Key Points

- The average Social Security benefit amount is $1,657 per month.

- In 2022, the maximum you can collect is $4,194 per month.

- Your age, income, and the length of your career will determine how much you receive.

Does Social Security still have a minimum benefit?

The benefit amounts are still calculated through both formulas, but with the minimum Social Security benefit provision, the higher of the two benefits is the amount provided to qualified individuals. In 2019, there were 64 million Social Security recipients; about 32,092 of them qualified for the minimum benefit. While it’s not a provision that impacts most people qualifying for Social Security, it’s still an important concept to understand if you want to broaden your full understanding ...

When should I take Social Security to maximize my benefits?

You can expect the following when applying for Social Security spousal benefits:

- You can receive up to 50% of your spouse’s Social Security benefit.

- You can apply for benefits if you have been married for at least one year.

- If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years.

- Starting benefits early may lead to a reduction in payments.

How do you determine your Social Security benefit amount?

- For earnings that fall within the first band, you multiply by 90%. That is the first part of your benefit.

- For earnings that fall within the second band, you multiply by 32%. That is the second part of your benefit.

- For earnings that are greater than the maximum of the second band, you multiply by 15%. This is the third part of your benefit.

What is the MAX monthly SS benefit?

Many retirees get significantly more than the average benefit. In fact, the maximum possible Social Security benefit is $4,194 per month, or $50,328. This amount would certainly go much further toward creating financial stability in retirement. So ...

How much do you have to earn to get maximum Social Security?

In 2022, if you're under full retirement age, the annual earnings limit is $19,560. If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960.

How much Social Security will I get if I make $100000 a year?

Based on our calculation of a $2,790 Social Security benefit, this means that someone who averages a $100,000 salary throughout their career can expect Social Security to provide $33,480 in annual income if they claim at full retirement age.

What is the average Social Security check at age 66?

$3,240At age 66: $3,240. At age 70: $4,194.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

How much Social Security will I get if I make 60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much will I get from Social Security if I make $200000?

Workers who earn $200,000 per year earn far above the wage base limit for Social Security, which for 2017 is set to rise to $127,200.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

How much Social Security will I get if I make $120000 a year?

If you make $120,000, here's your calculated monthly benefit According to the Social Security benefit formula in the previous section, this would produce an initial monthly benefit of $2,920 at full retirement age.

How much Social Security will I get if I make $50000 a year?

For example, the AARP calculator estimates that a person born on Jan. 1, 1960, who has averaged a $50,000 annual income would get a monthly benefit of $1,338 if they file for Social Security at 62, $1,911 at full retirement age (in this case, 67), or $2,370 at 70.

How much money do you need to retire with $100000 a year income?

Percentage Of Your Salary Some experts recommend that you save at least 70 – 80% of your preretirement income. This means if you earned $100,000 year before retiring, you should plan on spending $70,000 – $80,000 a year in retirement.

