Compare the Best Life Insurance With Living Benefits

| Company | AM Best Rating | Coverage Capacity | Issue Ages | Policies Offered |

| John Hancock | A+ | $65 million | Up to 90 | Term and universal |

| AIG | A | $1 million and up | Up to 80 | Term, whole, and universal |

| New York Life | A++ | $5 million and up | Up to 90 | Term, whole, and universal |

| Haven Life | A++ | $3 million | Up to 64 | Term |

What are the advantages and disadvantages of life insurance?

Here are some of the most common disadvantages:

- Fear that money-driven insurance agents will scam you

- The inability to pay a monthly premium

- Lack of dependents who would need a death benefit

- The contestability period

- The cost of your insurance being contingent on your medical history

What happens to life insurance when the insured dies?

- Policy 1 for himself

- Policy 2 for his wife

- Policy 3 for his child Rahul

How do life insurance death benefits pay out?

- Life insurance providers pay out within 60 days of receiving a death claim filing in most cases.

- Beneficiaries must file a death claim and verify their identity before receiving payment.

- The benefit could be delayed or denied due to policy lapses, fraud, or certain causes of death.

How long does life insurance take to pay out?

How to Get Claims Paid Fast

- Have the Death Certificate Ready. Life insurance companies will require a death certificate which gives proof that the insured person is deceased.

- Contact Your Life Insurance Company Immediately. The time immediately following a death can be extremely difficult. ...

- Make Sure That You Have All Requirements the First Time. ...

What does living benefit mean in insurance?

A living benefit rider is additional coverage on your basic life insurance policy that provides supplementary benefits and protection to you, sometimes at an extra cost. A rider comes in handy when you have specific needs that aren't covered by a standard insurance policy.

Are living benefits worth it?

With life insurance with living benefits, the answer is: yes. You can advance part of the death benefit early for your needs and care. This is why life insurance with living benefits is worth the money. It gives you and your family financial flexibility when your family needs the money the most.

What is a living benefit claim?

A Living Benefit payment is a lump sum payment to those who are terminally ill and have a documented medical prognosis showing a life expectancy of no more than nine months.

What are living benefit options?

Living benefits give you the option to use some of your life insurance proceeds while you're alive. You can only use the funds for end-of-life care and only if you have a qualifying health condition, like a terminal illness. Living benefits are usually provided through optional policy additions called riders.

What is a living benefit fee?

Key Takeaways. Living and death benefit riders are optional add-ons to an annuity contract that you may buy for an extra fee. A living benefit rider guarantees a payout while the annuitant is still alive. A death benefit rider protects beneficiaries against a decline in the annuity's value.

Are living benefits taxable?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

What type of life insurance has living benefits?

