What does annual maximum mean for dental insurance?

The annual maximum on your dental insurance plan is the total amount of money that your dental insurance provider is willing to pay out for your dental care needs in a one-year period. In some cases, a dental insurance provider will place a limit on the total amount it’ll pay out over the course of your life.

What does annual maximum benefit mean?

The annual maximum refers to the maximum amount the dental benefits provider like Delta Dental will pay out in one plan year. Conversely, the “out-of-pocket maximum” refers to the maximum amount you, the member, will pay in one plan year. Your plan has an annual maximum of $1,500.

What is the best dental insurance with no waiting period?

Dental Insurance With No Waiting Period:

- cleanings

- fluoride treatments

- fillings

- X-rays

- extractions

- root canals

- crowns

What does annual maximum dental mean?

Annual maximums and deductibles are common in many health plans, including dental plans. An annual maximum is the maximum dollar amount a dental benefit plan will pay toward the cost of dental care within a specific period, usually a calendar year.

What is an annual max benefit?

Most dental plans have what is called an “annual maximum" or "annual benefit maximum.” This is the total amount of money the dental benefits provider—say Delta Dental—will pay for a member's dental care within a 12-month period. That time period is called a benefit period.

What is an annual maximum?

An annual maximum is the maximum dollar amount your dental insurance will pay toward the cost of dental services and/or treatment in a benefit plan year, typically a 12-month period.

What does plan year maximum mean?

Sometimes referred to as a plan maximum, or maximum amount - a dental annual maximum is the total your dental plan will pay toward your care during any one plan year.

Whats an annual benefit?

Annual Benefit means a retirement benefit payable annually in the form of a straight life annuity. A benefit payable in a form other than a straight life annuity will be adjusted to be the Actuarial Equivalent of a straight life annuity before applying the limitations of this Section 11.2.

What is a good dental deductible?

A dental insurance deductible is the dollar amount you must pay for covered dental services before your dental plan starts to pay. Your deductible amount resets once every 12 months....Dental insurance deductibles – explained.Example Deductible CalculationService cost$250Your total out-of-pocket cost (deductible + balance after plan coverage)$903 more rows

What does no annual maximum mean?

A full coverage dental plan with no annual maximum: No annual maximum means there is no cap on the amount of services your insurance pays for during any given benefit year.

Is Delta Dental good insurance?

We award Delta Dental a final rating of 3 out of 5 stars. The carrier has several decades' worth of experience in the insurance industry and is highly rated by AM Best and the BBB. Their products are offered nationwide through independent agencies.

What's the point of having dental insurance?

What's the point of getting dental insurance? In a nutshell, it's about getting essential preventive care, lowering your costs for other procedures, and maintaining your overall wellbeing. Having dental coverage leads to more consistent dental care, which is important to your general health.

What is annual out-of-pocket maximum?

The most you have to pay for covered services in a plan year. After you spend this amount on deductibles, copayments, and coinsurance for in-network care and services, your health plan pays 100% of the costs of covered benefits.

What does benefit maximum mean?

A benefit maximum is a limit on a covered service or supply. A service or supply may be limited by dollar amount, duration, or number of visits.

What is my annual benefit statement?

Your benefit statement is an annual summary of your pension savings. It tells you about the savings you have now and what they could be worth in the future. Keep your benefit statement safe – it may help you when you're making decisions about your retirement.

What is lifetime orthodontic maximum?

Unlike most insurance coverage, which has annual maximum benefits that renew each year, orthodontic benefits are usually lifetime maximums. This means that once you use the benefit, there is no more, and it will not renew.

What is an orthodontic lifetime maximum?

Unlike most insurance coverage, which has annual maximum benefits that renew each year, orthodontic benefits are usually lifetime maximums. This means that once you use the benefit, there is no more, and it will not renew.

Is there a cap on insurance?

Insurance companies can no longer set yearly dollar limits on what they spend for your coverage. Previously, health plans set an annual limit — a dollar limit on their yearly spending for your covered benefits. You were required to pay the cost of all care exceeding those limits.

How much does dental insurance pay for a root canal?

Meaning if the dental insurance company is paying 50% of your root canal and the root canal is $700, you will each pay $350 of it. Once the maximum annual benefit has been reached, you are responsible for 100% of the costs until your maximum annual benefit resets.

