Can I receive VA DIC and Social Security benefits?

Since income does not matter for DIC benefits, receipt of Social Security benefits will not affect your DIC eligibility. If you prove to VA that you are entitled to DIC benefits, you should draw your benefit from Social Security and your DIC benefit as well. This is the way it should be.

Is VA DIC income taxable?

Review 2022 VA Dependency and Indemnity Compensation (DIC) rates for the surviving spouses and dependent children of Veterans. These VA survivor benefits are tax exempt. This means you won’t have to pay any taxes on your compensation payments. These rates are effective December 1, 2021.

How much is DIC compensation?

DIC rates if veteran died on or after January 1, 1993. Dependency and indemnity compensation is paid to a surviving spouse at the monthly rate of $1,437.66 for 2022.

How much are DIC payments?

* E-9 special capacity veteran spouse rate: $1,767.80

- Sergeant Major of the Army or Marine Corps

- Senior enlisted adviser of the Navy

- Chief Master Sergeant of the Air Force

- Master Chief Petty Officer of the Coast Guard

How Much Does VA DIC pay?

How Much Is DIC? The basic monthly tax-free DIC benefit will increase from $1,357.56 for 2021 to $1,437.66 for 2022, with additional amounts also seeing the 5.9% increase.

How does VA DIC work?

DIC is a monthly benefit paid to eligible survivors of: a military member who died while on active duty. a veteran whose death was the result of a service-related injury or disease. a veteran whose death wasn't related to their service but who was rated totally disabled by the VA.

How much will my spouse get for DIC?

The basic monthly rate of DIC is $1,340 for an eligible surviving spouse. The rate is increased for each dependent child, and also if the surviving spouse is housebound or in need of aid and attendance.

Is VA DIC for life?

DIC for spouses and dependent children is not means tested. The recipient of DIC can have any amount of income or assets. It is really a life insurance benefit.

How long does a widow get DIC?

Once granted, DIC is permanent for surviving spouses, unless the surviving spouse remarries prior to turning 57 years of age. For surviving children, DIC usually lasts until the age of 18 (or 23 if the child is still in school). “Helpless” adult children might also be entitled to DIC.

How does a widow qualify for DIC?

Who is eligible? You may be eligible for DIC benefits if you are a surviving spouse who: • Married a Service member who died on active duty, active duty for training or inactive duty training, OR • Married the deceased Veteran before Jan.

Can a widow receive DIC and Social Security?

Many survivors do not know that they can receive both DIC benefits and Social Security benefits at the same time. They receive DIC benefits because the death is service connected and Social Security benefits for a separate reason (retirement, disability, etc.).

Do I get my husbands VA pension when he dies?

A VA Survivors Pension offers monthly payments to qualified surviving spouses and unmarried dependent children of wartime Veterans who meet certain income and net worth limits set by Congress. Find out if you qualify and how to apply.

How do I know if I qualify for DIC benefits?

To be eligible for this benefit, the claimant(s) must be the eligible surviving spouse or dependent child of a military Servicemember or Veteran who meets one of the following: Died while serving on active duty, active duty for training, or inactive duty training.

Is DIC automatic?

HOW DO I APPLY FOR DIC PAYMENTS? DIC is NOT automatically payable to survivors. Survivors must apply for DIC by completing VA form 21-534. You must apply to the nearest VA Regional Office within 12 months from the date of death to receive full payment.

What is the difference between DIC and SBP?

SBP allows a military retiree or retirement-eligible service member to ensure a continuous lifetime annuity for their dependents. However, a VA benefit called the Dependency and Indemnity Compensation (DIC) offsets the money a widow would receive from SBP, dollar-for-dollar.

Is VA DIC based on income?

The amount of DIC compensation is not based on income and is paid as a tax-free monthly benefit. Died from a non-service-related injury or disease but was eligible for or receiving VA compensation for a totally disabling service-connected disability: For at least 10 years before death, or.

Am I eligible for VA DIC as a surviving spouse or dependent?

Eligibility You may be eligible for VA benefits or compensation if you meet these requirements. One of these must be true: You lived with the Veter...

What kind of benefits can I get?

If you qualify, you can get tax-free monetary benefits. The amount you receive depends on the type of survivor you are. DIC benefit rates for survi...

How do I apply for compensation?

First you’ll need to fill out an application for benefits. The application you fill out will depend on your survivor status. If you’re the survivin...

Should I submit an intent to file form?

You may want to submit an intent to file form before you apply for DIC benefits. This can give you the time you need to gather your evidence while...

What is VA DIC?

About VA DIC for spouses, dependents, and parents. If you’re the surviving spouse, child, or parent of a service member who died in the line of duty, or the survivor of a Veteran who died from a service-related injury or illness, you may be able to get a tax-free monetary benefit called VA Dependency and Indemnity Compensation (VA DIC).

Can a veteran die from a service connected illness?

The Veteran didn’t die from a service-connected illness or injury, but was eligible to receive VA compensation for a service-connected disability that was rated as totally disabling for a certain period of time.

Can you get DIC benefits if you are denied service connected disability?

If we denied your Blue Water Navy Veteran’s service-connected disability claim in the past, you may be eligible for DIC benefits based on the Blue Water Navy Vietnam Veterans Act of 2019.

What is DIC in military?

Survivors' Dependency and Indemnity Compensation (DIC) DIC is a tax free benefit paid to eligible survivors of Servicemembers or Veterans who died in the line of duty or from a service related injury or disease.

