The Benefits of Annuities

- Steady Retirement Income. The most obvious benefit of annuities is that they provide structured payments during one’s retirement, a period in life where regular income can be hard to come ...

- Tax-Free Retirement Growth. Money contributed to an annuity is tax-deferred. ...

- Freedom & Flexibility. ...

- Death Benefits. ...

- Investment Diversity. ...

- Living Benefits Options. ...

What are the advantages of owning an annuity?

- They aren’t subject to contribution limits.

- The money in them grows tax deferred.

- Many states protect them from creditors.

- They are exempt from probate.

What are the pros and cons of annuity?

Pros. Annuities can provide lifelong income. Taxes on deferred annuities are only due upon the withdrawal of funds. Fixed annuities guarantee a rate of return, which translates into a steady income stream. Cons. They’re complex and hard to understand. Fees make annuities more expensive than other retirement investments.

What are the biggest disadvantages of annuities?

What Are the Biggest Disadvantages of Annuities?

- Annuities Can Be Complex. Annuities come in many varieties, and that fact alone is enough to create a lot of confusion among consumers.

- Your Upside May Be Limited. ...

- You Might Pay More in Taxes. ...

- Expenses Can Add Up. ...

- Guarantees Have a Caveat. ...

- Inflation Can Erode Your Annuity’s Value. ...

- The Bottom Line. ...

What is the most you should pay for the annuity?

What is the most you should pay for the annuity? $6,973.48 You just inherited some money, and a broker offers to sell you an annuity that pays $18,200 at the end of each year for 20 years.

What is the principal of an annuity?

The annuity principal is the sum of money you use to buy an annuity and the base on which annuity earnings accumulate. If you're buying a deferred annuity, you may make a one-time -- or single premium -- purchase, or you may build your annuity principal with a series of regular or intermittent payments.

What is the principal benefit of an annuity contract?

They are a common source of retirement income because they provide a steady stream of payments at regular intervals and because their earnings grow tax-free until you withdraw funds. All annuities also offer a death benefit that protects your original investment for your beneficiaries.

What is the biggest advantage of an annuity?

The biggest advantages annuities offer is that they allow you to sock away a larger amount of cash and defer paying taxes. Unlike other tax-deferred retirement accounts such as 401(k)s and IRAs, there is no annual contribution limit for an annuity.

What is the main benefit and downside of annuities?

An annuity is a way to supplement your income in retirement. For some people, an annuity is a good option because it can provide regular payments, tax benefits and a potential death benefit. However, there are potential cons for you to keep in mind. The biggest of these is simply the cost of an annuity.