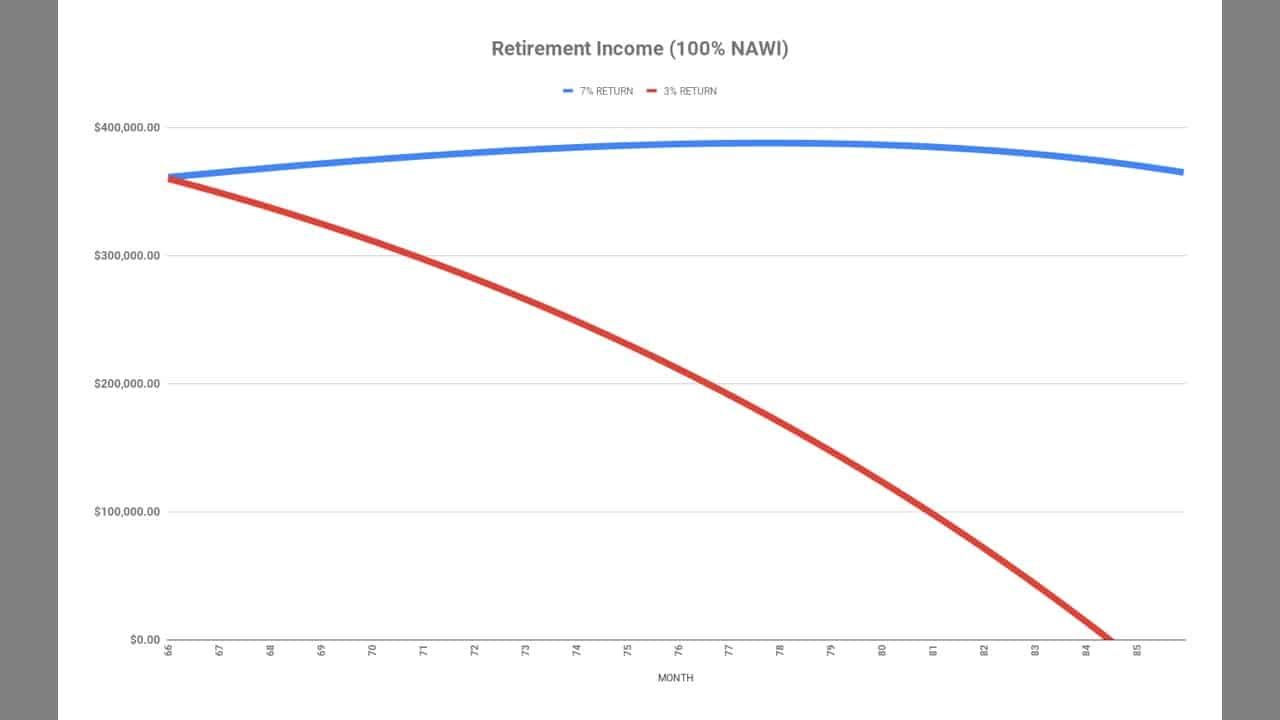

Can I retire on 500k plus Social Security?

Can I retire on $500k plus Social Security? Yes, you can! The average monthly Social Security Income check-in 2021 is $1,543 per person. In the tables below, we'll use an annuity with a lifetime income rider coupled with SSI to provide you a better idea of the income you could receive off a $500,000 in savings.

Can you collect Social Security at 66 and still work full time?

When you reach your full retirement age, you can work and earn as much as you want and still get your full Social Security benefit payment.

How much Social Security will I get in 2021?

What is the maximum Social Security benefit? En español | The most an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is: $3,895 for someone who files at age 70. $3,148 for someone who files at full retirement age (currently 66 and 2 months). $2,324 for someone who files at 62.

What is the maximum taxable income for 2021?

The maximum taxable income in 2021 is $142,800.

What is the maximum Social Security benefit for 2021?

The maximum monthly Social Security benefit that an individual can receive per month in 2021 is $3,895 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,113, and for someone aged 62, the maximum amount is $2,324.

How much will Social Security pay in 2021?

According to the Social Security Administration (SSA), the maximum monthly Social Security benefit that an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is as follows: $3,895 for someone who files at age 70. $3,113 for someone who files at full retirement age (FRA)

How are Social Security benefits calculated?

Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years). First, all wages are indexed to account for inflation. Wages from previous years are multiplied by a factor based on the years in which each salary was earned and the year in which the claimant reaches age 60. 5 .

How much will Social Security decrease at age 62?

Opting to receive benefits at age 62 will reduce their monthly benefit by 28.4% to $716 to account for the longer time they could receive benefits, according to the Social Security Administration. That decrease is usually permanent. 7 . If that same individual waits to get benefits until age 70, the monthly benefit increases to $1,266.

How much Social Security can I get at 70?

A high earner who enrolls at age 70 could get a maximum Social Security benefit of $3,895 each month.

What is the maximum wage for Social Security in 2021?

The maximum wage taxable by Social Security is $142,800 in 2021. However, the exact amount changes each year and has increased over time. It was $137,700 in 2020 and $106,800 in 2010. Back in 2000, the taxable maximum was just $76,200. Only $39,600 was taxed by Social Security in 1985.

How much does a spouse get if they receive Social Security?

So, if one spouse has a Social Security payment of $3,895 per month , the other spouse might qualify for a spousal payment of $1,947.50 monthly. And after you pass away, your spouse could receive a survivor's payment of the full $3,895 per month, which would also be adjusted annually for inflation.

How long do you have to work to get Social Security?

You need to earn at least the taxable maximum each year for 35 years to get the maximum possible Social Security payment. If you don't work for 35 years, zeros are averaged into your calculation and will decrease your Social Security payments.

How much can a child receive from a family member?

The maximum family benefit all your family members can receive is usually about 150% to 180% of your full retirement benefit.

When can I postpone Social Security?

The maximum Social Security benefit changes based on the age you start your benefit. Those who postpone claiming Social Security between ages 62 and 70 become eligible for higher payments with each month of delay.

Can I increase my Social Security if I work for more than 35 years?

If you work for more than 35 years, a higher-earning year will replace a year when you earned less in the Social Security calculation. You can increase your Social Security payments even after you retire if you earn more now than you did earlier in your career .

Maximum Social Security Benefits For 2022

Many people wonder, “How much does Social Security pay?” You may already know that your Social Security benefits are calculated based on your earnings history. The more money you make during your working years, the more money you can expect from Social Security during retirement.

Calculating Your Monthly Social Security Benefit

Can you calculate your own Social Security retirement benefit amount? Absolutely! Though the calculation is quite cumbersome, you can manually calculate how much your Social Security check will be when you start your benefits. First, you will need to calculate your average indexed monthly earnings or AIME.

How To Maximize Your Social Security Payments

It should come as no surprise that most people want to maximize their retirement income, and many do this by maximizing their monthly payments from Social Security. With the average Social Security retirement benefit in 2022 being $1,657, you can quickly see that many people are not maximizing their benefits.

Spousal Benefits & Social Security Family Maximum

In addition to the primary earner, there are other Social Security beneficiaries who might be able to receive benefits from your earnings record. The first is your spouse. Eligible spouses may receive up to 50% of the benefit amount of the primary recipient.

