Benefits of a 15-year mortgage

- Build equity faster. A 15-year fixed-rate mortgage, with its lower interest rate and higher payment amount, builds home equity faster because you pay down the principal balance quicker.

- Shorter path to full homeownership. Owning a home free and clear is a goal that burns bright for many people. ...

- Long-term savings. ...

What are the advantages of a 15 year mortgage?

Pros of 15-Year Mortgages

- Shorter Debt Horizon. No one likes debts hanging around their necks. ...

- Build Equity Faster. Sure, building equity in your home feels nice. ...

- Lower Interest Rate. Mortgage lenders charge lower interest rates for shorter-term loans. ...

- Lower Total Interest Paid. The lower interest rate aside, borrowers still pay more in interest for longer-term loans. ...

Why a 15 year mortgage is a smart move?

When interest rates are rising, the conventional wisdom says that refinancing your mortgage is less appealing. But for some homeowners, a 15-year refinance mortgage could be a smart financial move. Shorter mortgage terms help you increase your home equity faster.

Is a 15 year mortgage better than a 30 year?

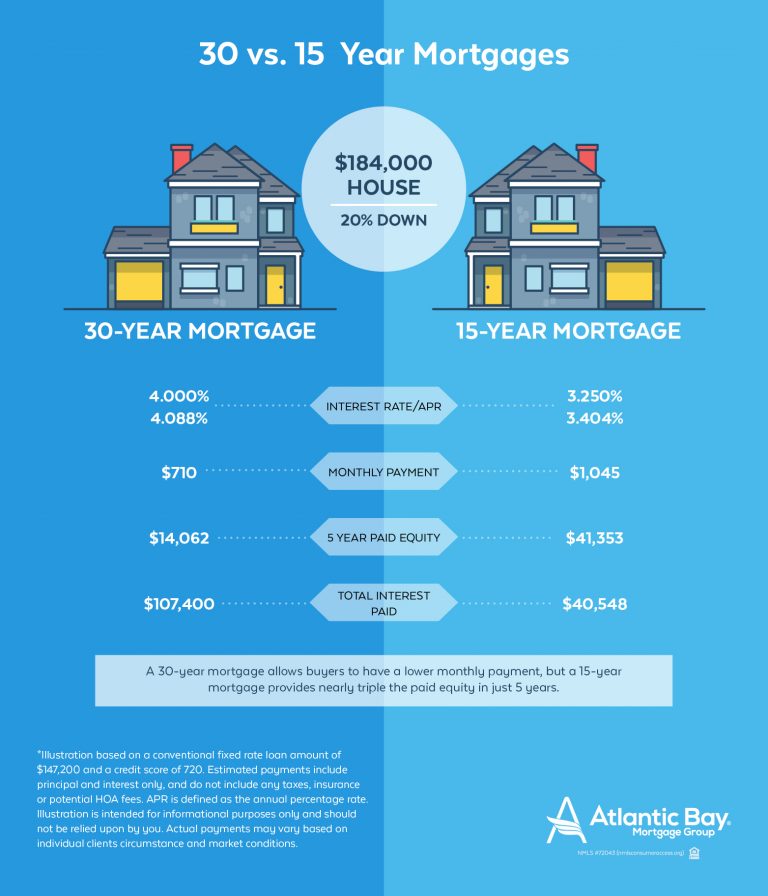

While a 30-year mortgage can make your monthly payments more affordable, a 15-year mortgage generally costs less in the long run. Most homebuyers choose a 30-year fixed-rate mortgage, but a 15-year mortgage can be a good choice for some. A 30-year mortgage can make your monthly payments more affordable.

How much house can I afford 15 year mortgage?

While you may have heard of using the 28/36 rule to calculate affordability, the correct DTI ratio that lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs (which includes property taxes and homeowners insurance) should be no more than 36% of your gross monthly income, and your total monthly debt (including your anticipated monthly mortgage payment and other debts such as car or student loan payments) should be no more than 43% ...

Is it better to get a 15-year mortgage or pay extra on a 30-year mortgage?

The advantages of a 15-year mortgage The biggest benefit is that instead of making a mortgage payment every month for 30 years, you'll have the full amount paid off and be done in half the time. Plus, because you're paying down your mortgage more rapidly, a 15-year mortgage builds equity quicker.

What is a disadvantage to having a 15-year loan vs a 30-year loan?

The main drawback to a 15-year mortgage is that monthly payments are much higher since you have to pay off the same amount in half the time. As a result, many homeowners simply can't swing the monthly payments. It's up to you and your loan officer to compare the costs — and potential savings — of a 15 vs.

