TurboTax PLUS includes everything in the Federal Free Edition, plus:

- Import and transfer previous-year tax returns. TurboTax PLUS eliminates the biggest downside of its Federal Free Edition...

- 5% federal refund bonus: Opting to receive your federal refund as an Amazon gift card will earn you an extra 5% on the...

What is the difference between TurboTax and TurboTax plus?

1 Answer. TurboTax PLUS includes everything in the Federal Free Edition, plus: Import and transfer previous-year tax returns. TurboTax PLUS eliminates the biggest downside of its Federal Free Edition by allowing users to import their previous year’s tax return, whether they filed it with TurboTax or a competitor.

How can TurboTax help you during tax time?

As such, it’s not surprising that TurboTax has a dazzling array of financial tools to help you during tax time as well as year round, regardless of your tax situation. TurboTax offers both totally DIY filing options as well as an upgraded suite of DIY filing with live online help.

What is TurboTax full service?

It offers a one-on-one review with a tax pro before you file, as well as unlimited live tax advice throughout the year. You can make an appointment or talk on the fly to a tax pro via one-way video (you see them, but they see your screen only). New this year is TurboTax Full Service, which does away with tax software altogether.

What are the pros and cons of TurboTax?

Like all financial products and services, there are both pros and cons to using TurboTax. Affordable: TurboTax’s tiers clock in at a lower price than similar tiers from competitors — though its free DIY service doesn’t cover as many filers as other options.

Can I get a refund for plus benefits on TurboTax?

We're unable to offer discounts or refunds for PLUS Help & Support. Once you've paid for PLUS (or deducted the fee from your refund), it can no longer be removed from your return. Your PLUS purchase entitles you to support when you need it and 24/7 access to your tax returns, as well as other benefits.

How do I get rid of plus benefits on TurboTax?

Select File from the left menu. Continue to the Just a few steps left... screen and select Start or Revisit next to Step 1: Review Your Order. On the Your order summary screen, select Remove* in the PLUS Benefits section, then Remove PLUS Benefits on the screen that comes after that.

Is TurboTax plus a one time fee?

One time. If you want it again next year you have to buy it again.

What is TurboTax free Plus bundle?

The Plus Bundle provides you benefits after your TurboTax Free tax return is completed. Your filed tax return is: Time stamped and saved up to 7 years. Securely stored online in your TurboTax account and organized by tax year. Easy to retrieve with 24/7 access in case it's ever reviewed.

Which version of TurboTax is best for me?

If you have rental property and/or deductions related to stocks and investments, you should use either TurboTax Premier or Home & Business. If you are self-employed, are a contractor, or have a home business, you should not use anything less than TurboTax Home & Business. It maximizes your home deductions.

Is it worth it to upgrade TurboTax?

TurboTax is pricey, but it has a good user experience with the option to upgrade for expert help. Self-employed filers who use QuickBooks will find TurboTax especially valuable....You might not like filing with TurboTax if you:TurboTaxCost of DIY filing$0 - $119 +$49 per state return4 more rows•Mar 24, 2022

Why do I have to pay $40 for TurboTax?

The $40 service charge is because you requested to have your TurboTax account fees paid from your federal tax refund. This is the service charge the third party processor charges for receiving your tax refund, deducting the fees and then direct depositing the remainder of the tax refund.

Why is TurboTax charging me $200?

ii. If your TurboTax Online fees aren't quite what you expected, it's likely you upgraded to a more full-featured version, added a state, and/or chose one or more optional services or add-ons.

Is it better to buy TurboTax or use it online?

Most people choose to use the online service. TurboTax reported that 80% of the returns it handled came from its online products. When you have a choice between buying the software you install on your computer and paying to use the service online, you are better off buying the software download.

Should I get TurboTax plus?

Is TurboTax Plus Worth It? It depends on your specific situation. Plus provides the convenience of having your previous year's information automatically transferred to the new year's forms. It also lets you access your prior year's tax returns at a later date.

How do I get 20% off TurboTax?

Invite your friends, and you'll get a $25 Gift Card for each new TurboTax customer* who files their taxes (limits apply). And, they'll get up to 20% off any paid federal products.

