Survivors benefits, or a “widow's pension” as it’s sometimes called, refer to monthly Social Security payments made to the family members of a wage earner who has died. This income can help keep family finances on even footing during a very difficult time.

What percentage of Social Security does a widow receive?

- A widow or widower over 60.

- A widow or widower over 50 and disabled.

- Surviving divorced spouses, assuming the marriage lasted at least ten years.

- Widow or widower who is caring for a deceased child who is either under 16 or disabled.

How to calculate SSA survivor benefits?

There are three basic steps:

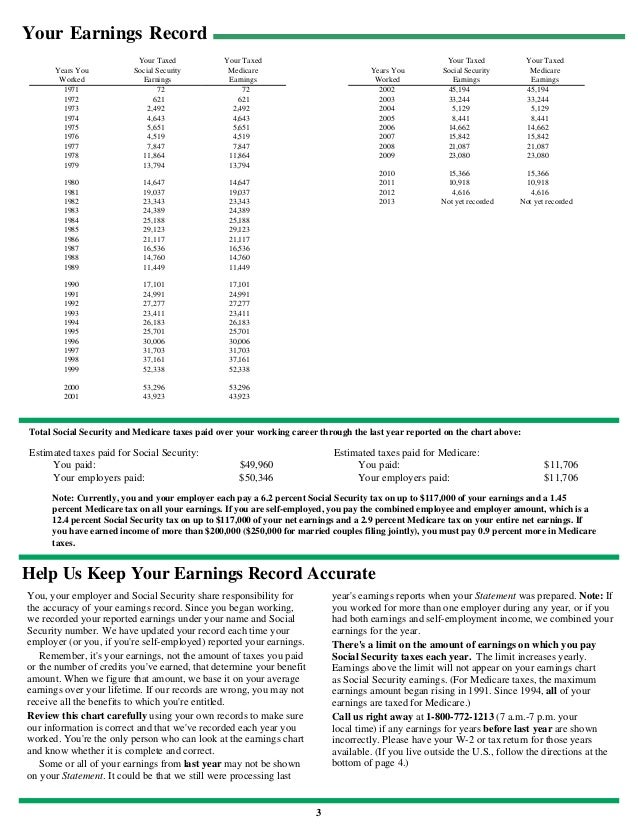

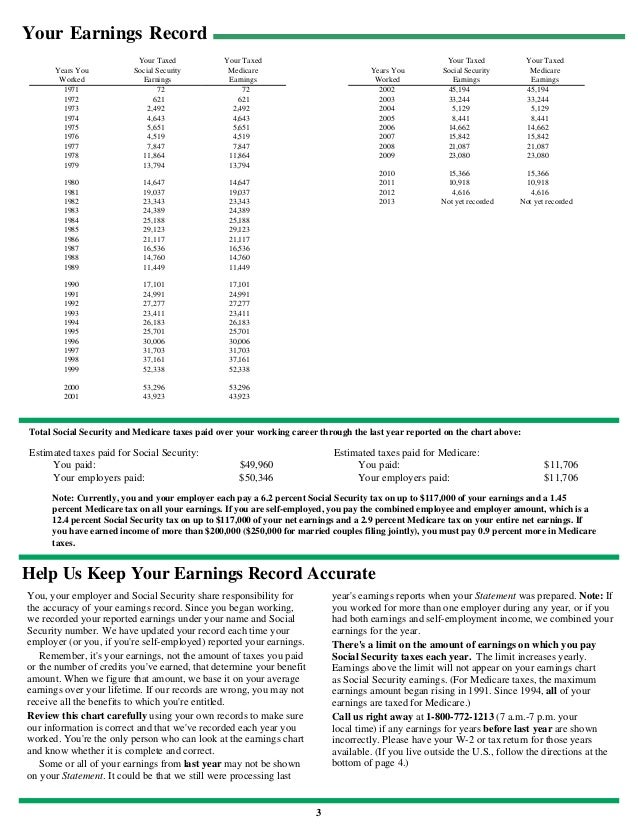

- Adjust historical earnings for inflation.

- Get monthly average from the highest 35 years

- Apply monthly average to benefits formula

Who qualifies for Social Security survivor?

- Widows and widowers typically get Social Security survivor benefits when their spouse dies.

- LGBTQ+ widows and widowers were historically denied survivor benefits, but they are now available as of February 2022.

- Mention emergency message codes EM-21007 SEN REV, code 529 and EM-20046 SEN REV 2 for faster service at Social Security field offices.

How are Social Security survivor benefits calculated?

You can expect the following when applying for Social Security spousal benefits:

- You can receive up to 50% of your spouse’s Social Security benefit.