Which of these is a disadvantage of 15-year mortgages?

The cons of a 15-year fixed-rate mortgage You HAVE a higher payment: Monthly payments for a 15-year mortgage run about 50% higher than on a 30-year home loan. You also have to pay property taxes, insurance and, if you put less than 20% down, mortgage insurance.

What percent of people have a 15-year mortgage?

While 15-year mortgages are less common than 30-year mortgages — accounting for only 6% of the market — that doesn't mean you shouldn't consider one. If you can afford the higher monthly payments, a 15-year mortgage can help you save money in the long run and be debt-free sooner.

How many years can I cut off my mortgage if I pay extra?

Just paying an additional $100 per month towards the principal of the mortgage reduces the number of months of the payments. A 30 year mortgage (360 months) can be reduced to about 24 years (279 months) – this represents a savings of 6 years!

How can I pay off a 15-year mortgage in 5 years?

Five ways to pay off your mortgage earlyRefinance to a shorter term. ... Make extra principal payments. ... Make one extra mortgage payment per year (consider bi-weekly payments) ... Recast your mortgage instead of refinancing. ... Reduce your balance with a lump-sum payment.

Is it smart to pay off your house?

You might want to pay off your mortgage early if … Paying off your mortgage early frees up that future money for other uses. While it's true you may lose the tax deduction on mortgage interest, you may still save a considerable amount on servicing the debt.

How can I pay off my 30-year mortgage in 15 years?

Options to pay off your mortgage faster include:Adding a set amount each month to the payment.Making one extra monthly payment each year.Changing the loan from 30 years to 15 years.Making the loan a bi-weekly loan, meaning payments are made every two weeks instead of monthly.

What is a 15 year mortgage?

A 15-year mortgage is the dream home loan for buyers who can afford higher monthly payments and want to pay off their mortgage in half the usual time. A 15-year timeline can save thousands or even tens of thousands of dollars in interest. To make a 15-year fixed-rate mortgage work, you’ll need a reliable income and enough money left ...

Why is a 15 year fixed rate mortgage better?

A 15-year fixed-rate mortgage, with its lower interest rate and higher payment amount, builds home equity faster because you pay down the principal balance quicker.

How many times as many 30-year mortgages are written?

Your taxes and insurance costs can change, though. In 2018, lenders wrote nearly 22 times as many 30-year home purchase mortgages as they did those with 15-year terms, according to NerdWallet analysis of Home Mortgage Disclosure Act data.

How long does it take for a Rocket Mortgage to close?

We've matched you with Rocket Mortgage by Quicken Loans. Quicken Loans works to close loans fast, averaging a closing time of around thirty days for a typical loan. (Read our Rocket Mortgage Review .)

What does it mean to use more money for mortgage payments?

Using more money for monthly mortgage payments means it’s not available for other investments such as home improvements or capturing an employer’s matching contribution to a retirement account.

What is the difference between a 15 year mortgage and a 30 year mortgage?

Monthly principal and interest payments for a 15-year fixed-rate mortgage run about 50% higher than on a 30-year home loan. You also have to pay property taxes, insurance and, if you put less than 20% down, mortgage insurance. This could make it hard to respond to emergencies and other needs. Even if numbers seem doable now, a mortgage is a commitment. Getting out means selling, refinancing or foreclosure.

How long does it take to pay off a 15 year mortgage?

What is a 15-year mortgage? A 15-year mortgage will be paid off completely in 15 years if you make all the payments on schedule. These mortgages typically have a fixed rate, which keeps the principal and interest rate the same for as long as you hold the mortgage. Your taxes and insurance costs can change, though.

1. You spend less on interest

You can save your money on interest in two ways with a 15-year mortgage. One is you can pay off your home loan in half the time, so you are spending less because you’re not carrying a loan for all that extra time.

2. You're debt-free sooner

Generally, mortgage debt is considered a healthy debt, and credit card debt is considered problematic.

3. Pay off your mortgage prior to retirement

Though it is not compulsory to pay off your home by the time of your retirement yet entering retirement ‘mortgage free’ is a happy and peaceful feeling.

What is the danger of a 15 year mortgage?

So if you can swing that higher monthly payment, you might as well go for it. 2. You have a stable job. The danger of getting a 15-year mortgage -- and the higher monthly payment that goes with it -- is that if you suddenly find yourself unemployed, ...

Do 30-year mortgages pay more?

For one thing, homeowners with 30-year mortgages typically take longer to pay off their homes and pay much more in interest. These are just a couple of the reasons why some homebuyers prefer the 15-year mortgage.

Is a 15 year mortgage good for self employed?