When does dental insurance reset?

Some reset on your one year anniversary of having the plan, others will reset at the beginning of a new calendar year, on January 1st.

Does dental insurance pay for cleaning?

This means that if you go into your dentists office for your free cleaning, the dental insurance company is paying for that cleaning and it eats away at that maximum annual benefit. Additionally, if you are in need of a lot of dental work, or very expensive dental work, you would probably be best served to consider buying a plan with ...

What is the maximum amount of dental insurance?

Sometimes referred to as a plan maximum, or maximum amount - a dental annual maximum is the total your dental plan will pay toward your care during any one plan year. Annual maximums usually range between $1,000 and $2,000.

How many people reach max dental benefits?

But in reality, most people never reach their dental insurance annual maximum. According to the National Association of Dental Plans, only 2.8% of people on a PPO plan reach their dental annual maximum each year.

Is it a good idea to talk to your dentist about dental costs?

If you have a family and a tight budget , it may be the right one for you. In the end , if you are concerned about your annual maximum, it’s always a good idea to talk to your dentist about costs when scheduling dental treatments. Be upfront about wanting to stay within your dental annual maximum. Working in partnership with your dentist, you may be ...

Does deductible apply to dental insurance?

Your annual maximum only applies to the portion your dental insurance plan pays on your behalf. • Your deductible doesn’t apply to the annual maximum.

How Do Annual Maximums on Dental Plans Work?

Visit Member Connection today for specific information about your plan’s annual maximum.

How much does a dental crown cost in October?

Your dental benefits provider will pay $500 and then you will have reached your plan’s annual maximum. In October, you need a crown, the cost of which is $850. That means your dental plan will pay out the remaining $500 left for them to contribute in this plan year.

How much does it cost to fill a cavity in January?

Your dentist says you need a cavity filling in January. The cost for that procedure is $100.

When does the benefit period start?

A benefit period can start at different points of the year. For now, we’ll assume your plan’s benefit period is the calendar year. That would mean the annual maximum for your plan’s year applies to January through December.

Does dental work count toward annual max?

Keep in mind that depending on your dental plan, services that are considered diagnostic or preventive may not count toward your annual maximum.

What to do if you have an annual max?

If you’re ever concerned about your annual maximum, make sure to talk to your dentist about potential costs before scheduling treatments. If necessary, you may even be able to set up a treatment plan that spreads your out-of-pocket costs while still meeting your dental needs.

Does lifetime max reset?

Once your lifetime maximum is spent, it is not reset. Usually this applies to treatments like orthodontia that are unlikely to be repeated. However, if your plan changes (Ex: starting a new job, switching employers, etc.), the lifetime maximum will reset.

Does my plan have an annual maximum?

Your annual maximum is the dollar amount limit your dental plan pays within one benefit period, which is usually one year.

What is the maximum dental insurance coverage?

That cap is the annual maximum coverage provided by your plan. Bizarrely, dental insurance policies generally limit coverage to $1000 -$1,500 a year – a rate that hasn’t changed for about forty years. To put that in perspective, back in 1970 $1,000.00 gave you the buying power of $6,273.87 in 2016.

How much does a dental savings plan cost?

Dental savings plans are very affordable. The plans available on dentalplans.com range from $79.95-$199.95 annually. Plus, many of DentalPlans.com dental savings plans include additional free bonus benefits too, such as savings on vision and hearing care, prescriptions, and other wellness services. Select plans even include a bundle of health and wellness services which range from telemedicine –free consultations with local doctors who can diagnose and treat common ailments (including prescribing medications), discounts on chiropractic, alternative medicine and fitness centers, and savings on lab work and medical diagnostic services.

How to get the most out of dental insurance?

Pre-planning helps you get the most from your dental coverage. Don’t hesitate to talk to your dentist about scheduling treatments that meet your insurance maximums. For example, if your plan provides a year’s coverage starting in January and you need a root canal and crown that will cost about $3,000 you might be able to get $1500 worth of care in December, and finish your treatment in January. That’s assuming, of course, that you have your full annual maximum unused by the end of the first year, and are willing to exhaust your coverage at the beginning of the next year. It’s also assuming that you’re not in pain, and/or your dental issue doesn’t require treatment ASAP.

How much does a crown cost?