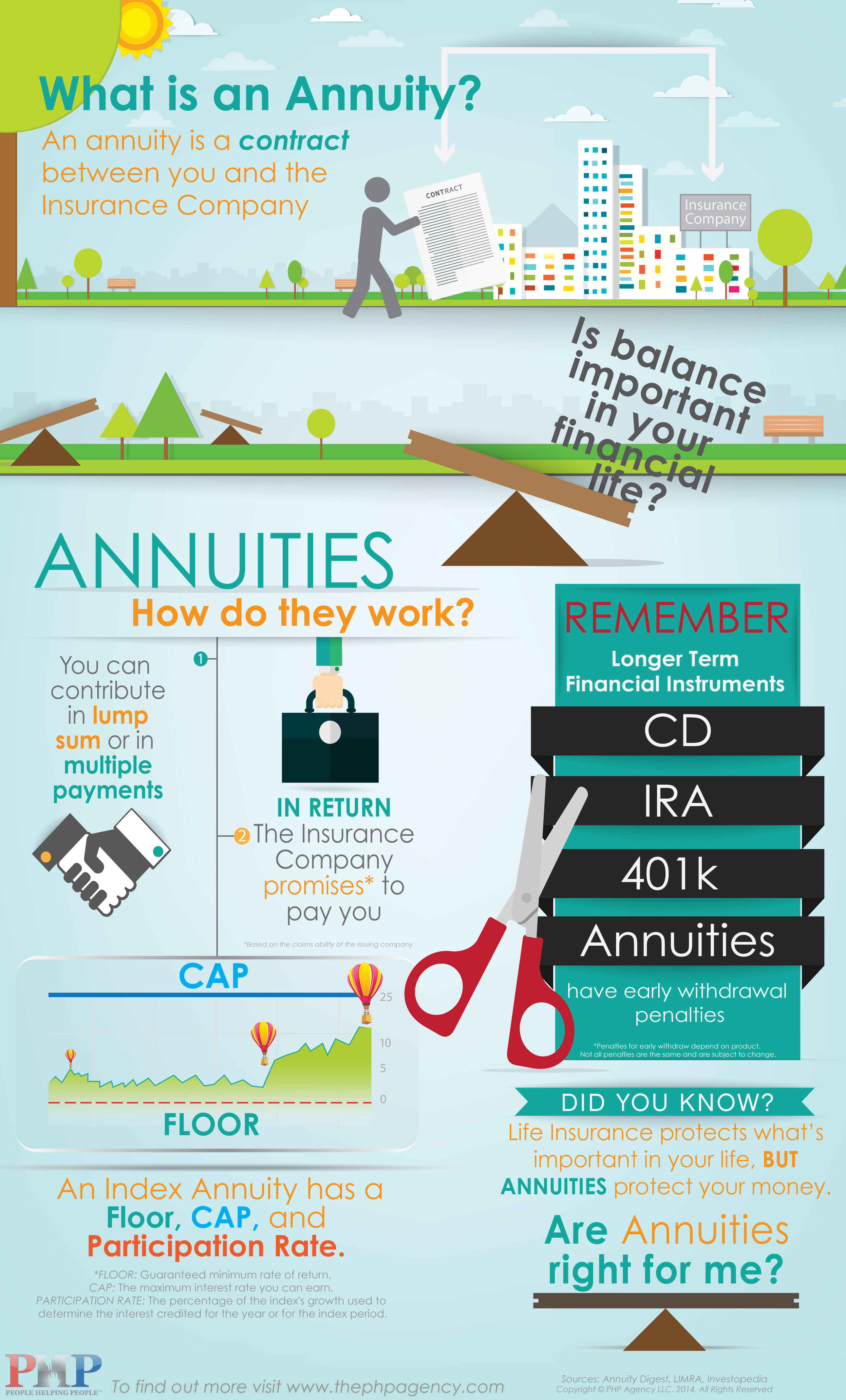

How does an annuity work for dummies?

Annuities are essentially insurance contracts. You pay a set amount of money today, or over time, in exchange for a lump-sum payment or stream of income in the future. The type of annuity and the details of the particular annuity can determine the payouts you'll receive.

How do annuities work when you retire?

Retirement annuities promise lifetime guaranteed monthly or annual income for a retiree until their death. These annuities are often funded years in advance, either in a lump sum or through a series of regular payments, and they may return fixed or variable cash flows later on.

What does Dave Ramsey say about annuities?

Dave Ramsey says that he doesn't have any annuities and because of this, no one should buy annuities. Every reputable annuity company and insurer out there is quick to say that annuities are not the best product for everyone, but they are a great product for many people.

Who benefits from an annuity?

What are the benefits of an annuity? Annuities offer a stream of income, provide tax advantages, can grow tax-deferred over time and have no contribution limits. In the event of death, annuities also offer riders that allow you to transfer money to your beneficiaries.

Why do financial advisors push annuities?

Advisers are exploiting the fear of market risk to get people to cash out their 401(k) and reinvest that money into a variable annuity that offers a "guaranteed income option.

Should a 70 year old buy an annuity?

Many financial advisors suggest age 70 to 75 may be the best time to start an income annuity because it can maximize your payout. A deferred income annuity typically only requires 5 percent to 10 percent of your savings and it begins to pay out later in life.

What are the pitfalls of an annuity?

