of insurance, but ...

What are some supplemental benefits?

Some of the most common supplemental benefits are visits to the optometrist, hearing aids, dental care, and reimbursement for fitness costs (such as a gym membership).

What are Medicare approved supplemental benefits?

Some commonly offered supplemental benefits are dental care, vision care, hearing aids, and gym memberships. Most supplemental benefits must be primarily health-related.

What is the purpose of supplemental life insurance?

Supplemental life insurance is a life insurance policy that can be purchased in addition to a traditional life insurance policy. It's a way to expand your existing life insurance coverage if it's insufficient to cover your family's financial needs in the event of your death.

How do supplemental benefits work?

Overview. Supplemental benefits products are insurance policies that provide financial protection against expenses associated with accidents or illnesses not covered by major medical insurance.

Who would benefit from supplemental insurance?

Supplemental health insurance can be an added layer of protection used to cover what a traditional health insurance plan does not. It can also help pay for nonmedical expenses that can go with illness or injury, such as lost income or childcare.

What is the difference between a Medicare Advantage plan and a Medicare supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Can I cash out my supplemental life insurance?

Most employee supplemental life plans offer term coverage which does not build cash value and cannot be cashed out later on.

What's the difference between life insurance and supplemental life insurance?

Basic life insurance policies are typically free and cover one or two times your annual salary. Your employer pays the premiums. Supplemental life insurance policies have higher coverage limits, but you typically pay the premiums.

What happens to supplemental life insurance when you leave a job?

Supplemental life insurance policies are generally job dependent: When you leave your job, you lose the coverage. However, some companies allow you to “port” coverage, meaning you continue to buy the group life insurance after you've left the job.

What is Supplemental Benefits?

Supplemental Benefits means benefits, other than Health Benefits, provided to Employees, including, but not limited to: fair and reasonable vacation allowances, sick leave, holiday, jury duty, birthday, welfare, retirement and non - occupational disability benefits, life, accident, or other such types of insurance, but excluding Health Benefits.

Can a household be eligible for Supplemental Benefits?

A Household may be eligible for Supplemental Benefits if available.

Do Supplemental Benefits change?

However, in the event the premium cost and/or level of coverage shall change for all management employees with respect to Supplemental Benefits, the cost and/or coverage level, likewise, shall change for the Executive in a corresponding manner.

Why do you need a supplemental plan?

You might think about a supplemental plan if you know that you couldn't afford the costs of long-term care, or the loss of income if you were diagnosed with something like cancer. Long-term care or critical illness plans may be worth thinking about in these cases.

What is supplement insurance?

Supplemental health insurance helps to pay for healthcare costs that aren't typically covered by traditional health insurance. Some cover specific situations, like hospital or disability insurance, while others cover specific health conditions like cancer. Learn more about these policies and how they work.

How Does Supplemental Health Insurance Work?

Supplemental health plans may pay benefits to either the insured person or to the health care provider. The amount that's paid and how it's paid out will depend on the plan. These are a few types of supplemental health policies and how they work.

What is accidental death insurance?

Accidental Death and Dismemberment Insurance. This type of insurance typically reimburses you for medical costs resulting from accidents. Benefits are paid to your beneficiaries if you die. Premiums are usually low, and no medical exam is required.

What is a cash benefit plan?

This type of plan provides a daily, weekly, or monthly cash benefit if you are hospitalized. There is often a minimum hospital stay before benefits will be paid. The cash benefit is paid to you. It is in addition to any other insurance you may have. 4

What are some examples of health plans?

Examples of these health plans include dental plans, critical illness plans, and vision plans. They include disability plans, long-term care plans, and travel insurance for health care coverage when you are outside your health plan network.

Do you need a dental plan?

Whether you need this type of health plan depends on your risk factors. You should also think about the cost of the premiums, how much insurance you want to carry, and what you want to be insured for. You may decide that a dental plan is worth buying if you think that your children will need it to cover orthodontic care in the coming years.

What are the common expenses covered with health insurance supplements?

If costly life expenses pop up for your employees, a supplemental health insurance policy can help. Employers may offer them as a voluntary benefit, or your employees can purchase a plan directly from an outside insurance company or the health insurance marketplace.

Can employees purchase their own health insurance supplement?

If you’re not looking to purchase supplemental insurance for your entire company, that’s okay too. Your employees can purchase individual supplemental policies that they need to cover their own specific needs based on their own circumstances. Depending on the type of plan they want, they may not need to wait until the annual open enrollment period to purchase their supplemental plan.

What is a SUB plan?