Maximum Social Security Disability Benefit

Just like retirement benefits, SSDI benefits also have a maximum amount that will be paid each month. Calculating SSDI benefit amounts is a little more complicated than retirement benefits. Most SSDI recipients do not have 35 years of work history. However, they need at least ten years of work history to qualify for SSDI payments in most cases.

The Bottom Line

When it comes to Social Security retirement benefits, the sky is not the limit. In fact, the limit in 2022 is $3,345 if you start your benefits upon reaching full retirement age. Starting your benefits earlier than retirement age will reduce this amount, but delaying your benefits can cause this amount to go all the way up to $4,194.

How much do you have to earn to get maximum Social Security?

To get the max Social Security benefit, you need to earn the maximum taxable income each year. For 2022, this means that your taxable income needs to be at least $147,000. Almost every year, this limit is adjusted for inflation. In 2021, the maximum was $142,800, so you can see that the amount went up $4,200 in just one year.

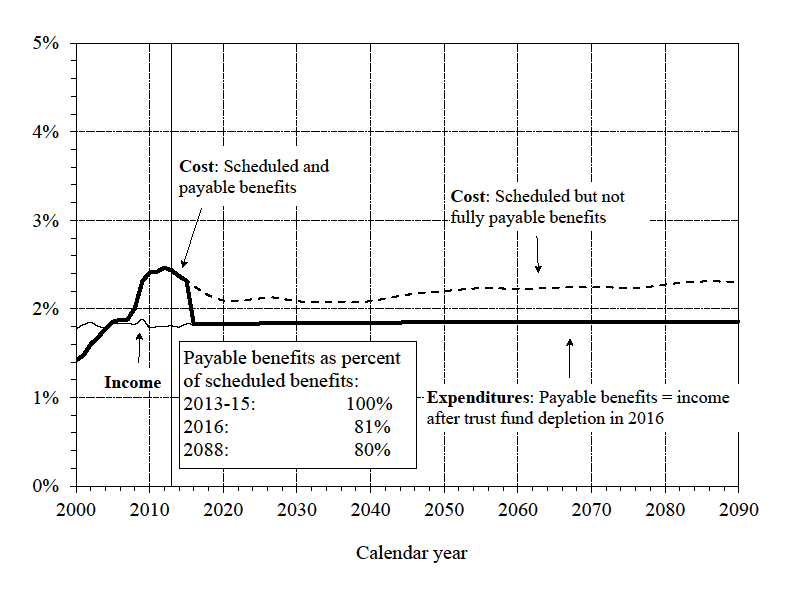

How do Social Security benefits depend on earnings?

Social Security benefits depend on earnings. The amount of a person's retirement benefit depends primarily on his or her lifetime earnings. We index such earnings (that is, convert past earnings to approximately their equivalent values near the time of the person's retirement) using the national average wage index.

What is the retirement age for a person born in 1943?

c Retirement at age 66 is assumed to be at exact age 66 and 0 months. Age 66 is the normal retirement age for people born in 1943-54. People who retired at age 66 and who were born before 1943 received delayed retirement credits ; those born after 1954 will have their benefits reduced for early retirement.

How is Social Security calculated?

Social Security benefits are typically computed using "average indexed monthly earnings.". This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount ( PIA ). The PIA is the basis for the benefits that are paid to an individual.

What is the AIME amount for 2021?

For example, a person who had maximum-taxable earnings in each year since age 22, and who retires at age 62 in 2021, would have an AIME equal to $11,098. Based on this AIME amount and the bend points $996 and $6,002, the PIA would equal $3,262.70. This person would receive a reduced benefit based on the $3,262.70 PIA.

Can disability benefits be reduced?

In such cases, disability benefits are redetermined triennially. Benefits to family members may be limited by a family maximum benefit.

What is the average Social Security benefit for 2021?

3 The estimated average monthly Social Security benefits payable to a disabled worker, their spouse, and one or more children in Jan. 2021 is $2,224. 4 .

How long do you have to wait to get Social Security?

There is a mandatory waiting period of five months after your disability begins before you can start receiving benefits.

How long does it take to get disability?

You should apply for Social Security disability benefits as soon as you become disabled. The application process can take three to five months, according to Social Security, and counts as part of the mandatory waiting period of five months after the onset of your disability. 12

How much will I earn if I am not blind in 2021?

If you are working, you are not blind, and your earnings average more than $1,310 per month in 2021, you will not be considered disabled. 9 If you are not working, or your income falls below Substantial Gainful Activity (SGA) limits, move on to question two.

Can you be disabled if you are on Social Security?

If Social Security determines that your condition does not interfere with basic work-related activities, you will not be considered disabled. If your condition does interfere with basic work-related activities, move on to question three.

What is the maximum federal income tax for 2021?

The latest such increase, 1.3 percent, becomes effective January 2021. The monthly maximum Federal amounts for 2021 are $794 for an eligible individual, $1,191 for an eligible individual with an eligible spouse, and $397 for an essential person.

How is SSI payment reduced?

Payment reduction. The monthly amount is reduced by subtracting monthly countable income. In the case of an eligible individual with an eligible spouse, the amount payable is further divided equally between the two spouses. Some States supplement SSI benefits.