The main drawbacks are the long-term contract, loss of control over your investment, low or no interest earned, and high fees. There are also fewer liquidity options with annuities, and you have to wait until age 59.5 to withdraw any money from the annuity without penalty.

What is better than an annuity for retirement?

Some of the most popular alternatives to fixed annuities are bonds, certificates of deposit, retirement income funds and dividend-paying stocks. Like fixed annuities, these investments are regarded as relatively low-risk and income-oriented.

What are annuities?

Annuities are financial instruments that earn interest and provide a guaranteed stream of payments over a predetermined amount of time. An annuity...

How much does an annuity cost?

All annuities share similar fees, but the total cost of an annuity can differ by type. When you purchase an annuity, you pay a premium that can be...

What are the benefits of an annuity?

Annuities offer a stream of income, provide tax advantages, can grow tax-deferred over time and have no contribution limits. In the event of death,...

Are annuities safe?

Purchasing an annuity is among the safest options for long-term financial planning. They are insurance products, so they experience less volatility...

Are annuities insured?

Annuities are insurance products, and annuity providers are often insurance companies. Although the annuity itself is not insured in the literal se...

Do annuities have beneficiaries?

You can designate one or more beneficiaries in your annuity contract if it has a death-benefit provision. The beneficiary would inherit either a sp...

Why are annuities important?

The market can be a powerful tool for growing your assets. Some annuities offer protection against market ups and downs—helping to make investing less intimidating. They can even offer market access that provides opportunities for growth through a variety of investment options.

Why are annuities good for retirement?

And that's one of the great advantages of annuities. You can defer your taxes on interest and investment earnings until you take income from them.

What is an annuity?

Annuities are long-term, tax-deferred vehicles designed for retirement. Earnings are taxable as ordinary income when distributed. Individuals may be subject to a 10% additional tax for withdrawals before age 59½ unless an exception to the tax is met. Variable annuities involve investment risks and may lose value.

What is Jackson annuity?

Income protection. Many people are living longer, healthier lives, so reliable income that lasts is essential to any retirement. Jackson annuities offer a variety of add-on benefits * that can provide lifetime income † to meet the challenge of longevity head-on. Explore Income Protection.

Why are there fewer employer sponsored retirement plans?

With fewer employer-sponsored retirement plans available, you are probably looking for strategies to help grow and protect your hard-earned assets to fund the retirement you want . Annuities may provide an opportunity for growth and protection for income that can last your lifetime.

What are the benefits of an annuity?

One of the key benefits of an annuity is that it allows the investor to save money without paying taxes on the interest until a later date. Annuities have no contribution limits, unlike 401 (k)s and IRAs. Another significant benefit of annuities is the creation of a predictable income stream to fund retirement.

Why do people buy annuities?

People buy annuities to create long-term income. While most often considered financial solutions for older people who are close to retirement, annuities can benefit investors of any age with a variety of financial goals. Reasons to buy an annuity include: Long-term security. Tax-deferred growth.

What is an annuity contract?

More specifically, an annuity contract is a legally binding, written agreement between you and the insurance company that issues the contract. This contract transfers your longevity risk — the risk of you outliving your savings — to ...

What is an annuity owner protected from?

This means you, the annuity owner, are protected from market risk and longevity risk, that is, the risk of outliving your money. To offset this risk, insurance companies charge fees for investment management, contract riders, and other administrative services.

What is an annuity?

Annuities are financial instruments that earn interest and provide a guaranteed stream of payments over a predetermined amount of time . An annuity is often used to fund retirement and can come in a variety of types that align with different financial goals and risk tolerance.

How long does it take for an annuity to grow tax deferred?

That initial investment will grow tax-deferred throughout the accumulation phase, typically anywhere from ten to 30 years, based on the terms of your contract. Once the annuitization, or distribution, phase begins — again, based on the terms ...

Why are annuities bad for investors?

This means that in addition to the possibility that you won’t be able to cover unexpected expenses, you may miss the opportunity to take advantage of higher interest rates or to invest in the stock market.

How does an annuity work?