What is a Supplemental Unemployment Benefits (SUB) Plan? A Supplemental Unemployment Benefits (SUB) plan is an employer-sponsored benefit that provides severance pay to employees who involuntarily lose their jobs such as through layoff, reduction in force, or plant closing. Payments funneled through the SUB plan are made in addition to ...

Why do employers use sub plan?

In an economic downturn, employers may find it easier to make installment payments via the SUB plan instead of having to come up with a lump-sum severance payment.

Can a discharged worker receive unemployment benefits?

Therefore, to receive SUB plan payments, discharged workers must qualify for unemployment benefits under state law. A SUB plan can be funded by the employer or the employee or both. The plan payments make up the difference in the discharged workers’ state unemployment compensation and their prior regular weekly income.

Do former employees qualify for unemployment?

Former employees do not have to qualify for state unemployment benefits in order to receive traditional severance pay. However, to obtain SUB plan payments, the employee must be eligible for state unemployment benefits. In some cases, a SUB plan can extend eligibility to discharged workers who are no longer receiving state unemployment benefits.

Who reaps tax savings from the sub plan?

Both the employer and former employee reap tax savings from the SUB plan.

Can a sub plan extend unemployment benefits?

In some cases, a SUB plan can extend eligibility to discharged workers who are no longer receiving state unemployment benefits. Traditional severance pay may lower the amount of state unemployment benefits the discharged worker receives or render the worker ineligible for unemployment. Conversely, SUB plan payments generally do not affect state ...

What is Medicare Advantage?

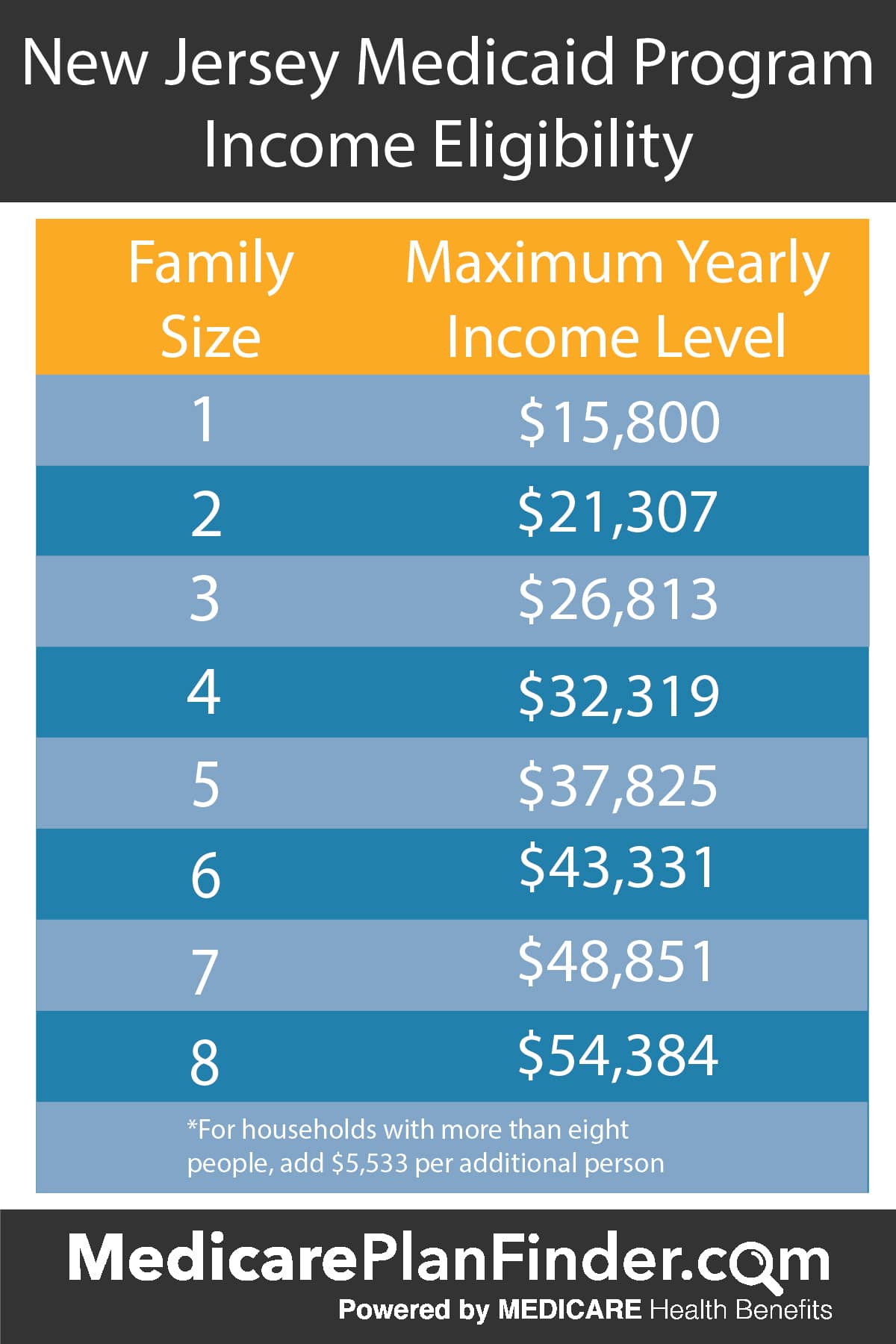

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

What is supplemental retirement plan?

