Benefits

- Avoid added interest and penalties.

- Avoid losing future refunds. Part or all of any refund is first used to pay any back taxes owed.

- Safeguard credit. If the IRS files a tax lien against a taxpayer, it could affect credit scores and make it harder to get a loan.

What is a 1040 Form used for?

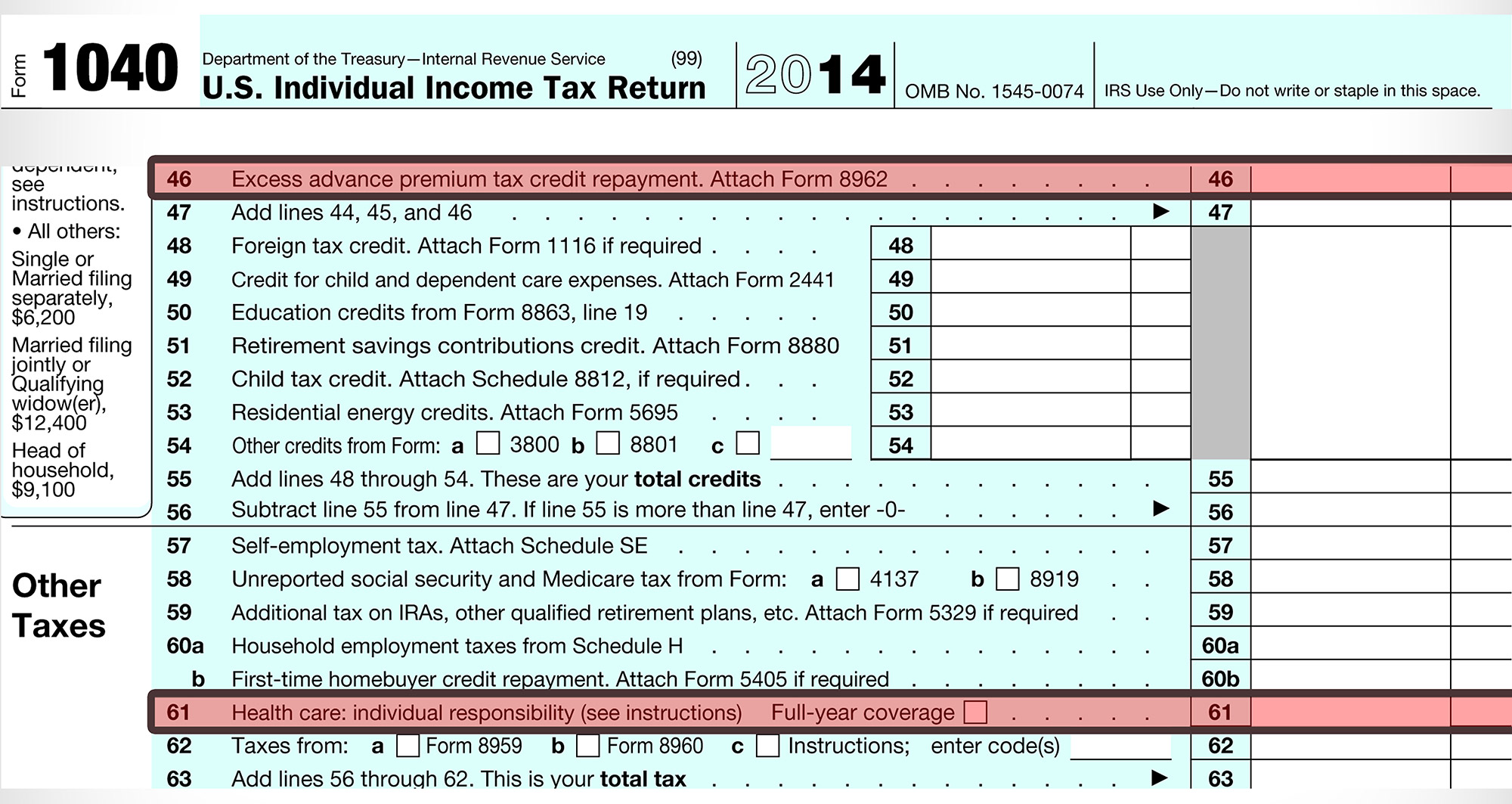

IRS Form 1040 is a tax return used by individual filers. The 2020 version of the form is its third major restructuring since tax year 2018. The 2020 version continues to replace Forms 1040-EZ and 1040-A, which were eliminated from the tax code in 2018.

What is the new IRS Form 1040?

IRS Form 1040 is a tax return used by individual filers. The 2020 version of the form is its third major restructuring since tax year 2018. The 2020 version replaced older versions of the forms from 2019 and 2018. Forms 1040-EZ and 1040-A were eliminated from the tax code in 2018.

What are the features of form 1040-sr?

Another nice feature of Form 1040-SR is the large typeface designed to be easier on the older eyes of taxpayers who prefer to print out the return and fill it in by hand. Can Form 1040-SR Be E-Filed?

Can form 1040-sr be E-filed?