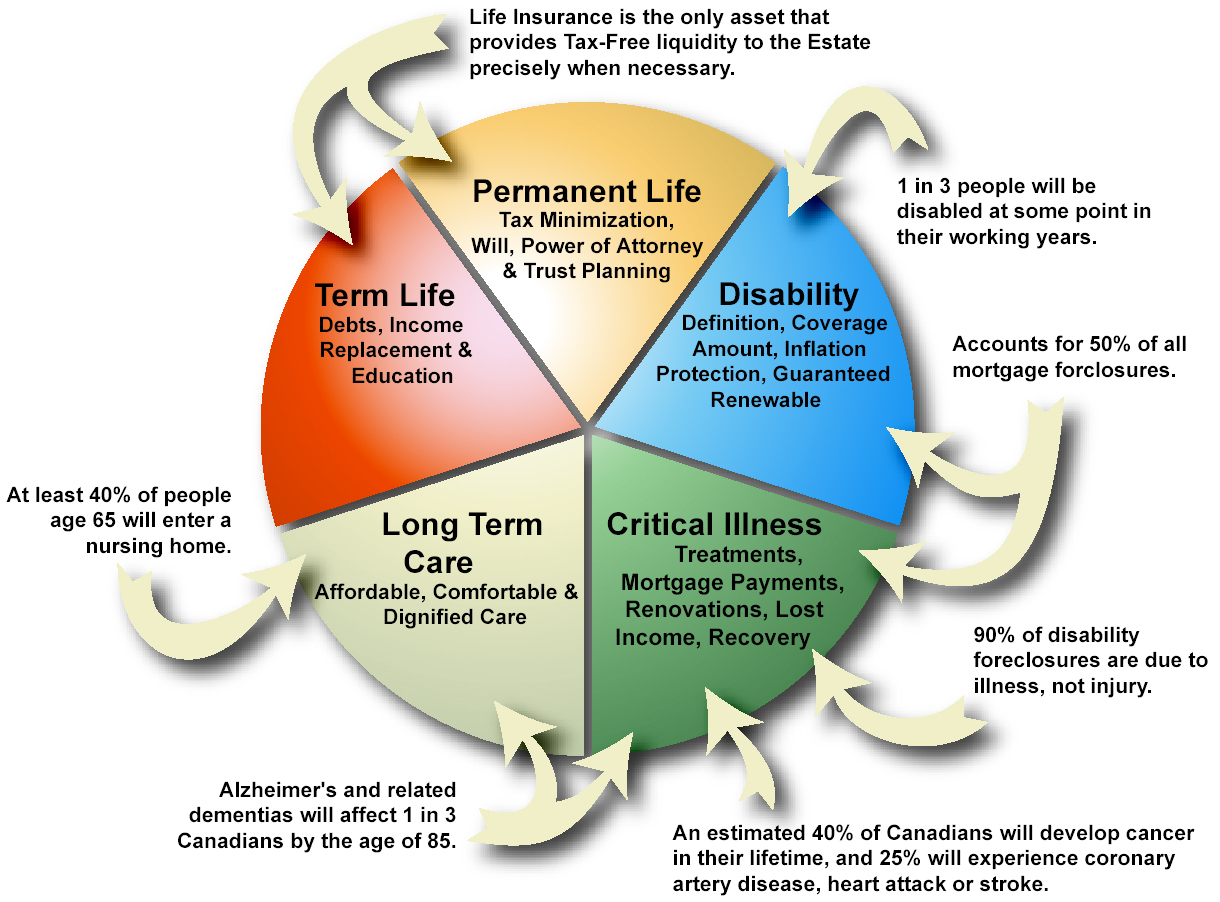

Permanent Life Living Benefits Permanent life insurance has a death benefit like term life insurance, along with the ability to accumulate cash value on a tax-deferred basis, which a term policy does not.

What happens if someone dies shortly after getting life insurance?

If a policyholder dies shortly after buying life insurance, the insurance company has more freedom to contest/deny the beneficiary's claim. Consequently, it is all the more important to contact an experienced life insurance lawyer if your claim has been unjustly delayed or denied.

When did living benefits start?

1937We call them Living Benefits, and we have been providing them since 1937. Based on the product, living benefits can provide benefits should a qualifying terminal, chronic or critical illness or critical injury occur1, or if your desire is to have an income that you cannot outlive.

What are the two types of guaranteed living benefits?

There are three basic types of living benefits.Guaranteed lifetime withdrawal benefit (GLWB). ... Guaranteed minimum income benefit (GMIB). ... Guaranteed minimum accumulation benefit (GMAB).

What does a living benefit rider do?

A living benefits rider enables the policy owner to access eligible policy proceeds when facing a terminal illness. Policy owners can also access funds through a loan or surrender, but it is possible for a life insurance policy with living benefits to provide more money.

What is life insurance?

Life insurance is there to protect your family financially after you’re gone. But what if you need the money sooner? Some life insurance policies allow you to accelerate the death benefit or access your cash value early, an option called “living benefits insurance.”. If you’re wondering “what is living benefits insurance,” here’s how term life ...

What is a living benefit rider?

A living benefit rider, which allows someone to get the payout from accelerated death benefits, can offer extra peace of mind, whether or not you end up needing it, just like regular term life policies.

What is accelerated death benefit?

A living benefits rider allows you to access a portion of your payout while you’re still alive if you’ve been diagnosed with a serious condition.

Is cash value more expensive than term life insurance?

You can borrow against it or use it as collateral if you need extra money for expenses. While whole life policies are more expensive than term life insurance, they can provide permanent protection and extra support if the worst happens.

Can you add a rider to a life insurance policy?

You can add a rider to an existing policy or a new one, typically for an extra cost. One of the most common riders is a living benefits or terminal illness rider, also known as an accelerated death benefit rider.

What is the living benefit of life insurance?

What Does Living Benefits of Life Insurance Mean? Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime. This is considered a living benefit of life insurance because, in contrast to a death benefit that pays out when you pass away, ...

What is a living benefit rider?

A living benefit rider is additional coverage on your basic life insurance policy that provides supplementary benefits and protection to you, sometimes at an extra cost. A rider comes in handy when you have specific needs that aren’t covered by a standard insurance policy. Basically, a rider is used to customize your policy to fit your needs.

What happens to the cash value of a life insurance policy?

When you have a permanent life insurance policy, the cash value grows tax-deferred. Loans. You can borrow against the cash value of your policy for things like tuition payments, emergencies and even to supplement your retirement income.

What happens to your life insurance when you pass away?

You could use the payout for things like medical expenses, among other uses, and when you pass away, your beneficiaries will receive a reduced life insurance benefit since you used a portion of the policy already.

Is cash value life insurance more expensive than term life insurance?

Typically, a premium for cash-value life insurance is more expensive than a term life insurance premium because it is long-term coverage (versus a specific length of time like term life insurance) and accumulates cash value over time. Here's a closer look at the benefits:

What is the living benefit of life insurance?

