The universal OAS pension is a taxable monthly payment available to seniors who are aged 65 and older and who meet the eligibility requirements. Unlike the CPP, Old Age Security benefits are not tied to your employment history. You may be eligible to receive the OAS pension even if you have never worked or are still employed.

What do you need to know about old age security?

Your employment history is not a factor in determining eligibility. You can receive the Old Age Security (OAS) pension even if you have never worked or are still working. If you are living in Canada, you must: be 65 years old or older

What are Old Age Security payments?

- the Guaranteed Income Supplement

- the Allowance

- the Allowance for the Survivor

What are the benefits of old age?

The Delhi Police on Tuesday told the Delhi High Court that the real estate barons Sushil Ansal and Gopal Ansal cannot take the benefit of their old age to seek suspension of the 7 year jail term ...

How much old age pension do you get?

- cash at a specific pay point on a particular day

- electronic deposit into your bank or Postbank account (the bank may charge you for the service)

- institutions (e.g. old age home).

Who qualifies for OAS?

To be eligible for an OAS pension, you must: be 65 years of age or older; be a Canadian citizen or legal / permanent resident of Canada (or landed immigrant) when your pension application is approved; and. have lived in Canada for at least 10 years since the age of 18.

What is the maximum income to qualify for OAS?

Your Old Age Security (OAS) pension amount is determined by how long you have lived in Canada after the age of 18. It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year ($79,054 for 2020).

What is the OAS amount for 2020?

Payment amounts are adjusted quarterly (in January, April, July and October) according to the cost of living in Canada, as measured by the Consumer Price Index. As you can see from the chart below, the 2020 average monthly amount paid by OAS is $614.14, which comes out to just under $7,400 a year.

What is the difference between Old Age Security and Canada pension?

Individuals and their employees are required to contribute to the CPP and/or QPP. CPP/QPP are contributory retirement pensions. OAS is funded out of general government revenues and individuals are not required to have contributed in order to receive it. It's a non-contributory retirement pension.

Does everyone get OAS in Canada?

Not everyone receives the full Old Age Security pension. The amount you receive depends on the number of years you have lived in Canada. If you lived in Canada for less than 40 years (after age 18) you will receive a partial payment amount. Your payment amount is based on the number of years in Canada divided by 40.

How much is OAS per month in 2021?

OAS payment amounts are based on your age, how long you've lived in Canada and your income. No matter what your marital status, you'll receive the maximum monthly OAS payment of $618.45 if your annual individual income is less than $129,260 (these numbers are for April to June 2021 and may change every year).

Do both husband and wife get OAS?

To be eligible, the person must have received a federal GIS or a federal OAS allowance for the preceding year. A single benefit is paid per couple. However, if the spouses live apart (e.g. if one of them is in a nursing home), both are eligible for the benefit.

How much is OAS for a single person?

GIS for single person who receives an Old Age Security pensionYearly Income (excluding OAS Pension and GIS )Monthly GIS with Maximum OAS PensionCombined Monthly OAS Pension and GIS$0.00 - $23.99$968.86$1,617.53$24.00 - $47.99$967.86$1,616.53$48.00 - $71.99$966.86$1,615.53$72.00 - $95.99$965.86$1,614.5314 more rows•Mar 31, 2022

Will seniors get a raise in 2021 in Canada?

In the 2021 federal budget, it was announced that OAS pensions will increase by 10 per cent for seniors 75 and over as of July 2022. It also proposes a one-time payment of $500 in August 2021 to OAS pensioners who will be 75 or over as of June 30, 2022.

Is CPP and OAS paid together?

CPP payments also coincide with Old Age Security (OAS) pension payments, so if you're receiving both, you'll get both payments on the same day. The CPP payment dates for 2022 are: June 28, 2022.

Do you still get CPP if you have a pension?

The Canada Pension Plan (CPP) retirement pension is a monthly, taxable benefit that replaces part of your income when you retire. If you qualify, you'll receive the CPP retirement pension for the rest of your life.

How old do you have to be to get Social Security?