- You can apply for benefits if you have been married for at least one year.

- If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years.

- Starting benefits early may lead to a reduction in payments.

What percentage of Social Security benefits does a widow receive?

Widow or widower, full retirement age or older—100% of your benefit amount. Widow or widower, age 60 to full retirement age—71½ to 99% of your basic amount. A child under age 18 (19 if still in elementary or secondary school) or has a disability—75%.

What is the difference between survivor benefits and widow benefits?

While spousal benefits are capped at 50% of your spouse's benefit amount, survivor benefits are not. If you're widowed, you're eligible to receive the full amount of your late spouse's benefit, if you've reached full retirement age. The same is true if you are divorced and your ex-spouse has died.

When my husband dies do I get his Social Security and mine?

Social Security will not combine a late spouse's benefit and your own and pay you both. When you are eligible for two benefits, such as a survivor benefit and a retirement payment, Social Security doesn't add them together but rather pays you the higher of the two amounts.

When Can a widow receive her husband's Social Security benefits?

age 60The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

How do you qualify for widow's benefits?

Who is eligible for this program?Be at least age 60.Be the widow or widower of a fully insured worker.Meet the marriage duration requirement.Be unmarried, unless the marriage can be disregarded.Not be entitled to an equal or higher Social Security retirement benefit based on your own work.

How long does a widow receive survivor benefits?

for lifeWidows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

What happens when both spouse's collect Social Security and one dies?

Many people ask “can I collect my deceased spouse's social security and my own at the same time?” In fact, you cannot simply add together both a survivor benefit and your own retirement benefit. Instead, Social Security will pay the higher of the two amounts.

Can you collect 1/2 of spouse's Social Security and then your full amount?

Your full spouse's benefit could be up to one-half the amount your spouse is entitled to receive at their full retirement age. If you choose to begin receiving spouse's benefits before you reach full retirement age, your benefit amount will be permanently reduced.

Should I take widows benefits at 60?

If both payouts currently are about the same, it may be best to take the survivor benefit at age 60. It's going to be reduced because you're taking it early, but you can collect that benefit from age 60 to age 70 while your own retirement benefit continues to grow.

Can I collect my deceased husband's Social Security and still work?

No! The restoration of benefits lost to the earnings test is associated with the specific benefit you're filing for. In your case, it's a survivor's benefit. So, any future restorations will be to your survivor's benefit.

Is a widow considered married or single?

Although there are no additional tax breaks for widows, using the qualifying widow status means your standard deduction will be double the single status amount. Unless you qualify for something else, you'll usually file as single in the year after your spouse dies.

What is maximum Social Security benefit?

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364. If you retire at age 70 in 2022, your maximum benefit would be $4,194.

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

How old do you have to be to be a widow?

A widow or widower age 60 or older (age 50 or older if disabled).

What happens if the sum of the benefits payable to family members is greater than this limit?

If the sum of the benefits payable to family members is greater than this limit, the benefits will be reduced proportionately. (Any benefits paid to a surviving divorced spouse based on disability or age won't count toward this maximum amount.)

How much is a lump sum death payment?

A one-time lump-sum death payment of $255 can be paid to the surviving spouse if he or she was living with the deceased; or, if living apart, was receiving certain Social Security benefits on the deceased’s record.

How do survivors benefit amounts work?

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be.

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

What happens if you die on reduced benefits?

If the person who died was receiving reduced benefits, we base your survivors benefit on that amount.

What to do if you are not getting survivors benefits?

If you are not getting benefits. If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

How old do you have to be to get a mother's or father's benefit?

Mother's or Father's Benefits (You must have a child under age 16 or disabled in your care.)

Can you collect survivors benefits if a family member dies?

You may receive survivors benefits when a family member dies. You and your family could be eligible for benefits based on the earnings of a worker who died. The deceased person must have worked long enough to qualify for benefits.

Can you get survivors benefits if you die?

The Basics About Survivors Benefits. Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

Can you report a death online?

However, you cannot report a death or apply for survivors benefits online. In most cases, the funeral home will report the person’s death to us. You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, ...

What are widow benefits?

Also known as Social Security spousal survivor benefits, these funds help individuals supplement their income after their husband or wife passes away.

How much does a widow get from Social Security?

Since Social Security widow benefits pay up to 100% of the deceased’s benefits, you can calculate the amount using the same formula. For example, let’s say that your spouse had an average salary of $50,000 per year during their working life. Your benefits will likely look something like this:

What is the age of a widow?

A widow or widower who is caring for the deceased’s child (under 16 years of age or receiving disability benefits) An unmarried child of the deceased who is either: 18 years of age or younger. Disabled, with the disability occurring before the age of 22.

