Which states are still paying extra unemployment benefits?

A Baltimore judge on Saturday ordered the state to continue paying enhanced ... to continue the unemployment programs, just hours before they were set to end under a decision by the Republican governor. The benefits include an extra $300 per week for ...

Should you buy supplemental unemployment insurance?

Supplemental unemployment insurance is an extra financial safety net should you become involuntarily unemployed. The insurance will pay you a monthly sum. How much you receive depends on: Your salary. Which cover you have chosen. The insurance company or unemployment fund – some cover up to 80 % of your salary, while others cover 90 % (IDA ...

Is supplemental unemployment the same as unemployment?

Supplemental unemployment insurance is an insurance policy that provides income to workers that become unemployed. Payments from this type of insurance are made in addition to state unemployment. If set up correctly, supplemental unemployment insurance payments do not reduce the amount of state unemployment benefits or eligibility.

Who pays for unemployment benefits and what do employers pay?

Who Pays for Unemployment in New York State?

- Employers’ Duties. Once employers hire employees within the state, New York law requires them to contact the New York Department of Labor to determine their individual tax contribution rates and ...

- Covered Employment. ...

- Exceptions and Special Programs. ...

- Considerations. ...

What are supplemental unemployment benefits California?

About the PEUC Extension. Pandemic Emergency Unemployment Compensation (PEUC) provided up to 53 additional weeks of payments if you've used all of your available unemployment benefits. The first 13 weeks were available from March 29, 2020 to September 4, 2021.

What is sub payment?

A Supplemental Unemployment Benefits (SUB) plan is an employer-sponsored benefit that provides severance pay to employees who involuntarily lose their jobs such as through layoff, reduction in force, or plant closing.

What is a sub Plan Canada?

Overview. Employers can use a Supplemental Unemployment Benefit (SUB) plan to increase their employees' weekly earnings when they are unemployed due to a temporary stoppage of work, training, illness, injury or quarantine.

Can a furlough collect unemployment in California?

Furloughed employees will typically be eligible for Unemployment Insurance benefits through the California Employment Development Department (EDD). A layoff is a temporary separation from payroll.

What does supplemental employment mean?

Supplemental Employment is any other employment for. compensation in addition to an employee's regular employment with the. City of Grand Rapids. Supplemental employment shall not prevent an employee from fulfilling their primary responsibilities to the Department.

What does SUBs mean on my payslip?

Section 3402(o)(2) defines SUBs as payments to an employee that are includible in the employee's gross income and are made because of an involuntary separation from employment by a layoff, plant closing or similar condition.

What is a sub plan for EI?

A supplementary unemployment benefit plan (SUBP) is a plan that is established by a single employer or group of employers to top up employee employment insurance (EI) benefits during a period of unemployment due to training, sickness, accident, disability, maternity, parental, compassionate care, family caregiver leave ...

Can I get EI for reduced hours?

Employees finding themselves in the latter scenario may be wondering – can I get EI if my hours of work are reduced? Unfortunately, you do not qualify for EI regular benefits unless you had to completely stop working.

What is the family supplement for EI?

The Family Supplement is paid as a top-up benefit to EI claimants who have a net family income of up to $25,921 and who receive (or whose spouse receives) the Canada Child Benefit. The Family Supplement is the only EI-related payment that considers family income as opposed to an individual's earnings.

What is the difference between layoff and furlough?

The difference between being furloughed and being laid off is that a laid-off employee would have to be rehired to work for the company again. If you are furloughed, you may still receive employee benefits and you may be eligible for unemployment during this time.

How many hours can I work and still get unemployment in California?

Earnings equal to or over the benefit amount will result in no benefits for that week. You may work part-time and earn up to 30 percent of your weekly benefit rate in each claim week before your earnings affect your weekly benefit payment.

Who qualifies for pandemic unemployment in California?

You must also have been unemployed, partially unemployed, or unable or unavailable to work due to at least one of the following reasons to be eligible for PUA: My place of employment was closed as a direct result of the COVID-19 public health emergency.

What are supplemental unemployment benefits (SUB)?

Supplemental unemployment benefits (SUB) are tax benefits paid out to terminated employees due to training, illness or injury, Reduction in Force (...

How do you apply for supplemental unemployment benefits?

Laid-off employees are required to file a claim with the unemployment insurance office in the state where they worked.