Can Form 1040-SR Be E-Filed? Form 1040-SR can be filed electronically, just as Form 1040 can. If you prefer not to e-file, the mailing address for your completed tax return depends on the state in which you live and whether you're enclosing a payment. The IRS provides a listing of the addresses for each state.

What is the purpose of filing a 1040 form?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Who must file Form 1040?

For anyone whose filing status was single and under the age of 65 at the end of 2019, you will have to file the Form 1040 if your gross income was at least $12,200. Then, for anyone who was single and over the age of 65 at the end of 2019, you will have to file the Form 1040 if your gross income was at least $13,850.

What is a 1040 refund?

Form 1040 is what individual taxpayers use to file their taxes with the IRS. The form determines if additional taxes are due or if the filer will receive a tax refund. Personal information, such as name, address, Social Security number, and the number of dependents, are asked for on Form 1040.

What is the difference between a 1040 and a w2?

The W-2 is the form your employer sends to you each January reporting your wages & withholding. The form 1040 is your tax return you file.

What are the benefits of a tax refund?

Benefits. Avoid added interest and penalties. Avoid losing future refunds. Part or all of any refund is first used to pay any back taxes owed. Safeguard credit. If the IRS files a tax lien against a taxpayer, it could affect credit scores and make it harder to get a loan.

When will the IRS e-file for 2018?

For 2018 returns, e-file and Free File will continue to be available until the fall of 2019. Be sure to keep a copy of tax returns.

How long can you pay your taxes if you can't pay?

Taxpayers owing $50,000 or less can usually set up a short-term payment plan or a monthly payment agreement for up to 72 months.

Do you have to pay late taxes if you owe late payment?

Late payment penalty may not apply. For taxpayers who get a tax-filing extension and pay most of what they owe by the original deadline, they probably won’t owe a late-payment penalty. To qualify, request a 2018 extension by the April deadline and pay at least 90 percent of the total tax liability by that date.

Do you pay a penalty for not filing taxes?

No penalty if reasonable cause. Taxpayers won’t have to pay the late-fi ling or late- payment penalty if they can show reasonable cause for not filing or paying on time. Alternatively, if they have filed and paid on time for the past few years, they may qualify for the First Time Abatement program.

What is Form 1040?

Form 1040 is the federal tax form that individuals fill out when they file their taxes each year. This form collects information such as your income, tax deductions and tax credits. You use this information to calculate your tax obligation for the year and determine whether you owe additional money or are due a refund.

Who needs to file a 1040 tax form?

Most people who earn an income are required to file a 1040 form each year. Below are general guidelines to assist you but please refer to the IRS website for the most complete information.

What is the 1040-SR form?

The 1040-SR form is a version of the 1040 form that is intended for people aged 65 and older. The IRS offers this form to help with accessibility issues, such as challenges with eyesight, and to help this group of people claim the right standard deduction for their age group.

What is the purpose of the 1040-SR form?

A 1040-SR tax form does the same thing as a standard 1040 tax form, it reports identifiable information, income, tax credit eligibility and tax liability to the IRS. The differences between the 1040-SR and the standard 1040 have to do with the appearance of the form.

How to find a copy of Form 1040

If you choose to use tax filing software, you typically enter your relevant information into their program or website. The tax filing software can then transfer your information directly onto Form 1040. After completing your return, the software electronically files your form with the IRS.

How to fill out Form 1040

While it’s possible to fill out Form1040 yourself, you may want to seek professional assistance if you’re unsure about a particular section. If you complete Form 1040 yourself, here are some basic guidelines:

What is a 1040 SR?

Form 1040-SR is a version of the 1040 tax return that was created specifically for use by senior citizens. Lawmakers have been trying for years to cut seniors a bit of a break at tax time, and the Bipartisan Budget Act of 2018 finally marked a solid step in that direction. It required the Internal Revenue Service (IRS) to create a tax form ...

How old do you have to be to file a 1040?

Federal legislation passed in 2018 provided for a Form 1040 tax return designed specifically to meet the needs of senior citizens. Taxpayers must be at least age 65 to use Form 1040-SR, with one exception. Only one spouse must be age 65 or older if they’re filing a joint married return.

Can seniors get a 1040-SR?

Seniors can access Form 1040-SR in two ways. The IRS offers an online form online. You can complete it, then save it to your computer, and print it out. You'll also have access to the form if you use a reputable tax software provider to prepare your return. The IRS indicates that more than 90% of taxpayers now use software to prepare ...

Can I file 1040-SR in 2021?

Taxpayers born before January 2, 1956 can use this form beginning in 2021. They can file the 2020 Form 1040-SR. 5 . Filers don't have to be retired to qualify to use this form. Only one spouse must meet the age requirement if you're married and filing a joint return. 6 .

Does the 1040-SR have a cap?

The 1040-SR, though, doesn't put a limit on interest, dividends, or capital gains, nor does it cap overall income. Form 1040-EZ was repealed effective 2018 when the IRS revamped the standard Form 1040 tax return. Even seniors who met the 1040-EZ income requirements no longer had that option.

