Social Security Disability Benefits (RSDI or Title II Benefits) These benefits are available to disabled workers under retirement age who have earned a minimum number of quarters of coverage from employment covered under the Social Security system. The required number of quarters varies depending on your age at the time you become disabled.

Full Answer

What are Title II benefits?

leading St. John Paul II to the Canyon Athletic Association state title ahead of its move to AIA in 2019-20. Story continues Three and a half years later, that newness has its benefits. “They've kinda just gelled from the beginning,” Green said.

What does Title II mean?

- 2020, Table 2. Number of operating public schools and districts, student membership, teachers, and pupil/teacher ratio, by state or jurisdiction: School year 2018–19

- 2019, Digest of Education Statistics 2018, Table 215.20. ...

- 2019, Digest of Education Statistics 2018, Table 401.70. ...

What is SSA title II benefits?

- CE scheduling intervals;

- CE report content;

- Elements of a complete CE;

- When a complete CE is not required; and

- Signature requirements.

What is Title II?

WESTON, W.Va. – Braxton County had 11 wrestlers finish in the top four, earning the Eagles the Region II wrestling title. Several other schools in the region have wrestlers that are states bound. The full AA-A Region II wrestling tournament results can ...

Is RSDI the same as Social Security?

An acronym for three types of benefits SSA pays. RSDI is considered “Social Security” benefits and individuals are insured by Medicare. SSI is Supplemental Security Income, which is for low income individuals with a disability. Individuals with SSI are insured by Medicaid.

What is RSDI Social Security benefits?

RSDI is an acronym that stands for Retirement, Survivors, and Disability Insurance. It refers to benefits that are paid to a disabled child or widow of someone who has worked. The benefits may come from survivors benefits, disability benefits or retirement benefits. SSD stands for Social Security Disability.

What type of Social Security is RSDI?

The Retirement, Survivors, and Disability Insurance (RSDI) program refers to retirement, survivors, and disability benefits paid to workers, their dependants, and survivors. For more detailed information on each of these programs, please visit the following links: Retirement Benefits. Survivors Benefits.

How much do you get for RSDI?

Currently, that reduced rate is 80 percent of the full retirement rate, but for those born after 1960, the reduced rate will decrease to 70 percent. For example, if your full retirement rate is $1,000 a month and you retire at 62 years old, you will only receive $800 per month.

Who can receive RSDI?

Retirees qualify for full RSDI when they reach full retirement age, if they are insured under the SSDI system (generally, if they have worked 10 years or more in the United States). Full retirement age is 65 years old for anyone born before 1960 and 67 years old for anyone born since 1960.

Can you receive RSDI and SSI at the same time?

Yes, you can receive Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) at the same time. Social Security uses the term “concurrent” when you qualify for both disability benefits it administers.

Do RSDI recipients get a stimulus check?

Individuals who receive Railroad Retirement and Survivor benefits and those who receive Social Security Retirement, Survivors, or Disability benefits who do not have qualifying children under age 17, will automatically receive the $1,200 stimulus payment directly from the IRS as long as the individual received an SSA- ...

How often is RSDI paid?

RSDI (Retirement, Survivors and Disability) also referred to as SSA Benefits. Since June 1997 SSA delivers recurring RSDI benefits on four days throughout the month on the 3rd of the month and on the second, third and fourth Wednesdays of the month.

Is RSDI taxable income?

Social Security disability is subject to tax, but most recipients don't end up paying taxes on it. Social Security disability benefits (SSDI) can be subject to tax, but most disability recipients don't end up paying taxes on them because they don't have much other income.

What type of Social Security is Title II?

Title II provides for payment of disability benefits to disabled individuals who are "insured" under the Act by virtue of their contributions to the Social Security trust fund through the Social Security tax on their earnings, as well as to certain disabled dependents of insured individuals.

What is SSDI disability?

SSD - Social Security disability. SSDI - Social Security disability insurance. Title II benefits. If Social Security agrees that you are medically disabled and you are younger than full retirement age, you can receive disability benefits roughly equal to what your full retirement benefits would be. In this sense, disability insurance is kind ...