How long will the supplemental unemployment last?

Supplemental unemployment benefits last until the employee is rehired or finds alternative work.

Are supplemental unemployment benefits taxable?

Supplemental unemployment benefits are exempt from payroll taxes (FICA, FUTA, SUTA) but subject to federal and state income taxes.

How long can a company furlough an employee?

Employees can be furloughed until the company for which they work reopens.

What can't a SUB plan provide for?

Termination for cause or resignation.

What is a SUB in unemployment?

Supplemental unemployment benefits (SUB) are tax benefits paid out to terminated employees due to training, illness or injury, Reduction in Force (RIF), or temporary layoff. These benefits are a supplemental income to state unemployment benefits and are exempt from payroll taxes.

What is a sub plan?

When a company is downsized, it can be costly for the employer to pay out a lump sum to laid-off employees, therefore a SUB plan allows them to contribute to the fund over time and minimize the financial impact on the company. SUB pay is classified as benefits, not wages, which results in a reduced payroll tax liability for both ...

How to apply for sub pay?

How to apply for SUB: To receive SUB pay, former employees must be eligible for state unemployment benefits and willing participants of their employer's SUB plan. They are also required to file a claim with the unemployment insurance office in the state where they worked (SUB rules may differ depending on the state you are in).

When was the Supplemental Unemployment Benefits Plan created?

The Supplemental Unemployment Benefits Plan was initially created in the 1950s as a way to provide a more meaningful benefit to individuals affected by reductions in force, as state unemployment benefits were often inadequate to support displaced workers and their families during times of layoffs.

How much is unemployment benefit in a sub plan?

Under a SUB Plan, the employee applies for state unemployment compensation benefits and is eligible to receive $616 per week. The company then supplements the difference by paying the gap of $384. Together, the two benefits equal 100 percent of the employee’s regular wage.

How does a sub plan work?

How SUB Plans Work. Under a SUB Plan, the employer-paid severance benefit is offset by the amount of State Unemployment the employee is eligible to receive. Displaced employees maintain their pre-displacement wage, while employers save 30-50% when compared to traditional severance.

What is a sub plan?

It is an IRS approved, tax-exempt vehicle used by employers to maintain weekly income for permanently or temporarily displaced employees while generating considerable cost savings for the organization. 2. How SUB Plans Work. Under a SUB Plan, the employer-paid severance benefit is offset by the amount of State Unemployment ...

Why do unions advocate for supplemental pay?

Unions, especially in the auto and steel industries where seasonal and cyclical layoffs are common, advocated for supplemental pay to lessen the disparity between their former wage and the state Unemployment Insurance (UI) benefit.

What is the most important aspect of a company's severance plan?

The most important aspect of a company’s severance plan is that it fit the company’s culture. For instance, if your organization subscribes to an entitlement culture, paying out a lump-sum windfall in amounts correlating to job level might make a lot of sense.

Is a sub plan subject to FICA?

As discussed above, SUB Plans are not subject to FICA taxes when administered properly. The employer saves 7.65% on the SUB payments it makes, and the employee also benefits from their 7.65% of tax savings, increasing the total take-home pay a released employee receives.

Why do employers use sub plan?

In an economic downturn, employers may find it easier to make installment payments via the SUB plan instead of having to come up with a lump-sum severance payment.

What is a SUB plan?

What is a Supplemental Unemployment Benefits (SUB) Plan? A Supplemental Unemployment Benefits (SUB) plan is an employer-sponsored benefit that provides severance pay to employees who involuntarily lose their jobs such as through layoff, reduction in force, or plant closing. Payments funneled through the SUB plan are made in addition to ...

Can a discharged worker receive unemployment benefits?

Therefore, to receive SUB plan payments, discharged workers must qualify for unemployment benefits under state law. A SUB plan can be funded by the employer or the employee or both. The plan payments make up the difference in the discharged workers’ state unemployment compensation and their prior regular weekly income.

Do former employees qualify for unemployment?

Former employees do not have to qualify for state unemployment benefits in order to receive traditional severance pay. However, to obtain SUB plan payments, the employee must be eligible for state unemployment benefits. In some cases, a SUB plan can extend eligibility to discharged workers who are no longer receiving state unemployment benefits.

Can a sub plan extend unemployment benefits?