The average cost for a crown these days is $750-$2000 per tooth, and the cost of a root canal is $750-$1,000+ per tooth (that price can soar if you need a complex root canal). Obviously you can exhaust your annual dental coverage of $1000-$1500 fairly quickly. And when your dental costs for most procedures go over that limit, you then have to pay for your own dental care out of pocket for the rest of the year.

Do dental supplements have waiting periods?

Supplemental plans also usually don’t have waiting periods and restrictions on preexisting conditions. The bad news is that supplemental dental insurance policies also tend to be expensive, assume you’ll pay at least as much for your supplemental plan as you do for your primary plan.

How much does Spirit Dental cover?

Spirit Dental plans offer options up to a $5,000 calendar year maximum. With this higher maximum coverage, you can rest easy getting the procedures you need without worrying too much.

Does medical insurance have to be paid out of pocket?

Medical insurance has a reputation for being overly complicated. Depending on the type of services, you might have to pay out-of-pocket until your deductible has been met.

How much does dental insurance cost?

For example, while Physicians Mutual’s plans begin around $30 per month, Careington’s plans start as low as $8.95 per month. Plans with additional facets like deductibles, copays, and waiting periods can all impact price, so carefully consider what features are most important to you and their related costs. An insurance agent can also help you review policy options so you can be sure to find the best dental insurance plan with no annual maximum cost for you.

Which dental insurance has the best coverage?

Physicians Mutual is our pick for the best dental insurance plan with no annual maximum. Coverage spans the entire country with half a million dental providers, so most members have little trouble finding a provider nearby. With coverage for over 350 procedures, Physicians Mutual has comprehensive coverage with no deductibles and no waiting period for preventive care, offering the well-rounded coverage that could work best for your family.

How much does Humana cost?

Affordable rates start at $7 per month for the Dental Savings plan and $19 for the PPO plans.

How long does it take for dental insurance to kick in?

There are no deductibles with a three-month waiting period for basic procedures, but after three months, coverage kicks in for cavity fillings, minor surgeries, sedation, and simple tooth extractions. There is a longer waiting period for major work, requiring policyholders to wait 12 months until coverage applies for root canals, crowns, dentures, and surgical tooth extractions.

What is the best dental insurance?

Physicians Mutual is our pick for best overall dental insurance plan with no annual maximum because of its multifaceted coverage and no waiting period for preventive care. Coverage with Physicians Mutual starts at around $30 per month for its basic plan, which can include more than 350 procedures, including not only your preventive care but also more serious dental needs like crowns and dentures. Even better, there is no waiting period for preventive care, so you can get started right away on cleanings, X-rays, and routine exams.

How often do you pay your insurance premium?

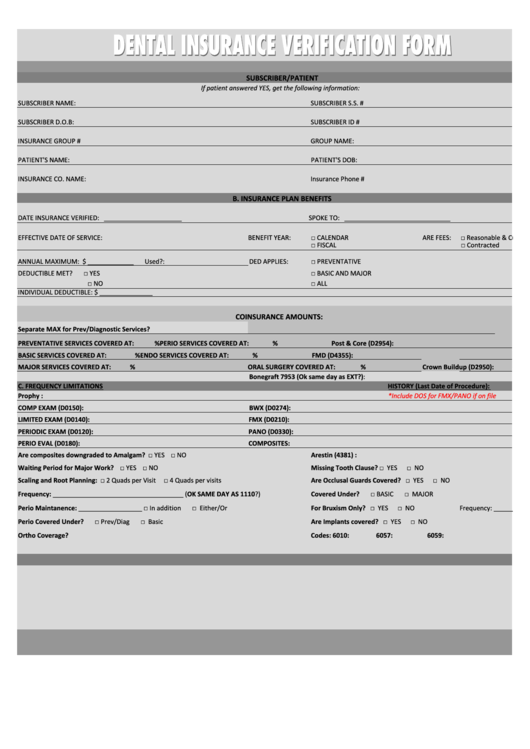

Premium: This is the amount that you pay for your plan. Depending on your insurance provider and your chosen plan, you may pay your premium each month or annually.

Do you have to pay deductibles before you get insurance?

Deductible: Before your insurance provider pays for coverage, there is typically a minimum deductible that you must pay first . Be sure to check to see what deductibles apply to your plan, as some plans may not charge any at all.