What benefits does social security offer spouses?

What benefits does social security offer spouses? As a spouse, you can claim a Social Security benefit based off your own earnings, as well as you collect the spousal benefit, which can provide up to 50% of the full retirement age (FRA) of your spouse’s Social Security benefit. The Social Security website can help you determine what your FRA ...

How much can a married couple get from Social Security?

You may need to produce these documents when you apply

- Your Social Security card.

- An original birth certificate or other proof of your birth.

- A copy of your W-2 form or self-employment tax return for the previous year.

- Your marriage certificate.

- If you weren't born in the United States, proof of U.S. citizenship or lawful alien status.

What determines my spousal Social Security benefit?

Pick Up a Copy of My Book:

- How retirement benefits, spousal benefits, and widow (er) benefits are calculated,

- How to decide the best age to claim your benefit,

- How Social Security benefits are taxed and how that affects tax planning,

- Click here to see the full list.

How to maximize social security with spousal benefits?

According to the Social Security Administration, you may qualify for spousal benefits if:

- Your spouse is already collecting retirement benefits.

- You have been married for at least a year.

- You are at least 62 years old (unless you are caring for a child who is under 16 or disabled).

When can I collect Social Security spousal benefits on my husband's work record?

at least 62 years oldIf your spouse has filed for Social Security benefits, you can also collect benefits based on the spouse's work record, if: You are at least 62 years old. Regardless of your age, if you care for a child who is entitled to receive benefits on your spouse's record, and who is under age 16 or disabled.

Can I collect spousal benefits and wait until I am 70 to collect my own Social Security?

You can only collect spousal benefits and wait until 70 to claim your retirement benefit if both of the following are true: You were born before Jan. 2, 1954. Your spouse is collecting his or her own Social Security retirement benefit.

What are the rules for collecting your spouse's Social Security?

To qualify for spouse's benefits, you must be one of these: At least 62 years of age. Any age and caring for a child entitled to receive benefits on your spouse's record and who is younger than age 16 or disabled.

When can my spouse collect half of my Social Security?

You can receive up to 50% of your spouse's Social Security benefit. You can apply for benefits if you have been married for at least one year. If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years. Starting benefits early may lead to a reduction in payments.

Are Social Security spousal benefits going away?

Spouses born after Jan. 1, 1954, can no longer claim spousal benefits and later switch to collecting benefits based on their own work record. The new law also ended "file and suspend," which allowed a spouse to file for benefits but delay collecting them in order to make the other spouse eligible for spousal benefits.

Can my wife collect spousal Social Security benefits before I retire?

No. You have to be receiving your Social Security retirement or disability benefit for your husband or wife to collect spousal benefits.

How does Social Security work for married couples who both worked?

Each spouse can claim their own retirement benefit based solely on their individual earnings history. You can both collect your full amounts at the same time. However, your spouse's earnings could affect the overall amount you get from Social Security, if you receive spousal benefits.

How does SSA spousal benefit work?

The spousal benefit can be as much as half of the worker's "primary insurance amount," depending on the spouse's age at retirement. If the spouse begins receiving benefits before "normal (or full) retirement age," the spouse will receive a reduced benefit.

Can I take my Social Security at 62 and then switch to spousal benefit?

Only if your spouse is not yet receiving retirement benefits. In this case, you can claim your own Social Security beginning at 62 and make the switch to spousal benefits when your husband or wife files.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

What Are Social Security Spousal Benefits?

Social Security spousal benefits are retirement benefits paid by the Social Security Administration to the spouse of a primary beneficiary. When Social Security started, many women did not work outside the home. The Social Security Administration (SSA) quickly realized that many women would not qualify for benefits because they did not have a sufficient earnings record. So, spousal benefits for wives began in 1939. This allowed a married woman to collect benefits upon reaching retirement age, even though she did not work enough to qualify for her own benefits. Husbands were not allowed to claim spousal benefits until 1950.

What are the rules for spousal benefits of Social Security?