Breathing space on amounts you owe

Early submissions are also useful if you owe the tax-man because it gives the time between your first submission and the deadline to save enough money to cover your outstanding debts.

Access crucial information

Planning on making a big purchase, such as buying a home or enrolling in college? Preparing a tax return could be a great way to see exactly what your finances look like.

Avoid extensions

While there are certain circumstances that justify applying for a filing extension, you can easily avoid this extra paperwork by simply getting your finances organized.

Protect yourself from identity theft

Most people don’t realize that tax return theft is a lucrative source of income for criminals.

How to File Taxes Online in 3 Simple Steps - TurboTax Tax Tip Video

Remember, with TurboTax Online Tax Filing we’ll ask you simple questions and fill out the right forms for you. We’ll find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed!

What income is included in the 1040-SR?

Certain important income categories for seniors are specifically highlighted, including IRA distributions, pension income, and Social Security benefits. The tax credit for children or other dependents is also prominently featured on the 1040-SR.

What tax form was eliminated in the last year?

One of the biggest changes that taxpayers faced last year as a result of tax reform was a new 1040 tax form. The IRS eliminated the popular 1040-EZ and 1040A short forms, requiring everyone to use the full revised Form 1040.

Is Form 1040 2019 changed?

But one aspect of the change that hasn't gotten a lot of attention is that the regular Form 1040 for 2019 has also undergone a significant makeover. Gone is last year's format in which all the numerical information appeared on the back side of the return, with identifying and personal information on the front.

Can you use a 1040-SR as a standard deduction?

Form 1040-SR, however, includes provisions for those who wish to itemize their deductions instead of taking the standard deduction. You'll have to include a separate schedule, but you don't lose eligibility for using the 1040-SR as your main tax return.

Is the 1040-SR the same as the 1040-EZ?

For those who remember the old 1040-EZ return, the newly created 1040-SR will look familiar. Unlike the 1040-EZ, the 1040-SR does involve front and back sides , but the style and formatting bears a close resemblance to the old form. Image source: IRS. The new form features some senior-friendly features:

Is 1040-SR good for seniors?

It's good that the IRS is trying to look out for older taxpayers by making a form that's easier for them to read and understand. Even if the differences between Forms 1040-SR and the regular 1040 are mostly cosmetic, it's still something that many seniors might find useful as they prepare their returns in the coming months.

Why is the 1040-SR required?

Congress mandated the 1040-SR because the previous simplified return, Form 1040-EZ, didn't accommodate some typical items for older taxpayers, such as Social Security benefits, IRA distributions, and pension and annuity payments. As such, older filers had to fill out the more complex 1040 form even though their returns weren't complicated.

What is a 1040-SR?

Most tax-return software will generate a form 1040-SR; however, the form is most beneficial to filers who fill out paper returns by hand. If you use tax software to file taxes, as nearly 90 percent of taxpayers do, the software will choose which form is best for you.

How to file 1040EZ?

A taxpayer must meet all of the following to qualify to file Form 1040EZ: 1 The taxpayers filing status must be single or married filing jointly. 2 The taxpayer cannot claim any dependents. 3 The taxpayer cannot claim any adjustments to income (see IRS.gov/taxtopics) 4 The taxpayer can only claim the earned income tax credit (EIC). No other credits can be claimed with the Form 1040EZ. 5 The taxpayer must be under age 65 and not blind at the end of the tax year. 6 The taxpayer’s taxable income (line 6 of Form 1040EZ) must be less than $100,000. 7 The taxpayer’s income consisted of only wages, salaries, tips, taxable scholarship or fellowship grants, unemployment compensation, or Alaska Permanent Fund dividends.

What is a 1040EZ?

The Form 1040, Form 1040A, and Form 1040EZ are generally the forms US taxpayers use to file their income tax return. Form A is a hybrid of the Form 1040 and Form 1040EZ. The Form 1040EZ is a very simplified version of the tax return, and the Form 1040A allows for additional adjustments to income and credits available.

How many pages are there in a 1040?

It’s a one-page form with a few sections. The regular Form 1040 is two-pages and but can get much longer and more complicated depending on the transactions you had during the tax year. The Form 1040 usually has additional schedules and forms.

Can you claim a 1040EZ tax credit?

Since the Form 1040EZ doesn’t allow for tax credits, the only credit that you are able to claim is the Earned Income Credit (EIC) Note: The EIC is a refundable credit, which means that if your tax liability is at $0, any additional EIC you can use will result in a refund. See the EIC table here.

Can you be married on 1040EZ?

To claim a “married filing jointly” status on Tax Form 1040EZ, the taxpayers: or be considered legally married as of the last day of the tax year , and the taxpayer’s spouse died before the return was filed.

Is 1040EZ a hybrid?

For taxpayers with simple tax calculations, a lot of time can be saved by filing the 1040EZ. The IRS also provides a Form 1040A which is a hybrid between the Form 1040EZ and Form 1040. Luckily, there are a few different ways to fill out and file your Individual Income Tax Return.