Simply put, the living benefits of life insurance is the option for the insured to use his or her life insurance policy while still alive. The insured does not have to die to use the policy. This could happen in 2 scenarios:

What is living benefit?

Living benefits are available in term and permanent life insurance policies. They are utilized in a form of accelerated benefit riders, helping with the cost of critical, long-term chronic and terminal illness conditions. Pros: They are built into many policies at no additional cost.

How much does Jason's life insurance cost?

He purchases $500,000 life insurance with living benefits to protect his wife and 3 children. Jason’s monthly rate is $43.63 per month for a 20 – year level term policy. Jason does not smoke and qualifies for a standard rating. Ten years after the issuance of the policy, Jason is 45 years old and suffers a Major Heart Attack.

How long do you have to have a coma insurance policy?

End-stage renal failure. Coma and etc. Typically, you need to have the policy in force for at least 30 days prior to becoming eligible to accelerate your benefit. Also, it is important to point out that most carriers would pay out the benefit in a lump sum, rather than monthly installments.

Is permanent insurance more expensive than term insurance?

Cons: Only available in permanent policies that are more expensive when compared to term insurance. It does not grow significantly in the first years of the policy (some exclusions apply) It needs to be repaid, or it reduces the value of the insurance.

Is life insurance more like death insurance?

It sounds more like death insurance than life insurance . Therefore, it is hard for many to see value in life insurance since they would never see the benefits of their own policy. The life insurance industry is slowly evolving trying to adjust to match the needs of today’s consumer.

What is living benefit?

Living benefits refer to the cash benefits available to the insured after they have paid premiums over a specific period. The cash values and the endowment proceeds of a permanent life insurance policy are considered living benefits since they are made available to the insured while they are alive.

Why are living benefits riders added to variable insurance?

The cash available from a living benefit rider is aimed to cushion the impact of old age and the accompanying long-term care.

What is a living benefit?

A Living Benefit payment is a lump sum payment to those who are terminally ill and have a documented medical prognosis showing a life expectancy of no more than nine months. You are eligible to elect a Living Benefit if you are an employee, annuitant, or compensationer and you are enrolled in the FEGLI Program.

Why are living benefits reduced?

Living Benefit payments are reduced by a nominal amount (4.9%) to make up for lost earnings to the Life Insurance Fund because of the early payment of benefits. The election of Living Benefits has no effect on the amount of any Optional life insurance.

Can you pay optional life insurance as a living benefit?

Only Basic insurance is available for a Living Benefit. The Office of Federal Employees' Group Life Insurance cannot pay Optional insurance as a Living Benefit. A Living Benefit election has no effect on your Optional insurance. Your Optional insurance will not change and you will continue to pay your Optional insurance premiums.

What is life insurance with living benefits?

Your life insurance with living benefits policy riders include living benefits which allow you to access part of your death benefits while still alive. You may access living benefits when a qualifying life event occurs, like a terminal illness or permanent disability.

Which is the best term life insurance?

American International Group, Inc., also known as AIG, is best for term life insurance because of the company’s many customizable term policy options, including 18 terms to choose from and several add-on riders. AIG’s Quality of Life policies are also impressive, with accelerated death benefits for chronic, critical, or terminal illness.

Why is John Hancock the best insurance company?

The Boston-based provider has an A+ credit rating from AM Best and had 10 complaints through the National Association of Insurance Commissioners in 2019. 1

What are the factors that affect the cost of life insurance?

Other factors that may impact the cost of premiums include your age, health, smoking status, and add-on riders like living benefits .

How much does a woman pay for a 20 year life insurance policy?

A 35-year-old woman may spend about $15 per month for a 20-year $250,000 term policy, and a 50-year-old woman may pay about $40 per month for the same plan. You can’t get an online quote for universal life or whole life with a death benefit of more than $25,000, however.

Can you add living benefits to your life insurance?

While life insurance protects your family when you pass away, living benefits may offer protection while you are still alive. 13 You may add living benefits to your term or permanent life insurance policy through a rider, which costs extra.

Does State Farm offer life insurance?

You may buy life insurance through an agent nationwide, either in-person or by phone, with restrictions on some policies, depending on where you live.

What is a living benefits rider?

A living benefits rider gives you the option to accelerate your death benefit if you’re certified by a licensed health care practitioner as having a permanent chronic illness or severe cognitive impairment. This is optional, additional coverage that you can purchase and add on to your base policy to enhance your total life insurance coverage.

When will people buy life insurance?

February 3, 2020. Most people purchase life insurance with others in mind. They’re not thinking about themselves when they select a policy, but instead are considering their loved and what would happen if the unexpected were to occur.

What is advanced death benefit?

The advanced death benefit is paid directly to you and can be used for any purpose—replacing lost income, covering medical expenses, paying for care, making home modifications and providing stability during your family’s time of need .

What is the phone number for living benefits rider?

Are you ready to learn more? Give us a call at. (800) 525-7662, and we’ll pair you up with a local Washington National agent.