There are three requirements for an individual to be eligible to receive old age Social Security benefits. First, the individual must have attained the age of 62 . Second, the individual must file an application for old age benefits. Third, the application must demonstrate that the individual is “fully insured.”.

What is the retirement age for a worker born in 1960?

For workers born between 1950 and 1960, the retirement age for full benefits has increased to age 66. Workers born in 1960 or later will not receive full retirement benefits until age 67. However, any worker, regardless of birth date, may retire at age 62 and receive less than full benefits. At age 65, a worker’s spouse who has not contributed ...

How many quarters of Social Security coverage is required?

20 CFR § 404.115. But irrespective of birth date, any worker who has 40 quarters (i.e., 10 years) of coverage is fully insured.

How long is a quarter of Social Security?

20 CFR section 404.101 (a). A quarter is a three-month period ending March 31, June 30, September 30, or December 31.

Why did Social Security increase in 1975?

Since 1975 Social Security benefits have increased annually to offset inflation. Known as cost of living adjustments (COLAs), these increases are based on the annual increase in consumer prices as reflected by the consumer price index (CPI).

Can I get Social Security if I work past retirement age?

Workers who continue to work past retirement age may lose some benefits because Social Security is designed to replace lost earnings. If earnings from employment do not exceed the specified amount exempted by law, persons working past the age of retirement will receive full benefits.

When did John apply for old age security?

John could receive his Old Age Security pension in August 2018 and he decided to delay receiving it. In December 2019, John applied for Old Age Security.

How long is the deferral period for Old Age Security?

Michael turned 65 in July 2019. If he decides to delay receiving the Old Age Security pension for 1 year, his monthly amount will increase by 7.2% (0.6% x 12 months) to account for the 12-month deferral period from August 2019 to July 2020.

How long can you delay your pension?

You can delay payment of the Old Age Security pension for up to 60 months (5 years) after you are 65. The longer you delay, the larger your pension payment will be each month. After age 70, there is no advantage in delaying your first payment. In fact, you risk losing benefits.

What happens if you are still receiving your pension?

If you are still working and your income is higher than $79,054 (2020), you will have to repay part of your Old Age Security pension payment . Delaying your first payment can let you keep more of your pension.

How much is the pension for 20 years in Canada?

If you lived in Canada for 20 years after age 18, you would receive a payment equal to 20 divided by 40, or 50%, of the full Old Age Security pension.

How long do you have to live in Canada to receive a pension?

If you have lived in Canada less than 40 years. Not everyone receives the full Old Age Security pension. The amount you receive depends on the number of years you have lived in Canada. If you lived in Canada for less than 40 years (after age 18) you will receive a partial payment amount.

When is the OAS pension review?

Find out more about Old Age Security (OAS) payment amounts. The Old Age Security pension is reviewed in January, April, July and October to reflect increases in the cost of living as measured by the Consumer Price Index. Your monthly payment amount will not decrease if the cost of living goes down.

How and when to apply for OAS

In general, enrolment in OAS is automatic. Recipients will receive written notification by mail in the month after they turn 64 years old. If for some reason you do not receive written notification, you may need to apply. You can find the form on the Government of Canada’s website.

Deferring OAS

If you don’t want to receive your pension when you turn 65, you can voluntarily defer it. The longer you defer, the more money you will receive overall. For every month that you defer receiving the OAS, the monthly amount increases by 0.6% up to a maximum of 36% when you turn 70.

How OAS works

OAS recipients can qualify for a full pension or a partial pension. The pension you’ll qualify for (and hence the amount of money you’ll receive monthly) depends on how long you lived in Canada once you turned 18.

What is the OAS recovery tax?

Your OAS pension could be subject to a recovery tax, commonly referred to as the “OAS clawback,” if your net annual income exceeds the minimum income threshold set for the year by the government.

What happens to OAS if the beneficiary dies?

If the beneficiary of an Old Age Security pension dies, their benefits must be cancelled as soon as possible. The estate may receive payments for the month of death, but all payments issued thereafter must be repaid.