A supplemental executive retirement plan, or SERP, is a non-qualified deferred compensation plan offered by a company to its executives or other highly paid employees.

How does a defined benefit SERP work?

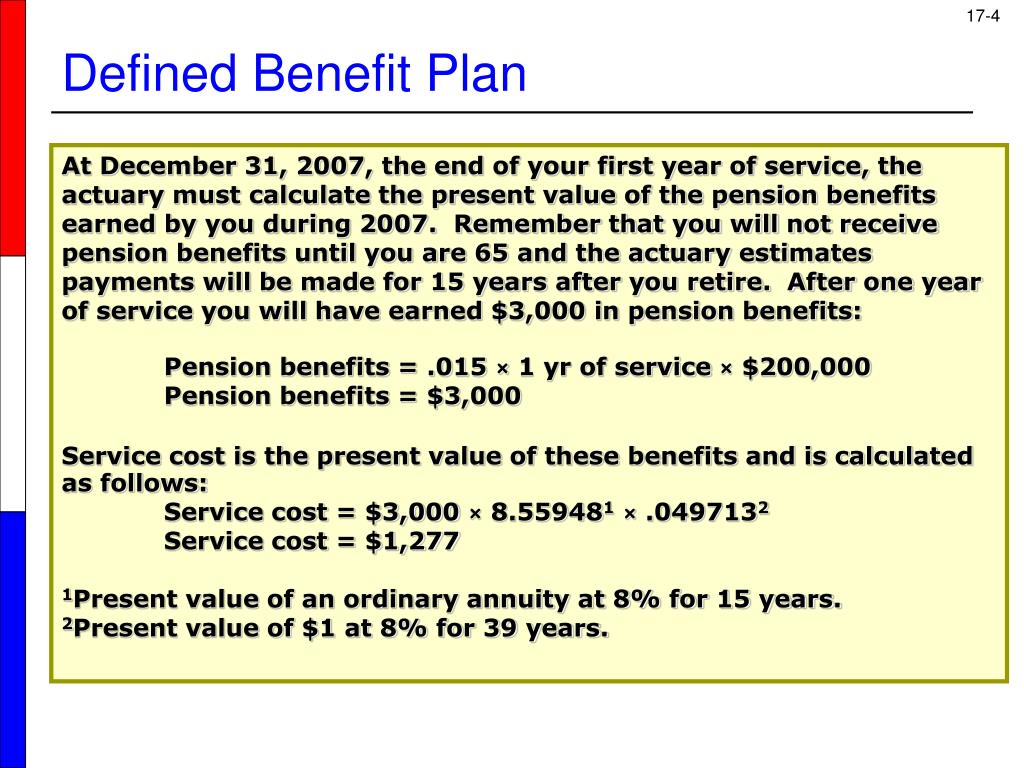

With a defined-benefit SERP, which is the most common, the employer usually chooses the amount of the benefit using a flat dollar amount or a percentage of the worker's average final pay. The firm pays that amount over many years. Payments starts when the person reaches retirement age. 2.

Why do firms offer SERP?

As such, firms might offer a SERP as part of key workers' benefits packages to convince them to stay for a long period of time. The SERP serves as an added benefit for the worker and some security for the firm that wants to keep that person around.

Why do qualified retirement plans require testing?

Qualified retirement plans require testing to ensure that firms don't exceed contribution limits and that workers don't exceed plan limits. But a non-qualified plan like a SERP doesn't require the fairness test and doesn't have contribution or plan limits. 5 2

When do pension payments start?

Payments starts when the person reaches retirement age. 2. Another deal is a defined contribution plan where the firm puts funds into an account for certain workers until it's time for them to retire. This functions much like a pension plan.

Is Linda's death benefit tax deductible?

When Linda begins to receive her benefits at age 61, they will be taxable to her and tax-deductible to her company for each year that they are received. When Linda passes away, Company ABC will receive her death benefit tax-free. A SERP is said to work like golden handcuffs.