How old do you have to be to get spousal benefits?

To qualify for this spousal benefit, you must be at least 62 years of age. For example, let’s say that your spouse began collecting Social Security at 65 and you are currently 62.

How much is my spouse's Social Security benefit reduced?

However, if your spouse chooses to retire and begin collecting benefits early, your spousal benefit could be reduced by as much as 32.5%. This reduction in benefits is negated if you have a child that is 16 years or younger. If you want to learn more about these Social Security spousal benefits, consult the Social Security Administration (SSA) ...

How to contact the SSA about widows?

In any case, you can start the process by calling the SSA at 1-800-772-1213. If you have more questions about your legal rights as a widow, check out our guide to free legal aid in all 50 states! Reader Interactions. This site uses Akismet to reduce spam. Learn how your comment data is processed.

How many work credits do you need to collect Social Security?

Regardless of age, no one requires more than 40 work credits to receive Social Security benefits. When it comes to surviving spousal benefits, the work credit requirements are less stringent.

How much is Lisa's survivor benefit?

Lisa is entitled to receive a full survivor benefit of $2,400 per month at age 66 (her Full Retirement Age), or a reduced survivor benefit of $1,716 per month at age 60. Lisa has also earned her own worker benefit of $1,500 per month at age 62, or $2,000 per month at age 66.

What is the full retirement age for 2020?

In every year leading up to the year Full Retirement Age is reached, $1 in benefits will be withheld for every $2 earned above the limit for that year ($18,240 in 2020).

What is survivor benefit?

A survivor benefit is 100% of the deceased spouse’s Primary Insurance Amount, which is based on contributions the deceased paid into the Social Security system during his or her lifetime. Like the worker benefit, the survivor benefit amount is permanently reduced if started prior to Full Retirement Age. If an individual is widowed and has not ...

When can Lisa draw her survivor benefit?

However, Lisa should consider her other options before making a decision. With the second strategy, Lisa could draw her $1,500 worker benefit at age 62, and then switch over to the full survivor benefit of $2,400 at age 66.

How much does delayed retirement credit increase?

1 Delayed Retirement Credits apply after the Full Retirement Age and increase worker benefits by 8% per year.

When can Lisa take the $1,716?

Using the first strategy, Lisa could choose to take the $1,716 reduced survivor benefit at age 60. On the surface, it might appear that this is the best option because not only is $1,716 higher than the $1,500 worker benefit Lisa is entitled to at age 62, but she can also start it two years earlier.

Can a widow take a survivor benefit?

For a widow or widower whose own worker benefit, if any, is less than that of a deceased spouse , this strategy allows her or him to take the highest survivor benefit possible. There are no Delayed Retirement Credits 1 for a survivor benefit, so it makes little sense to wait past Full Retirement Age to switch to the survivor benefit. ...

Who is eligible for survivor benefits?

Additionally, minor children, dependent parents age 62 or older, and stepchildren or grandchildren may be eligible survivor benefits. For a family member of the deceased to be eligible, the worker who died must have paid into the Social Security system during their career.

How many survivors benefits will be available in 2020?

Six million family members receive survivor benefits as of 2020, and for many it’s a crucial income following the passing of a spouse or parent. The amount a widow or widower receives is variable and depends on the age that the surviving spouse claims. In this article, we will help you understand how much you may be entitled to through survivor ...

How old do you have to be to be married to a deceased person?

You are age 60 or older, and married to the deceased for at least 9 months. Disabled and age 50 or older, and married to the deceased for at least 9 months. Caring for the deceased spouse’s child who is younger than 16 or disabled.

Do widows get Social Security benefits before they reach their FRA?

Many widows and widowers choose to claim survivor benefits before they reach their FRA. If you do so, your monthly benefit will be reduced depending on the number of months prior to your FRA that you claim. For someone born in 1955, whose FRA is 66, we show below the percentage of Social Security benefits that a widow would receive:

Can you claim survivor benefits on Social Security?

Should you one day claim survivor benefits, the amount of your survivor benefit will not simply be added to your other Social Security benefits. Instead, the SSA will compare your earned benefit to your survivor benefit and award you the greater value of the two.

Can a widow receive Social Security if she was born in 1955?

For someone born in 1955, whose FRA is 66, we show below the percentage of Social Security benefits that a widow would receive: Note that unlike Social Security earned benefits (what you receive based on your own earnings), there is no incentive to wait until after your FRA to claim. Your survivor benefit will not increase by delaying your claim ...

How many widows receive Social Security?

The Social Security Administration reports that 5 million widows and widowers receive benefits based on the deceased spouse's earnings record.

What happens to survivors benefits if spouse is deceased?