About the Author

Sandra MacGregor has been writing about personal finance, investing and credit cards for over a decade. Her work has appeared in a variety of publications like the New York Times, the UK Telegraph, the Washington Post, Forbes.com and the Toronto Star. You can follow her on Twitter at @MacgregorWrites.

How long do you have to live in Canada to get a full OAS pension?

To qualify for a full OAS pension, you must have lived in Canada for at least 40 years after age 18. You will receive a partial pension benefit if you haven’t resided in Canada for the full 40 years. The partial pension benefit is 1/40th of the full pension amount for each complete year you lived in Canada after age 18.

What is an OAS pension?

The Old Age Security (OAS) pension is one of the three main pillars of Canada’s retirement income system. The two other pillars are the Canada Pension Plan (CPP) and Employment Pension Plans/Individual Retirement Savings. The universal OAS pension is a taxable monthly payment available to seniors who are aged 65 and older and who meet ...

What is the OAS clawback?

OAS Clawback. Officially known as the OAS recovery tax. Your OAS benefit may be reduced by a clawback if your net income for the previous calendar year exceeds $77,580 (2019), $79,054 (2020), and $79,845 (2021).

How long can you defer your OAS?

Since July 1, 2013, individuals can voluntarily defer their OAS pension for up to 5 years after the date they become eligible. This deferral will make them eligible for a higher monthly pension later.

Is the OAS pension taxable?

The universal OAS pension is a taxable monthly payment available to seniors who are aged 65 and older and who meet the eligibility requirements. Unlike the CPP, Old Age Security benefits are not tied to your employment history. You may be eligible to receive the OAS pension even if you have never worked or are still employed.

When is the OAS adjusted for 2021?

For the third quarter of 2021 (i.e. July to September), the maximum monthly OAS benefit is $626.49.

Can seniors defer OAS?

Defer OAS/CPP: Seniors can defer OAS pensions for up to 5 years from when they are eligible. CPP can be deferred as well. However, note that deferring OAS or CPP will increase your benefits later down the road and could then trigger OAS clawbacks at that time.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What is the full retirement age for Oasdi?

The OASDI program provides payments to people who meet certain criteria. For old-age payments, money is paid to qualifying persons starting as early as age 62. Full retirement age depends on birth date and is 67 for everyone born in 1960 or later. 10 Qualifying persons who wait until age 70 (but no later) to begin collecting benefits can collect higher, maximum benefits due to delayed retirement credits. 11