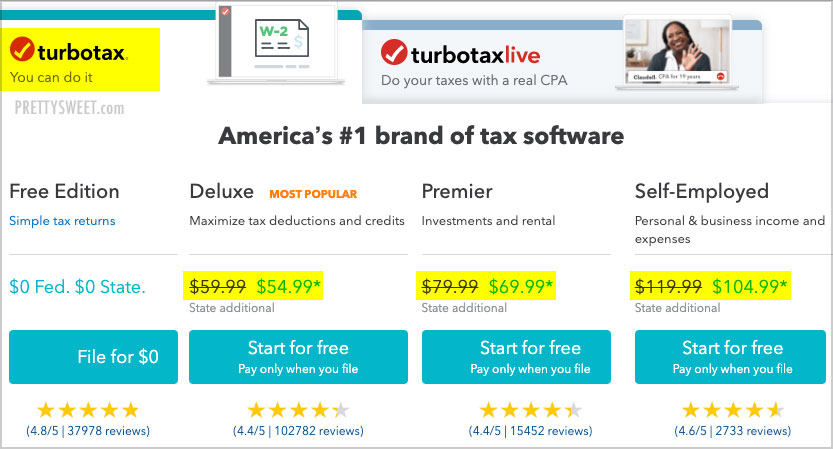

What are the different levels of TurboTax?

TurboTax Free Edition includes guidance in case of an audit, backed by TurboTax's audit support guarantee.TurboTax Free Edition.TurboTax Deluxe 2021 Tax Software, $40 (regularly $50)TurboTax Deluxe, $59.TurboTax Live Deluxe, $119.TurboTax Premier 2021 Tax Software, $70 (regularly $90)TurboTax Premier, $89.More items...•

What is the tax rate for self employed?

Pays for itself (TurboTax Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2020. Actual results will vary based on your tax situation.

How long does it take to get a tax refund?

The IRS issues more than 9 out of 10 refunds in less than 21 days.

Does TurboTax have a tax expert?

Tax Advice, Expert Review and TurboTax Live: Access to tax advice and Expert Review (the ability to have a Tax Expert review and/or sign your tax return) is included with TurboTax Live or as an upgrade from another version, and available through December 31, 2022. Intuit will assign you a tax expert based on availability. CPA availability may be limited. Some tax topics or situations may not be included as part of this service, which shall be determined in the tax expert’s sole discretion. For the TurboTax Live product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. For the Full Service product, the tax expert will sign your return as preparer. Administrative services may be provided by assistants to the tax expert. Payment by federal refund is not available when a tax expert signs your return. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

Is TurboTax included with TurboTax Deluxe?

TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premier, Self-Employed, TurboTax Live and TurboTax Live Full Service; not included with Free Edition (but is available as an upgrade). TurboTax specialists are available to provide general customer help and support using the TurboTax product. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Limitations apply. See Terms of Service for details.

Is TurboTax free for tax returns?

TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for simple tax returns only and has limited functionality; offer may change or end at any time without notice. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. Special discount offers may not be valid for mobile in-app purchases.

Does TurboTax pay penalty?

100% Accurate Expert-Approved Guarantee: If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return , we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

Does TurboTax include e-file?

TurboTax CD/Download Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees apply for e-filing state returns. E-file fees do not apply to New York state returns. Savings and price comparison based on anticipated price increase. Software updates and optional online features require internet. All features, services, support, prices, offers, terms and conditions are subject to change without notice.

Who Is TurboTax Best For?

When it comes down to it, most online tax preparation services are more alike than they are different.

What is TurboTax free?

The TurboTax Free Edition is appropriate for filers with simple tax returns. It covers W-2 income, the Earned Income Tax Credit (EIC) and child tax credits. True to its name, it’s free — but few peoples’ taxes are truly basic, and this tier doesn’t cover as many filers as competitors’ free options.

How much does TurboTax charge?

There is, however, an additional fee for this option; most users report a charge of $39.99, though this price is subject to change.

What is included in TurboTax Deluxe?

The TurboTax Deluxe edition includes everything the Free Edition does, plus mortgage and property tax deductions, charitable donations, student loan interest, education expenses and 1099-MISC income — i.e. earnings of an independent contractor like a freelance writer or Uber driver.

What are the features of QuickBooks?

This edition includes a host of features specifically designed for freelancers, such as: 1 Help finding deductions specific to your line of work. 2 The ability to import 1099-MISC forms with a quick photo. 3 Free access to Quickbooks Self Employed. 4 Access to a year-round tax estimator after filing.

Does TurboTax pay direct debit?

TurboTax also helps you pay via direct debit from your bank account for free . This is an option not all competitors offer; with other tax services, you’d have to go directly to the IRS to pay this way.

Is TurboTax self employed?