What does "died while serving on active duty" mean?

died while serving on active duty, active duty for training, or inactive duty training, OR. died as a result of a service-connected injury or disease, OR. died as a result of a non-service connected injury or disease, and who was totally disabled from his/her service-connected disabilities for.

What is Dependency and Indemnity Compensation?

Dependency and Indemnity Compensation (DIC) is a tax free monthly benefit paid to. eligible survivors of military Servicemembers who died in the line of duty or eligible. survivors of Veterans whose death resulted from a service-related injury or disease.

How long does a veteran have to serve in the military before he dies?

since the Veteran's release from active duty and for at least five years immediately preceding death, OR. at least one year immediately preceding death if the Veteran was a former prisoner of war. For more specific information, refer to the DIC factsheet. Check if you may be eligible for this benefit.

What is considered a veteran for DIC?

To be considered a qualifying veteran for DIC purposes, the deceased veteran must meet either of the following criteria: Died from a service-related injury or disease. Died from a non-service-related injury or disease but was eligible for or receiving VA compensation for a totally disabling service-connected disability: ...

What is DIC compensation?

Dependency and Indemnity Compensation, or “DIC,” is available to eligible survivors and dependents of veterans who had service-connected disabilities or diseases. The amount of DIC compensation is not based on income and is paid as a tax-free monthly benefit.

How long does a veteran have to be married to receive disability?

if the veteran had been receiving disability compensation for a totally disabling service-connected disability or disease for at least 8 continuous years during which the surviving spouse was married to them. Any dependent children under the age of 18. If the surviving spouse is entitled to aid and attendance (A&A)

How long do you have to be married to a veteran to qualify for DIC?

To be eligible for DIC, a surviving spouse must meet any of the following criteria: married to the veteran before 1/1/1957. married the veteran within 15 years of discharge from the period of service during which the service-connected disability or disease occurred ...

Can a parent of a veteran receive a tax free benefit?

Parents of veterans who died as the result of a service-related injury or disease may be eligible to receive a tax-free monthly benefit if their income falls below a certain level.

Do you have to pay back money after a veteran dies?

If a survivor receives any compensation that the veteran was receiving or entitled to after the date of the veteran’s death, they will be required to pay that money back if they spend it.

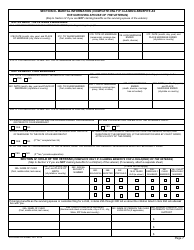

Surviving spouse rates if the Veteran died on or after January 1, 1993

You may also be eligible for added amounts based on certain factors. Find any descriptions in the table below that are true for you. Add the amount listed in the Added monthly amount column of each description to your monthly payment. This is your total monthly payment.

Surviving spouse rates if the Veteran died before January 1, 1993

If you're the spouse or child of a Veteran who died before January 1, 1993, we use a different method to determine your DIC monthly payment.

How DIC may affect your VA Survivors Pension or Survivor Benefit Plan

If you’re eligible for both DIC and Survivors Pension benefits, we’ll pay you whichever benefit gives you the most money. You can't get both.

More benefits for survivors

If you're the surviving spouse or child of a Veteran with wartime service, find out if you're eligible for monthly pension benefits based on your income and net worth.

What is DIC benefit?

DIC is a monthly benefit paid to eligible survivors of: a military member who died while on active duty. a veteran whose death was the result of a service-related injury or disease. a veteran whose death wasn't related to their service but who got VA disability compensation. for at least 10 years immediately before death, OR.

How much is a veteran rated disabled?

Add $288.27 if, at the time of death, the veteran was rated 100% disabled or unemployable as a result of disability. The veteran must have been rated that way for at least 8 continuous years immediately preceding death AND the surviving spouse had to be married to the veteran for those same 8 years.

Does DFAS reduce SBP annuity?

If a surviving spouse gets DIC from the VA based on the death of the service member who provides the SBP coverage, DFAS will reduce the SBP annuity by the amount of the DIC.

Dependency and Indemnity Compensation

- Dependency and Indemnity Compensation (DIC) is a tax free monetary benefit paid to eligible survivors of military Servicemembers who died in the line of duty or eligible survivors of Veterans whose death resulted from a service-related injury or disease.

Eligibility

- To qualify for DIC, a surviving spouse must meet the requirements below. The surviving spouse was: 1. Married to a Servicemember who died on active duty, active duty for training, or inactive duty training, OR 2. Validly married the Veteran before January 1, 1957, OR 3. Married the Veteran within 15 years of discharge from the period of military service in which the disease or injury tha…

Evidence Required

- Listed below are the evidence requirements for this benefit: 1. The Servicemember died while on active duty, active duty for training, or inactive duty training, OR 2. The Veteran died from an injury or disease deemed to be related to military service, OR 3. The Veteran died from a non service-related injury or disease, but was receiving, OR was entitled to receive, VA Compensation for ser…

How to Apply

- Complete VA Form 21P-534ez, "Application for Dependency and Indemnity Compensation, Death Pension and/or Accrued Benefits by a Surviving Spouse or Child and mail to the Pension Management Center th...

- Work with an accredited representative or agent OR

- Go to a VA regional office and have a VA employee assist you. You can find your regional offi…

- Complete VA Form 21P-534ez, "Application for Dependency and Indemnity Compensation, Death Pension and/or Accrued Benefits by a Surviving Spouse or Child and mail to the Pension Management Center th...

- Work with an accredited representative or agent OR

- Go to a VA regional office and have a VA employee assist you. You can find your regional office on our Facility Locator page OR

- If the death was in service, your Military Casualty Assistance Officer will assist you in completing VA Form 21P-534a, " Application for Dependency and Indemnity Compensation, Death Pension and/or...