To qualify for spousal benefits, you must be at least age 62, and your spouse must already be receiving Social Security benefits. Even an ex-spouse can receive these benefits as long as the marriage lasted ten years, you are not remarried, and your ex-spouse is receiving benefits. If the divorce occurred more than two years prior, then you can go ahead and claim spousal benefits as long as your ex-spouse is eligible to apply for benefits. They do not necessarily have to be receiving benefits already.

What is the difference between spousal benefits and survivor benefits?

Spousal benefits are paid to the spouse or ex-spouse of a primary beneficiary who is still living. These benefits can be up to 50% of the primary insurance amount if the spouse waits until full retirement age to start the spousal benefits. Survivor benefits, on the other hand, are paid to the widow or widower of a primary beneficiary. An ex-spouse can also receive survivor benefits based on the earnings record of the deceased ex-spouse. These benefits can be up to 100% of the primary insurance amount. If you are receiving spousal benefits and your spouse dies, then you will need to contact the Social Security Administration to switch over to survivor benefits. This does not happen automatically, and the increase in benefits is usually not retroactive. Promptly notifying SSA of the death will ensure that you receive the higher benefit amount as quickly as possible.

What are the benefits of claiming spousal benefits?

One of the biggest benefits of claiming spousal benefits is the fact that you can receive Social Security retirement income even if you do not have enough work credits to qualify for benefits on your own. This means that even if you never worked, you can receive benefits based on the work history of your spouse. This can provide a tremendous financial benefit to married couples during retirement. Even if you qualify for your own benefits, spousal benefits might provide a higher payment amount if you earned a low income or only worked part-time during your working years.

Can my wife claim spousal benefits before I retire?

No, if you are currently married, then you must be receiving Social Security retirement benefits before your wife can apply for spousal benefits. You can no longer apply for benefits and suspend your benefits to a later time, thus allowing your wife to go ahead and apply for spousal benefits. If you were to die, then your wife would be eligible for survivor benefits whether or not you reached retirement age. As long as you accrued ten years’ worth of work credits, then your wife would be able to claim survivor benefits upon reaching age 60.

How much is spousal benefit?

The spousal benefit can be as much as half of the worker's " primary insurance amount ," depending on the spouse's age at retirement. If the spouse begins receiving benefits before " normal (or full) retirement age ," the spouse will receive a reduced benefit. However, if a spouse is caring for a qualifying child, the spousal benefit is not reduced.

What is the reduction factor for spousal benefits?

For a spouse who is not entitled to benefits on his or her own earnings record, this reduction factor is applied to the base spousal benefit, which is 50 percent of the worker's primary insurance amount. For example, if the worker's primary insurance amount is $1,600 and the worker's spouse chooses to begin receiving benefits 36 months ...

Can a spouse reduce their spousal benefit?

However, if a spouse is caring for a qualifying child, the spousal benefit is not reduced. If a spouse is eligible for a retirement benefit based on his or her own earnings, and if that benefit is higher than the spousal benefit, then we pay the retirement benefit. Otherwise we pay the spousal benefit. Compute the effect of early retirement ...

What happens if your spousal benefit is larger?

If your spousal benefit is larger, you will receive a combination of benefits that total that amount.

What is the full retirement age for Social Security?

Full retirement age, for Social Security purposes, is between 66 and 67, depending on your year of birth. 2 . One exception: If you are caring for your spouse's child who is under age 16 or who receives Social Security disability benefits, you can collect spousal benefits at any age without a reduction. 3 . ...

Can a spouse apply for Social Security based on their own work record?

Spouses who aren't eligible for Social Security on their own work record can apply for benefits based on the other spouse's record.

Can you collect spousal benefits on your own?

However, only one person per couple may collect spousal benefits while earning delayed retirement credits on his or her own account. And, to repeat, this option is no longer available to anyone who wasn't born on or before Jan. 1, 1954.

How many people receive Social Security benefits as a spouse?