An annuity is an insurance contract that can pay you monthly income, either starting right away or in the future, or grow your savings over time. You can invest money in an annuity and choose whether it will pay you monthly, quarterly, or yearly, potentially for the rest of your life. Annuities charge extra fees for adding riders ...

What is an annuity contract?

An annuity is an insurance contract. 1 Using an annuity often looks and feels like using an account that you put money into. How you use this account depends on the type of annuity you buy. You may invest a lump sum or add money every month. Your insurer might promise to pay you monthly income, either starting right away or waiting ...

What is an annuity guarantee?

Any annuity guarantees are only as strong as the insurance company making them. If the insurance company goes through financial problems, your savings, earnings, or income could be at risk.

What happens to your insurance when you retire?

When you retire, the payments can help replace the income you earned while you were working. Monthly payments may feel similar to monthly wages in your working years. If you die shortly after starting payments, the insurer might be able to keep all of your money.

How long do surrender charges last on annuities?

These are fees you pay to withdraw money during the early years of your contract. 4 Those charges may last 10 years or more , and a lot can happen in that time. You can often withdraw 10% of your initial premium each year.

How long does a beneficiary keep making payments?

For example, a “10-year period certain” option keeps making payments for the greater of 10 years or your life. There are also other options you can pick from, which vary between plans.

What is the contract owner of an annuity?

Contract owner: If you buy an annuity, you are the contract owner. Premium: A monthly payment you make to keep an insurance plan. Surrender period: The time in which you will have to pay a surrender charge if you sell or cash out your annuity.

What are the benefits of an annuity?

What makes an annuity different? 1 Annuities are the only investment you can purchase that creates a regular pension-like payment in retirement. 2 Guaranteed lifetime income means you can’t outlive your money. 3 Earnings on your retirement savings can grow tax-deferred until you start taking income. 4 Flexible payment options can provide you income when you need it. 5 Death benefits help create a legacy for your beneficiaries.

What is an annuity?

An annuity is insurance for your retirement income. It’s a way to turn part of your retirement savings into a steady income stream for life. An annuity can also offer long-term benefits like tax-deferred growth and inflation protection.

What is guaranteed lifetime income?

Guaranteed lifetime income means you can’t outlive your money.

What is the number to call for annuities in Iowa?

We're here to help. Visit our annuities help section, or call us at 800-852-4450. Annuity products and services are offered through Principal Life Insurance Company, a member company of Principal, Des Moines, Iowa 50392. Guarantees are based on the claims-paying ability of Principal Life Insurance Company.

Can an annuity be used for an IRA?

Consequently, an annuity should be used to fund an IRA, or other tax qualified retirement arrangement, to benefit from the annuity’s features other than tax deferral. These features may include guaranteed lifetime income, guaranteed minimum interest rates, and death benefits without surrender charges.

Why is an annuity good?

For some people, an annuity is a good option because it can provide regular payments, tax benefits and a potential death benefit.

What is the most important thing about an annuity?

The most basic feature (and biggest pro) of an annuity is that you receive regular payments from an insurance company. These payments provide supplemental income during your retirement, and can help if you’re afraid that you haven’t saved enough to cover your regular expenses. Keep in mind that the value and number of your annuity payments will vary depending on the type of annuity you have and the terms of your contract.

What is the floor rate for an annuity?

Annuity companies constantly update the fixed rates they offer, as they’re dependent on market conditions. Most fixed annuities feature a rate floor of 1%, and in some of the best rate environments of the past, companies were offering around 3%.

What is the difference between fixed and variable annuities?

There are three main types of annuities – fixed, variable and indexed. A fixed annuity guarantees a minimum rate of interest on your money, as well as a fixed number of payments from the insurance company. On the other hand, a variable annuity allows you to invest your money in different securities, such as mutual funds. The payments you receive will depend on how well your investments perform.

Why are variable annuities risky?

Variable annuities carry risk because they have the potential for you to actually lose money. But they also provide an extra perk: a death benefit. A death benefit is a payment that the insurance company will make to a beneficiary if you die.