TurboTax Self-Employed helps you prepare tax returns with personal and business income, so it’s a fit for freelancers, independent contractors and small business owners.

I feel like everyone and everything is trying to sell me something

Has anyone else realized this? I’m so tired of scrolling social media and feeling like everyone is trying to sell me something.

Is it true that getting a credit card and using it for the sole purpose of making transactions to pay back asap is good for your credit score?

I know it’s a silly question, but I was told by one of my university friends that having a credit card and making small purchases on it to pay back instantly, is good for your credit score and it’s best to start young, so you can get a mortgage and all that?

Seems like most here are smart enough to avoid them, but just in case, never get a Credit One Bank credit card

They are a miserable company which gets away with capitalizing on Capital One's colors, name, and card layout with various predatory schemes.

Is salary a big deal if you live comfortably?

My wife and I both work full time with 2 kids in our mid twenties. I make $74,000 a year + $5,000 bonus as a marketing consultant. I also have a 9% 401k match. My wife makes $42,500 + $8,300 bonus as an elementary teacher (she can also earn another $5,000 a year for teaching summer school).

Our Financial Controller died of a heart attack at work 4 days before retirement and I am rethinking my 401K contribution and expanding my travel budget

Like the title stated. We lost our financial controller early last month. He came to work early on a Monday, the week of his retirement and died at work. He was discovered by his replacement (the poor guy) when he got to work.

How to get help with TurboTax?

Ways to get help 1 General guidance: Searchable knowledge base, forums and video tutorials are helpful for research on the fly. 2 Tech support: All users have access to TurboTax Assistant, a chatbot, or a contact form. Paid users get access to a TurboTax specialist. 3 One-on-one human tax help: Live, on-screen tax advice or review of your whole tax return by a tax pro is available if you buy the TurboTax Live version. These users also can submit written questions that a tax pro will answer within 24 hours.

How much does TurboTax cost?

You meet the tax preparer on a video call before they begin working, then you’ll meet again when your return is ready for review and filing. Prices range from $130 to $290 for federal returns, depending on complexity, plus $45 to $55 per state return.

What is TurboTax interface?

TurboTax’s interface is like a chat with a tax preparer, and you can skip around if you need to. A banner running along the side keeps track of where you stand in the process and flags areas you still need to complete.

How long does it take to get a tax pro to answer a question?

These users also can submit written questions that a tax pro will answer within 24 hours.

Does TurboTax have desktop software?

One note about prices: Providers frequently change them. We’ll keep updating this review, but you can verify the latest price by clicking through to TurboTax’s site. TurboTax also offers desktop software, where your return doesn't reside in the cloud, but it’s not part of our review.

Does TurboTax have a 1099-G?

TurboTax offers a free version for simple tax returns only; it lets you file a Form 1040 and this year can handle unemployment income reported on a 1099-G.

Does TurboTax have live tax?

One of TurboTax’s most outstanding support options is TurboTax Live. It offers a one-on-one review with a tax pro before you file, as well as unlimited live tax advice throughout the year. You can make an appointment or talk on the fly to a tax pro via one-way video (you see them, but they see your screen only).

What do you get with TurboTax?

TurboTax tells you what you need to enter to do your taxes based on your unique circumstances. Get step-by-step guidance and directions for most tax forms.

How does TurboTax work?

TurboTax packages up the things most people need to file their taxes. While some people with very complex or unique situations may feel more comfortable with the direct assistance of a tax professional, the majority of tax situations are easily covered by TurboTax.

What is TurboTax guidance?

Guidance for important tax forms. TurboTax tells you what you need to enter to do your taxes based on your unique circumstances. Get step-by-step guidance and directions for most tax forms. Mobile version. Work on your taxes on the mobile or web versions, or switch back and forth.

What is the best tax software for 2021?

Best tax software in 2021. Best rewards credit cards. Average stock market returns. TurboTax is the biggest and most popular tax-preparation software, handling a solid 30% of electronic filings, according to a report from Moody's.

How long does TurboTax keep tax returns?

Tax return storage. TurboTax will store your finished tax returns in your account for up to seven years.

How much is TurboTax Premier?

Premier: $90. Investors, including rental property owners, will want TurboTax Premier. This version even allows you to auto-import your investment data directly from many popular banks and brokerages.

Is TurboTax the most expensive tax preparation service?

Overall, TurboTax is the most expensive way to prepare your tax return online, unless you qualify for the free option. While the platform's features justify the cost for some people, it's not the best choice if saving money on tax prep is your priority.