In some cases, a SUB plan can extend eligibility to discharged workers who are no longer receiving state unemployment benefits. Traditional severance pay may lower the amount of state unemployment benefits the discharged worker receives or render the worker ineligible for unemployment. Conversely, SUB plan payments generally do not affect state ...

How does the Cares Act impact the implementation of sub plans?

How the CARES Act impacts the implementation of SUB plans is unclear. There are at least a few ways CARES could influence SUBs. For example, there are now additional eligibility requirements to qualify for unemployment. There’s a waived waiting period.

Can you create a sub plan quickly?

The viability of the strategy is very dependent on state-specific rules. And it’s not easy to create a SUB plan quickly. In some states, employers must seek approval for plan designs prior to implementation.

Can a sub plan be funded by an employer?

SUB plans can be funded entirely by an employer or by employees , or by some mix. The standard plan is entirely employer funded, with individual funds for each worker. These replace normal severance payments. Employee-funded SUB plans are different, contributions being shared into a collective fund for all employees.

Drawbacks Of Sub Plans For Employers

Creating an SUB plan can require a lot of administration and it cant be used in all situations . The viability of the strategy is very dependent on state-specific rules. And its not easy to create a SUB plan quickly. In some states, employers must seek approval for plan designs prior to implementation.

How Are Supplemental Unemployment Benefits Plans Linked To State Unemployment Benefits

Generally, the discharged employee must be unemployed and eligible for state unemployment benefits in order to receive payments through a SUB plan.

Supplemental Unemployment Benefit Plan

A Supplemental Unemployment Benefit Plan is an option that can prove beneficial to both employers and employees. It demonstrates that the employer is both compassionate and values work-life balance, and is attractive to potential employees concerned about that added layer of financial security.

What Are Supplemental Unemployment Benefits

Supplemental unemployment benefits are tax benefits paid out to terminated employees due to training, illness or injury, Reduction in Force , or temporary layoff. These benefits are a supplemental income to state unemployment benefits and are exempt from payroll taxes.

How Do You Create An Sub Fund

SUB plans can be funded entirely by an employer or by employees, or by some mix. The standard plan is entirely employer funded, with individual funds for each worker. These replace normal severance payments. Employee-funded SUB plans are different, contributions being shared into a collective fund for all employees.

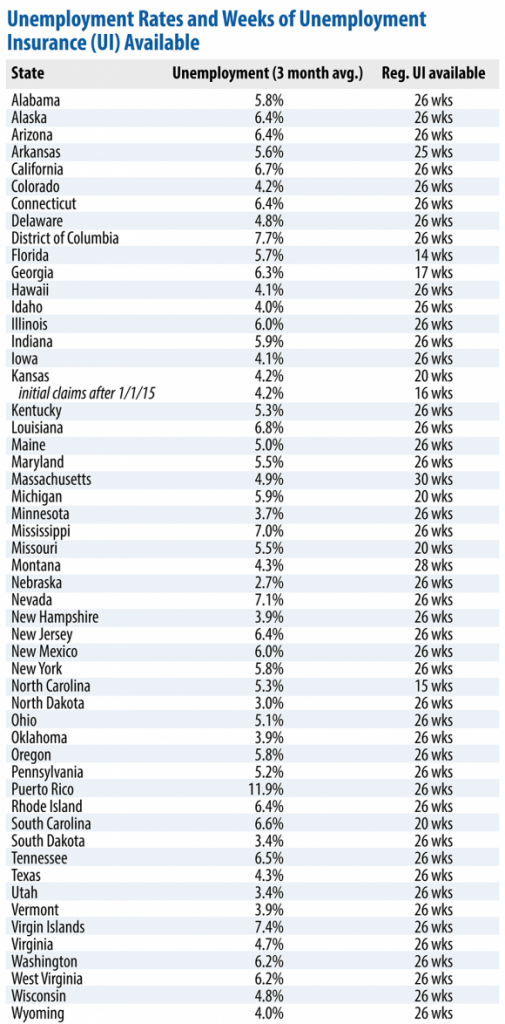

How Long Do Supplemental Unemployment Benefits Last

Unemployment benefits usually last for 26 weeks. However, each state determines the length of unemployment benefits. Due to the CARES Act, many benefits have been extended to 39 weeks. The length of time is also subject to change depending on other measures Congress takes in the coming months.