What is death benefit?

A death benefit is a payment that the insurance company will make to a beneficiary if you die. For a basic variable annuity, the death benefit is usually equal to the amount that you contributed to the annuity. If you get an annuity contract worth $100,000, then the death benefit payout will likely be $100,000.

What happens to an enhanced benefit annuity?

With an enhanced benefit, the insurance company will record the value of your annuity’s investments on each anniversary of your annuity’s start date. If you die, the insurance company will pay a death benefit equal to the highest recorded value of your annuity.

How does an annuity help you?

Although it may not help your wealth grow as an investment in stocks or bonds might, you can give yourself a steady stream of income for a set time. You can extend this period as needed to ensure that you never run out of cash with the various structures that are available.

Why are annuities important?

Although any investment provides a level of risk that investors must consider, some annuities can help to protect the cash in this product from downturns that happen in the market.

What is 2% fixed annuity?

That means a 2% fixed annuity will still give you that return even if the market decides to fall 4% in value for the year. You can also take advantage of a variable annuity to take the upside of market growth while using optional benefits to relieve losses from the downside. 4. Some annuities receive insurance coverage.

What is an annuity?

An annuity is a financial product that pays an individual a fixed income stream through payments after making an initial investment. These financial products are primarily used as a way to create retirement income, but some high-wealth households can use them to secure enough future income to maintain a specific lifestyle.

What are the fees associated with annuities?

Some of the common costs include surrender charges, administrative fees, mortality expenses, and optional costs that come with specific riders.

Why do you need annuities?

That means you can maintain your current lifestyle because you’re staying at the same pace as the cost of living.

Do you pay taxes on an annuity before you receive it?

The interest that you earn on an annuity before you receive payments will grow in a tax-deferred status. When you withdraw these funds, then the earnings and your past contributions get taxed as ordinary income, much like it is with a distribution from a non-Roth 401 (k) or IRA.

What is the purpose of an annuity?

The intent is to provide income later in life, at some future point in time to the "annuitant.". An annuity can be structured to provide a particular sum of money (principal income payments) at regular intervals for a designated amount of time or for an entire lifetime.

Can an annuity be used for retirement?

Annuity income can be used for retirement or to provide a stable income for the remainder of a surviving spouse's life. Annuities can be tailored to specifically suit individual needs. For instance, an immediate annuity can be purchased that provides income right away (immediately).

What is a living benefit variable annuity?

A variable annuity with a living-benefit feature is particularly suited for people with a low-risk tolerance and limited funds. A living-benefit feature in a variable annuity will inevitably come at a price: additional fees.

What is variable annuity?

A variable annuity is a tax-deferred financial product that pays benefits to you over a specified number of years and a death benefit to your beneficiaries. The benefit you receive is usually based on the purchase payments and the performance of the underlying investments.

What is GMAB in annuities?

The guaranteed minimum accumulation benefit (GMAB) ensures that the value of the annuity will not fall below the principal investment amount, which is referred to as accumulation, regardless of the market performance of the underlying investments. 2

What is guaranteed minimum income benefit?

Under the guaranteed minimum income benefit (GMIB) feature, you are promised a minimum rate of return on the principal regardless of the market performance of the underlying investments. Based on the return, you are guaranteed minimum annuity payment amounts, which can be more than projected if the market performance of the investments produces a rate of return that is higher than the guaranteed minimum rate of return. 4

What is a living benefit?

The living benefit—as the name suggests—is intended to guarantee the benefit provided, and toward that end, it usually offers guaranteed protection of the principal investment and the annuity payments or guarantees a minimum income over a specified period to you and your beneficiary.

Why do people have living benefit?

In addition, the living-benefit feature can help to provide peace of mind through guaranteed income for people with no risk tolerance due to factors such as limited assets in their retirement nest egg, a short retirement horizon, or just simply extreme caution about losing market value on investments.

Is variable annuity good for investors?

Many feel that variable annuities are not suitable for the majority of investors, especially as the financial benefits are often eroded by fees and penalties.