What does RSDI stand for?

RSDI stands for Retirement, Survivors, and Disability Insurance and is an acronym for the three of the types of benefits that the Social Security Administration pays. Another name for the Social Security program is "Old Age, Survivors And Disability Insurance Program," or OASDI. To be eligible for any RSDI, or OASDI, benefit, ...

How long do you have to work to get a RSDI?

To be eligible for any RSDI, or OASDI, benefit, you need to have worked for a certain number of years, paying FICA taxes into the Social Security system.

Who is eligible for a survivor benefit?

Survivors Benefits. Minor children, widows, and surviving divorced spouses of a worker who qualified for Social Security retirement or disability benefits are eligible for a survivors benefit (and sometimes a small one-time death benefit as well).

What is a RSDI?

A. Definition. Retirement, Survivors, Disability Insurance (RSDI) is a federally funded program designed to ensure the continuation of income to those who are disabled, have reached retirement age, or are the surviving dependents of those who qualified for Social Security Disability Insurance.

What is the RSDI program?

The RSDI program, or Title II of the Social Security Act , is the largest income continuation program in the United States. It was enacted in 1935 as part of Franklin D. Roosevelt’s New Deal during the Great Depression. The insurance program took the form of Social Security payments for widows with a family to support, the handicapped, and others in need of money, who were not able to support themselves.

What can a representative do for disability?

Your representative can help you determine if your physical or mental impairment is severe enough to qualify for disability benefits under the Social Security Administration. He or she also can advise you whether to apply for RSDI benefits, SSI benefits, or both.

What are the benefits of Social Security?

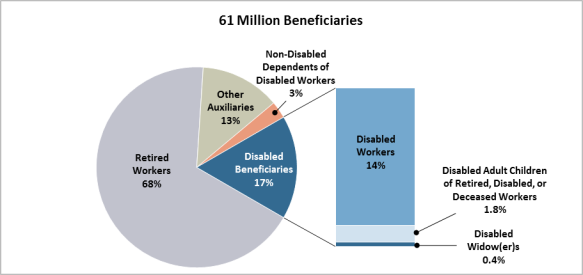

RSDI encompasses three types of benefits, which the Social Security Administration provides: 1 Retirement Benefits — People who have worked and paid into the Social Security system for the requisite number of years are eligible for retirement benefits when they retire. A worker can opt for early retirement benefits at age 62, or wait to receive full retirement benefits at a later age (66 for most people retiring today). If you wait until your full retirement age, your retirement benefit will be higher, permanently. 2 Survivors’ Benefits — Minor children, widows, and surviving divorced spouses of workers who qualified for Social Security retirement or disability benefits are eligible for survivors’ benefits, and sometimes, a small one-time death benefit, as well. 3 Disability Insurance — Disability insurance is synonymous with Social Security Disability. If the Social Security Administration agrees you are unable to sustain full time work for a year or longer, and you are younger than full retirement age, then you can receive disability benefits roughly equal to what your full retirement benefits would be. Disability insurance is like an early retirement plan for people who become ill or injured before reaching full retirement age because Social Security retirement benefits aren’t decreased, as they would be if you started collecting retirement benefits before your full retirement age.

How old do you have to be to collect Social Security?

If you are the minor child of a retired or disabled worker who qualifies for Social Security retirement or Social Security disability benefits, you are entitled to receive benefits until you are age 18 , based on your parent’s earnings record.

Who is eligible for survivors benefits?

Survivors’ Benefits — Minor children, widows, and surviving divorced spouses of workers who qualified for Social Security retirement or disability benefits are eligible for survivors’ benefits, and sometimes, a small one-time death benefit, as well.

Who determines if you are disabled?

The determination of whether you are disabled is made by your state’s Disability Determination Services (DDS), which contracts with the Social Security Administration. Although DDS’s are state agencies, they follow federal rules.

Why was Title II withheld?