The survivors benefits are limited to what the deceased would have received while alive.

How long does a divorced spouse have to be married to receive Social Security?

Social Security also provides survivor benefits to a divorced spouse if the marriage lasted 10 years, or if the divorced spouse cares for a natural or adopted child of the deceased who qualifies for benefits. The Social Security Administration reports that 5 million widows and widowers receive benefits based on the deceased spouse's earnings record.

How long do you have to work to get Social Security?

No worker has to have more than 10 years of work history and payment into the Social Security system. Under a special rule, a deceased worker can work 1 1/2 years within the three years prior to death and the survivor can qualify for benefits.

How old do you have to be to collect survivors benefits?

A widow or widower can collect survivors benefits as early as age 60, at a reduced amount. Full retirement age for the survivor is determined by birth date. Age 66 is full retirement age for those born between 1945 and 1954. If the deceased spouse collected benefits before full retirement age while alive, the benefits reflect early retirement ...

When can you cut out a survivor from your benefits?

Autoplay. Brought to you by Sapling. Brought to you by Sapling. Remarriage prior to age 60 can cut the survivor out of survivors benefits unless the marriage ends by divorce, death or annulment.

Can you get Social Security if you die?

If a deceased worker receives retirement or disability benefits at the time of death, Social Security does not require qualification, but will consider the credits already calculated as sufficient for determining survivors benefits. Remarriage prior to age 60 can cut the survivor out of survivors benefits unless the marriage ends by divorce, ...

Why are age widows not included in Social Security?

Aged-widow benefits were not included in the original Social Security Act, but over time few groups have received such sustained and often sympathetic consid-eration by policymakers during the history of the pro-gram. The group is noncontroversial for many reasons: The death of a spouse is beyond one’s control and is naturally addressed through social insurance mecha-nisms, and advanced age will often not allow for these widows to financially adjust to the loss of a spouse. Even today, proposals routinely call for increased benefits for aged widows. The policy attention has achieved results: Social Security benefit increases have clearly played a role in the dramatic reductions in poverty among widows.

When did disabled widows get Social Security?

Disabled widow benefits were added to Social Secu-rity in 1968, following a recommendation of the 1965 Social Security Advisory Council and a request by President Johnson as part of a set of proposals out-lined in a special message to Congress. The advisory council’s recommendation and the president’s proposal were somewhat general, but Congress legislated a tightly defined benefit structure. Kingson and others (2007) argue that cost considerations and uncer-tainty about the effects of a new type of benefit were important motivations behind the initial congres-sional focus on a narrow benefit structure. The initial requirements follow.

What is the current policy discussion over Social Security benefits?

At a specific level, there has been considerable discussion about certain features of the 1972 amendments (and subsequent legislation) that establish a link between the retirement decisions of workers and the benefit amounts received by their widows.

What was the original widow's benefit rate?

The original benefit rate for aged widows was set, by the amendments of 1939, at 75 percent of the basic benefit of the deceased worker, but discussion before the amendments reflected uncertainty about what the appropriate rate should be. Some policymakers believed a widow needed a benefit that equaled that of the deceased worker (100 percent), but others argued that the homemaking skills of women would allow them to get by with a smaller amount. The issue was crystallized by a question posed by Douglas Brown at a 1938 Social Security Advisory Council meeting:Can a single woman adjust herself to a lower budget on account of the fact that she is used todoing her own housework whereas the man has to go to a restaurant?

What were the issues with Social Security in 1935?

The policy discussions regarding aged widows in the years following the 1935 Social Security Act centered on two issues: whether to provide monthly benefits to widows and, if so , the appropriate benefit rate . The first of those issues was settled quickly as monthly widow benefits were added to the program with the amendments of 1939. However, the latter issue was the focus of policy discussions that lasted several decades. Those policy discussions produced the current-law framework for aged-widow benefits, resulting in the relatively high benefit rates and monthly benefit amounts reported in the previous section of this article. In addition, the historical policy debate has framed both policy and program discussions about benefit rates in the current period. Finally, the discus-sions over the benefit rate reflect a general concern of policymakers regarding the economic well-being of aged widows. This underlying concern has also produced several specialized provisions in the law that are nonetheless important to the economic security of a large number of widows.

Do widows get Social Security?

Though specialized, these provisions often affect large numbers of widows and, collectively, are part of the reason widows receiving Social Security are no

What is the age limit for Social Security for a widow?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age is age 60. If you start receiving survivors benefits at age. 60, you will get 71.5 percent of the monthly benefit because you will be getting benefits for an additional 72 months.

Can you match your full retirement age for survivors benefits?

Reminder: Your full retirement age for retirement benefits may not match your full retirement age for survivors benefits.