A 15-year mortgage might also be more suitable for someone who's a salaried employee, as opposed to a freelancer whose income is unpredictable. That said, some self-employed folks have more income stability than others. If you're a freelance employee who's built up a steady workflow and client base, then you might benefit from a 15-year mortgage as ...

Is 15 year mortgage good?

You can afford the higher monthly payment. If you don't have a lot of non-mortgage debt and you're earning decent money, then it's a good time to consider a 15-year loan.

Is a 15 year mortgage more affordable than a 30 year mortgage?

Remember, too, that while a 15-year mortgage will result in a higher monthly payment than a 30-year loan, it won't double your payment. Once you actually sit down to crunch the numbers, you may come to find that your payments under a 15-year loan are far more affordable than you initially thought.

How much would you pay if you paid off a mortgage in 15 years?

If you took the same terms but paid off the mortgage in 15 years, you'd pay $1,471 a month. Now, granted, your interest rate would likely be lower, but even if your interest rate dropped to 2.92 percent, you'd still pay $1,373 a month.

What is the key to deciding on a mortgage length?

Understanding your personal financial situation is key in deciding on a mortgage length.

Is a 15 year mortgage higher than a 30 year mortgage?

Con: The monthly payments for a 15-year mortgage are higher than a 30-year. For instance, if you took out a $200,000 mortgage at a 3.92 percent interest rate for 30 years, your monthly payments would be $946 (without factoring in taxes and other costs). If you took the same terms but paid off the mortgage in 15 years, you'd pay $1,471 a month.

Is it better to have a 15 year mortgage or a 30 year mortgage?

It isn't just that you've shaved off 15 years' worth of interest (though, yes, that's a plus), but the rates are usually lower for a 15-year mortgage than a 30-year mortgage.

Is 15 year mortgage good for thin savings?

So it's hard to argue with Fleming when he says: "Fifteen-year mortgages are not a good idea for folks with thin savings, or who carry credit card balances, or who have only one job in the family or who are on commission."

Is it better to pay off your mortgage sooner or later?

Pro: Your mortgage is paid off far sooner, freeing up your cash. That's an obvious pro, of course, and it's why many people do it. You might easily save tens of thousands, or even hundreds of thousands of dollars, depending on how expensive the home, thanks to having a shorter time to pay off your loan.

Is a 15 year mortgage a double bonus?

So a 15-year mortgage yields a double bonus, so to speak," Fleming says. But if you're thinking, "I am going to get a 15-year mortgage and become rich with savings," well, not so fast. There are some drawbacks. Con: The monthly payments for a 15-year mortgage are higher than a 30-year.

How much interest do you pay back on a 15 year mortgage?

You're paying back a loan of $250,000 that charges a 4.5 percent interest rate. If you added $200 a month to your monthly payment, you could reduce the payback on a 15-year mortgage to around 12.5 years. This would also save you nearly $13,000 in interest costs.

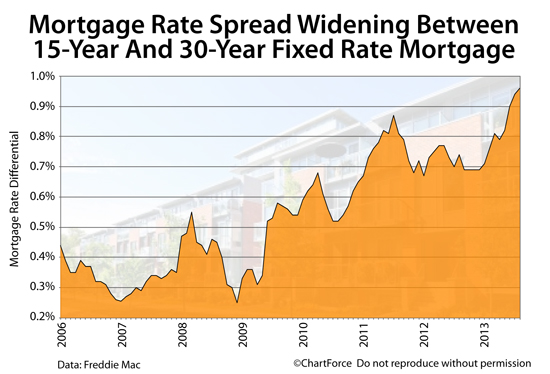

What is the average mortgage rate for a 30 year loan?

Mortgage rates just keep heading lower, defying expectations. Currently, the average rate is 3.56 percent for a fixed-rate 30-year loan. That’s nearly a half a percentage point lower than the rate just a year ago, according to Freddie Mac. Meanwhile, home values have been heading higher.

Does taking out a mortgage add up to closing costs?

Their total debt payments (including the mortgage) added up no more than 38 percent of their income on average. Keep in mind that taking out a new mortgage will come with closing costs. You can choose to pay upfront, or accept a slightly higher interest rate if you don’t want to use cash to cover your closing costs.

Is it a good time to refinance a 15 year mortgage?

With rates so low, it's also a good time to consider refinancing into a 15-year mortgage instead of a 30-year mortgage. Typically, homeowners prefer 30-year mortgages. Halving the payback period often means making a much higher monthly payment.

Can I refinance my mortgage if I have 15 years?