What Is A Supplemental Unemployment Benefits Plan

A Supplemental Unemployment Benefits plan is an employer-sponsored benefit that provides severance pay to employees who involuntarily lose their jobs such as through layoff, reduction in force, or plant closing. Payments funneled through the SUB plan are made in addition to the former employees state unemployment compensation.

Can An Employer Lay Off Its Employees If The Business Needs To Be Shut Down Due To Covid

Under the Employment Standards Act, 2000 , employers can temporarily layoff employees for a period of up to 13 weeks .

What Are Supplemental Unemployment Benefits

Reductions in force are unavoidable in economic downturns, but are traditional severance packages the way to go? They can be a big hit to your companys cash flow and are subject to payroll taxes. The tax-friendlier option, Supplement Unemployment Benefits plans , can spread out costs and deliver the same value for the employee, too.

What Are The New Documentation Requirements For Pua Claims

To weed out fraud, the latest relief bill requires additional documentation from PUA recipients.

Can An Employer Institute A Travel Policy Which Prevents Employees From Traveling Outside Of Canada

As noted above, the Government of Canada is currently recommending that Canadians avoid all non-essential travel outside of Canada to reduce the spread of COVID-19, and are recommending that anyone who does travel self-isolates for 14 days upon their return.

Does An Employer Have To Pay An Employee Who Is Unable To Work Due To A Positive Diagnosis Of Covid

No. Employees who are in quarantine or who have been advised by a medical or health official to self-isolate are entitled to take an unpaid leave of absence from the workplace. They can use paid sick time or vacation time to cover this period , and employers should also encourage employees to apply for Employment Insurance sick leave benefits.

Basic Requirements That Must Be Met

SUB plans are registered by Service Canada through the SUB program in Bathurst, New Brunswick. Plans must be registered before their effective date. Officers from the SUB program assess employers’ SUB plans against the requirements set out in subsection 37 of the EI Regulations.

Employment Insurance Telephone Information Service

The Employment Insurance Telephone Information Service is an automated telephone service that provides general and more specific information on the EI program. It is available 24 hours a day, 7 days a week.

What is supplemental unemployment?

What are supplemental unemployment benefits? Supplemental unemployment benefits are usually drawn from a tax-exempt trust that has been established to provide severance pay to workers who have been laid off. The plan, which supplements state unemployment benefits, provides assistance only if the workers have been let go due to workforce reduction ...

Who is responsible for supplemental unemployment benefits?

Employers are usually responsible for supplemental unemployment benefit payments even when the state pays for the bulk of unemployment compensation. The employer is still helping to supplement a former employee's lost wages, but they are only paying part of the former salary.

How long does unemployment last?

However, each state determines the length of unemployment benefits. Due to the CARES Act, many benefits have been extended to 39 weeks. The length of time is also subject to change depending on other measures Congress takes in the coming months. Individual states have to decide whether to extend the benefits.

Why do people get Supplemental Unemployment?

Supplemental unemployment benefits can help provide the consistency and reliability that people need in order to pay for food, shelter, and other necessities when they are unemployed because it replaces some or all of their lost income while they continue to look for work.

What are subs for unemployment?

SUBs help to provide unemployed individuals with the financial resources they need to meet their day-to-day needs, such as utilities, rent, food, health care insurance premiums, essential household items such as furniture or clothes.

How do subs help the economy?

Not only do SUBs help provide some financial relief to those who need it, but they can also help stimulate the economy: first, by providing much needed income to people who are out of work, and second, by helping people to save in order to contribute to the economy through spending once they return to work.

What is a supplemental unemployment plan?

The plan must be established and maintained by an employer or its employees solely for the purpose of providing supplemental unemployment compensation benefits. The plan must provide that the corpus and income of the trust cannot be used for, or diverted to, any purpose other than providing such benefits prior to the satisfaction ...

Why do you have to pay benefits to an employee?

Benefits must be paid to an employee because of the employee’s involuntary separation (whether or not such separation is temporary) from employment resulting directly from a reduction in force, the discontinuance of a plant or operation, or other similar conditions.

Can benefits be determined solely in the discretion of the trustees?

Benefits must be determined according to objective standards, and may not be determined solely in the discretion of the trustees. The eligibility requirements and the benefits payable must not discriminate in favor of officers, shareholders, supervisory employees, or highly compensated employees. Benefits payable under the plan will not be ...