A recent Social Security report found that 2.3 million individuals received at least part of their benefit as a spouse of an entitled worker. Some of these spouses had benefits of their own, but were eligible to receive higher benefit because the spousal benefit amount was greater than their own benefit. Others never worked outside the home ...

What Does It Take to Qualify for Social Security Spousal Benefits?

Unlike most rules related to Social Security, the rules for the spousal benefit entitlement are pretty straightforward and easy to understand.

What is the most generous benefit available to retirees?

What’s one of the most generous benefits available to retirees? That’s easy. It’s Social Security spousal benefits ! These benefits are some of the most important, too.

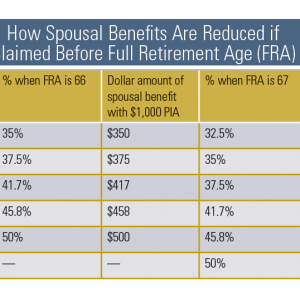

How much is spousal benefit?

Depending on how old you are when you file, the spousal benefit amount will range between 32.5% and 50% of the higher-earning spouse’s full retirement benefit. Check out the chart below to get an idea of how the benefit works and what your payment might be if you can take advantage ...

What is the 1 year requirement for Social Security?

The 1-year requirement is also waived if you were entitled (or potentially entitled!) to Social Security benefits on someone else’s work record in the month before you were married. An example of these benefits would be spousal benefits, survivor benefits or parent’s benefits.

How long do you have to be married to qualify for spousal benefits?

You may also qualify for the spousal benefit If you’re divorced but the marriage lasted for at least 10 years and you’re not currently married.

How much of my spouse's Social Security is my full retirement?

Remember, in that case, it’s between 32.5% and 50% of the higher-earning spouse’s full retirement age benefit, depending on your filing age. However, it can seem a little more complicated if you have Social Security benefits from your work history.

When does my spouse get my spousal benefits?

If your spouse is caring for your child who is younger than 16, your spouse may receive the full amount of spousal benefit at any age, and until the child turns 16. If your spouse receives a spouse’s benefit based on your work record, your retirement benefits are not reduced, you receive the full amount of your benefit.

What happens if your spouse receives more than your spousal benefit?

If the spousal benefit is higher, he or she receives an additional amount to equal the spouse benefit amount. If your spouse does not qualify for an individual benefit, he or she may receive the spouse benefit amount of 50 percent of your benefits, if they are at full retirement age.

What is the spousal benefit for a person who has not reached retirement age?

If you decide to opt for the spousal benefit but have not yet reached full retirement age yourself, that benefit will be less than 50 percent. This may still be a good option if you have not been working much through the years.

When does a widow receive Social Security?

A widow or widower who has reached full retirement age, and whose spouse did not receive Social Security benefits until 70 years old, receives the full benefit amount of the deceased spouse.

Can you increase your spouse's lifetime benefits?

For married couples who have both had full lifetime careers, there may still be an advantage to opting for spousal benefits to increase lifetime payments. This can be done by following different timing strategies.

Does Social Security pay your spouse first?

Social Security pays your benefits first, but if the benefits you would receive through your spouse are higher than yours, you can receive a combination of these benefits to reach the amount you would receive as a spouse.

Do federal employees pay Social Security?

Federal employees hired since 1984 pay Social Security taxes (previously they did not ). Some state and local government employees are covered by Social Security, some only by public-sector pension plans and some by both.

Does GPO affect Social Security?

The GPO applies only to your government pension. If you are collecting a deceased spouse’s government pension, it does not affect your Social Security payments. Published October 10, 2018.

Can I collect my own pension and Social Security?

Can I collect my own government pension and Social Security on my spouse’s record? En español | Yes, although a Social Security rule called the Government Pension Offset (GPO) will reduce your spousal benefits if your pension is from a “non-covered” government job in which you did not have Social Security taxes withheld from your paycheck .

Does the government pension offset affect Social Security?

The Government Pension Offset affects only your Social Security spousal or survivor benefit. If you are collecting Social Security retirement benefits and a non-covered government pension, you may be subject to the Windfall Elimination Provision.