If you have 15 years or less remaining on your existing mortgage you may not want to refinance, says Germi Cloud, a financial advisor in Huntsville, Ala. “You’ve paid most of the loan’s interest costs in the first 15 years, so you don’t want to start paying more interest now.”

How does a 15 year mortgage work?

Usually, a 15-year home loan is amortized in such a way that the borrower pays mostly interest during the first few years of the term. As time goes on, however, this ratio gradually changes and the borrower pays more toward the principal. Near the end of the repayment term, most of the monthly payment gets applied toward the principal. This is usually how it works — your lender can show you the particulars of your loan when you apply for it.

What is the average rate for a 15 year mortgage?

When this article was published, in August 2017, the average rate for a 30-year fixed home loan was 3.93%. The average rate for a 15-year mortgage was 3.18%. This is based on the weekly survey conducted by Freddie Mac, which you can find online. It’s common for the 15-year mortgage to have a lower interest rate than its longer-term counterpart.

How long is a mortgage loan amortized?

Let’s start with a basic definition. This type of mortgage loan has a repayment window, or “term,” of 15 years. The debt is amortized (spread out over) a 15-year period, after which the loan is paid in full.

What are the disadvantages of a 15 year mortgage?

The primary disadvantage to using the 15-year option is that you could end up with a higher monthly mortgage payment, when compared to a 30-year fixed home loan.

What is a 30 year fixed rate mortgage?

The 30-year fixed-rate mortgage is by far the most popular financing product in use today. It accounts for the vast majority of home loans that are originated in the United States.

Is it better to get a 30-year mortgage or a 30-year mortgage?

If your primary goal is to reduce the size of your monthly payments, then you’re probably better off with a 30-year home loan.

Is it better to have a fixed rate for 15 years?

There are some pros and cons to having a fixed interest rate for 15 years. It protects you from rising interest rates, but it might also cost you more in interest when compared to an adjustable-rate mortgage or ARM. (But there are pros and cons to using an ARM loan, as well.)

Why do people get 15 year mortgages?

Some borrowers opt for the 15 year mortgage because it saves them a significant amount of money in the long term. The market today is filled with several types of mortgage products. The 15 year mortgage has its own set of advantages and disadvantages in comparison to the 30-year. While both the products share similarities, ...

Why is a 15 year mortgage better than a 30 year mortgage?

A homebuyer can save significant money over the length of the loan with a 15-year mortgage because the interest paid is less than in a 30-year mortgage.

How much does a mortgage payment of $200,000 for 15 years cost?

The borrower would need to buy a house that is cheaper a $200,000 mortgage at 4%, for 15-years, turns out for a payment of $1,479.

How much does a 30 year mortgage cost?

So a 30-year mortgage for a $300,000 home would cost $1,432 per month, which too is under the $1,500 maximum and allows you to take on a larger loan by getting a bigger home or a better location.

What happens if you buy a mortgage from Fannie Mae?

If the mortgage is purchased by Fannie Mae, one of the government-sponsored companies, you will end up paying less in fees for a 15-year loan.

Why are 15 year mortgages higher?

Because in a 15-year loan the payments are significantly higher, if buyers cannot keep up with the payments due to loss of job or change in income they risk defaulting on the loan.

What is required for a higher payment?

The higher payment requires higher cash flow and one year’s worth of income in liquid savings.

What are the drawbacks of a 15 year mortgage?

The main drawback to a 15–year mortgage is that monthly payments are much higher since you have to pay off the same amount in half the time. As a result, many homeowners simply can’t swing the monthly payments.

What happens if you commit to a 15 year mortgage?

What’s more, committing to a 15–year mortgage may leave you with less money to devote to other investments, such as a retirement plan or funding a child’s college fund.

How much of your loan goes to interest?

Trott explains that, over the life of a 15–year loan, “roughly 17% of your total payments go toward interest versus around 34% of your payment being applied to interest on a 30–year loan.”

What are the disadvantages of a 30 year mortgage?

The primary disadvantage of a 30–year term is that you are committed to making payments over a longer period. That means you’ll pay much more in interest over the life of the loan and your home equity will build much more slowly.

What will affect the amount of a mortgage payment?

Of course, the exact payment amounts will depend on your credit score, down payment, interest rate, and other factors. So it’s worth comparing both loan types before you buy to see how your options break down.

How long does it take to pay off a 30 year mortgage?

Most borrowers choose a 30–year fixed–rate mortgage, which gives them three decades to pay off their home.

Is a 15 year mortgage better than a 30 year mortgage?

Traditionally, a 15–year mortgage loan comes with a lower interest rate than a 30–year mortgage. That’s because, by agreeing to pay off the debt more quickly, 15–year borrowers present less risk to mortgage lenders.