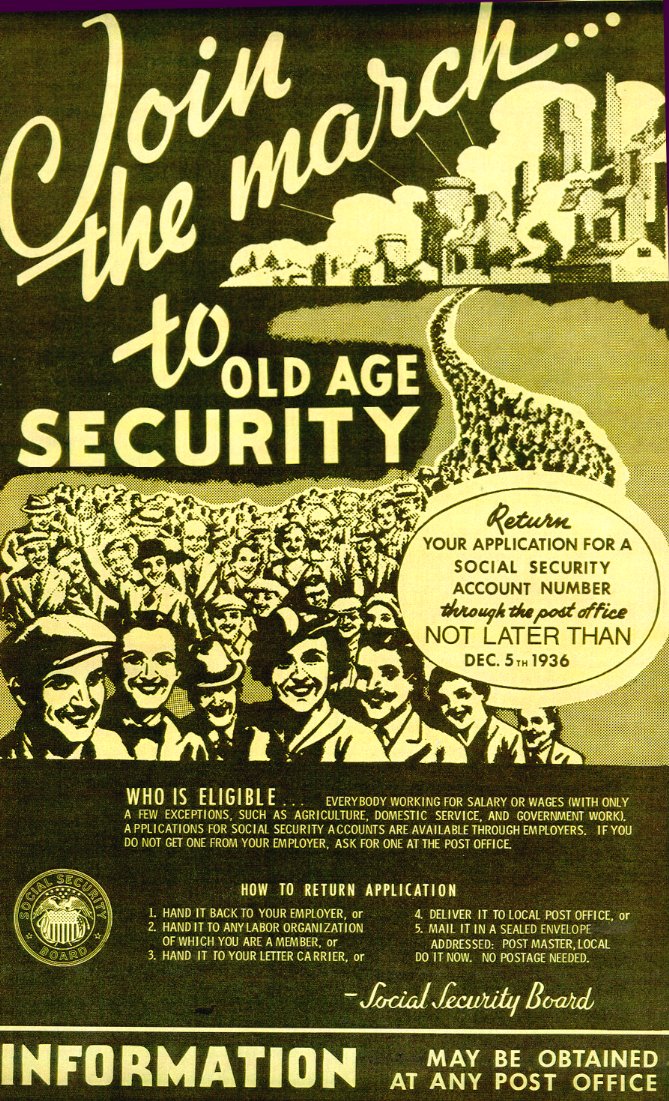

When did Social Security start?

The program was ushered in through the Social Security Act, signed by President Franklin D. Roosevelt on August 14, 1935, when the U.S. economy was in the depths of the Great Depression. 5 The program has grown massively over the decades, along with the U.S. population and economy.

What is the Oasdi program?

The federal OASDI program is the official name for Social Security. It provides benefits to retirees and disabled people. OASDI taxes, also known as FICA payroll taxes, fund the program. The amount of an individual’s monthly payment is based on their earnings during their working years.

What is OASDI in Social Security?

The federal Old-Age, Survivors, and Disability Insurance (OASDI) program is the official name for Social Security in the United States. The OASDI tax noted on your paycheck funds this comprehensive federal benefits program that provides benefits to retirees and disabled people—and to their spouses, children, and survivors.

How much will Social Security cost in 2021?

The U.S. Social Security program is the largest such system in the world and is also the biggest expenditure in the federal budget, projected to cost $1.2 trillion in 2021. 2 Nearly nine out of 10 individuals age 65 and older receive Social Security benefits, ...

What is OASDI payroll tax?

OASDI Payroll Tax. Payments to qualifying persons are funded through OASDI taxes, which are payroll taxes collected by the government that are known as FICA taxes (short for Federal Insurance Contributions Act) and SECA taxes (short for Self-Employed Contributions Act ).

What is Old Age Security?

Old Age Security (OAS) is Canada’s largest pension program that gives eligible residents and citizens a taxable monthly payment once they reach the age of 65. The government’s general tax revenues fund it so you don’t have to pay into it directly.

Who is eligible for OAS?

You need to be aged 65 or older to qualify for the OAS pension. There are also other eligibility requirements depending on where you live.

How much can I get from OAS in 2021?

From October to December 2021, the maximum monthly payment you can receive from OAS is $635.26. This amount is adjusted quarterly in January, April, July, and October based on changes to the Consumer Price Index.

How is the OAS pension calculated?

OAS pension amounts are determined by how long you’ve lived in Canada after turning 18. You’re entitled to a full pension if you’ve lived in Canada for at least 40 years. If you haven’t, you can still get a partial OAS pension which is 1/40th of the full OAS pension for every year you’ve resided in Canada since age 18.

How do I apply for OAS?

Service Canada will automatically enroll you for OAS if you’re eligible. You can expect a notification letter from the government agency the month after you turn 64.

When can I expect my first OAS payment?

If you set up direct deposit, OAS payments will be sent to your bank account every month on the following dates:

Need cash today?

OAS qualifies as income and can help you get approved for a cash advance personal loan. If you need money today, apply with Spring Financial (in just 3 minutes!) to get quick funds transferred to your bank account in hours, not days!

Retirement Age Calculator

Find out your full retirement age, which is when you become eligible for unreduced Social Security retirement benefits. The year and month you reach full retirement age depends on the year you were born.

Why Did the Full Retirement Age Change?

Full retirement age, also called "normal retirement age," was 65 for many years. In 1983, Congress passed a law to gradually raise the age because people are living longer and are generally healthier in older age.

What is the maximum amount you can earn before retirement in 2021?

If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is $50,520. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

Can you report a change in earnings after retirement?

If you need to report a change in your earnings after you begin receiving benefits: If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away. You cannot report a change of earnings online.