EXAMPLE: An individual's Title II benefits for January 2001 through May 2001 are withheld because of expected work and earnings. He reports in June 2001 that he quit working in February 2001 after sending the annual earnings report. He paid SMI premiums for January - March 2001, April - June 2001, and July - September 2001. A Title II check sent in July 2001 includes full benefits for January - June 2001 and refunds SMI premiums for August - September 2001, which will be withheld from future checks. For SSI purposes, the part of the check, which represents full benefits for January - June 2001 is unearned income in July 2001 and the refunded SMI premiums for August - September 2001 are not income.

What information is used to verify if a person is receiving RSDI?

Use information provided by the individual (e.g., claim number ) to verify whether he/she is receiving RSDI.

What happens if you garnish Title II?

If a monthly Title II benefit payment has been reduced because of a garnishment, the gross amount of the benefit received (plus any SMI premium withheld) is unearned income.

When was the 2001 SMI check sent?

A Title II check sent in July 2001 includes full benefits for January - June 2001 and refunds SMI premiums for August - September 2001, which will be withheld from future checks. For SSI purposes, the part of the check, which represents full benefits for January - June 2001 is unearned income in July 2001 and the refunded SMI premiums ...

What to do if your Title II is reduced?

If a monthly Title II benefit payment has been reduced due to a garnishment, charge the gross benefit payment as income. Use the deductions fields on the ISSA screen to record the garnishment amount (MSOM MSSICS 015.013).

What is the basis for determining SSI?

Use the correct benefit amounts and resulting countable income as the basis for determining the SSI payment.

Is Title II unearned income?

The amount of Title II after reductions, certain deductions, and dollar rounding, but before the collection of any obligations of the beneficiary (e.g., supplementary medical insurance (SMI) premium, Medicare Part D premium or prior overpayment) is unearned income for SSI purposes.

What chapter is Title II?

Title II appears in the United States Code as §§401-433, subchapter II, chapter 7, Title 42. Regulations relating to Title II are contained in chapter III, Title 20, Code of Federal Regulations. See Vol. II, 31 U.S.C. 3720 and 3720A with respect to collection of payments due to Federal agencies; and §3803 (c) (2) ...

What is Sec. 230?

Sec. 230. Adjustment of the contribution and benefit base

What are the goals of Title II?

GOALS. 1. To gain a very basic understanding of Title II Social Security Disability Insurance (SSDI) and Childhood Disability Beneficiaries. 2. To know what the five phases of the Title II survivor and disability insurance processes are when a consumer goes to work. 3.

What is SSDI insurance?

SSDI is an insurance program created to assist people with disabilities who are unable to work (or who work, but are not making what the Social Security Administration (SSA) calls “Substantial Gainful Activity (SGA)”. SSDI provides a monthly cash benefit and/or health insurance so the individual can get back to work and earn a living wage.

What is SSDI replacement rate?

The SSDI Replacement Rate is what the consumer would need to gross monthly to replace the amount of the SSDI cash benefit PLUS the net amount they could earn if they stayed below SGA.

How to verify where the consumer is in the SSDI return to work process?

The best way to verify where the consumer is in the SSDI Return to Work process is to get a Benefits Planning Query (BPQY). The BPQY is available for consumers on SSI as well.

How much is the average SSDI benefit in 2015?

The average SSDI cash benefit in calendar year 2015 is $1,100 a month. Just like SSI, the amount of monthly SSDI cash benefit is rarely high enough to be able to pay bills and live a full life.

What is a TWP on SSDI?

The Trial Work Period (TWP) is a time for consumers to try working at the maximum number of hours possible for the most money per hour and still get their monthly SSDI cash benefit.

How much can a family receive from SSDI?

The family member(s) will receive less in monthly cash benefit(s), and there is a maximum amount (typically between 150% and 180% of the record holder’s benefit) a family can receive. Individuals who receive SSDI can have unlimited unearned income and resources.

What is RSDI in the SSA?

RSDI: In the words of the SSA, RSDI refers specifically to “retirement, survivors, and disability benefits paid to workers, their dependants, and survivors. ”. Retirement, Survivors, and Disability Insurance or RSDI pays benefits to a disabled child or a widow or widower of someone who has worked, qualified based on the deceased person’s earnings.

What is SSI for children?

SSI: Supplementary Security Income or SSI is for “disabled adults and children who have limited income and resources, ” according to the SSA. In a great many cases, SSI recipients have not worked enough to pay into the system. Children under 18 only qualify for if they have been disabled since childhood.

What are the benefits of SSD?

Text version of the graphic above: 1 SSD : In the words of the Social Security Administration (SSA), Social Security Disability (SSD) benefits may be paid “to you and certain members of your family if you have worked long enough and have a medical condition that has prevented you from working or is expected to prevent you from working for at least 12 months or end in death.” Verifying your work history is a large component of an SSD application or appeal. Documenting your medical condition is the other essential aspect. 2 RSDI: In the words of the SSA, RSDI refers specifically to “retirement, survivors, and disability benefits paid to workers, their dependants, and survivors.” Retirement, Survivors, and Disability Insurance or RSDI pays benefits to a disabled child or a widow or widower of someone who has worked, qualified based on the deceased person’s earnings. These benefits may come from one of three programs: retirement benefits, survivors benefits and disability benefits. 3 SSI: Supplementary Security Income or SSI is for “disabled adults and children who have limited income and resources,” according to the SSA. In a great many cases, SSI recipients have not worked enough to pay into the system. Children under 18 only qualify for if they have been disabled since childhood.

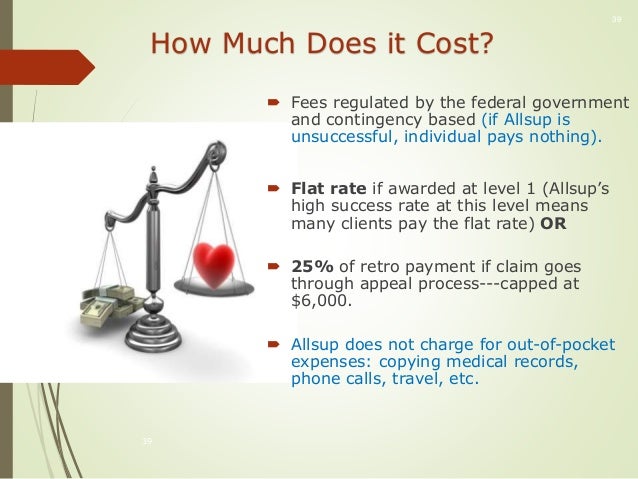

How to contact Midwest Disability?

We are here to explain what you need to know to pursue the disability benefits that are right for you. Call our office at 763-447-4103 or 888-351-0427 toll free, or complete our free case evaluation form online. At Midwest Disability, P.A., all cases are handled on a contingency fee basis.

What is RSDI in retirement?

Retirement, Survivors, Disability Insurance (RSDI) is a federally funded program that provides income to individuals and families who fit certain criteria. RSDI can provide income after you retire ...

Where can I find out if I qualify for RSDI?

To find out if you are entitled to RSDI benefits, contact the Social Security Disability Insurance attorneys at Midwest Disability, P.A., in Minnesota. From our Midwest office locations, we provide legal assistance to clients throughout the U.S.

How old do you have to be to get Social Security?

There are three types of benefits you may apply for within the Retirement, Survivors, Disability Insurance system, including: Retirement benefits: Applicants can receive benefits if they: Are at least 62-years-old. Are not currently receiving their Social Security benefits. Have not applied for retirement benefits.

Can I get RSDI if I retire?

RSDI can provide income after you retire and supplement lost income if you are hurt and cannot return to work. If a wage-earning family member dies or if a family member who was receiving disability benefits dies, RSDI benefits may also be obtained.

Retirement Benefits

- The condition must also prevent you from performing any type of gainful work activity. Those who apply for Title II benefits must also have enough work credits in order to be approved for Title II disability benefits. Work credits are earned each quarter that a taxpayer pays into the Social Sec…

Disability Insurance

Dependents Benefits

Survivors Benefits