What is the maximum Social Security benefit for a widow?

You will need to meet one of the following criteria to collect Social Security survivor benefits:

- A widow or widower who is at least 60 years old (50 years old if disabled)

- A widow or widower who is caring for the deceased’s child (under 16 years of age or receiving disability benefits)

- An unmarried child of the deceased who is either: 18 years of age or younger Disabled, with the disability occurring before the age of 22

What percentage of Social Security does a widow receive?

- A widow or widower over 60.

- A widow or widower over 50 and disabled.

- Surviving divorced spouses, assuming the marriage lasted at least ten years.

- Widow or widower who is caring for a deceased child who is either under 16 or disabled.

When a husband dies does the wife get his social security?

A widow qualifies to collect her husband’s Social Security benefit if the survivor is at least age 60 and was married for at least nine months at the time of death. In certain circumstances the widow will receive benefits earlier than age 60.

Are widows benefits considered social security?

Social Security's Widow(er)’s Insurance Benefits are federally funded and administered by the U.S. Social Security Administration (SSA). These benefits are paid to the widow or widower of a deceased worker who had earned enough work credits. Determine your eligibility for this benefit

When a spouse dies do you get their Social Security?

A surviving spouse can collect 100 percent of the late spouse's benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

What percentage of Social Security benefits does a widow receive?

Widow or widower, full retirement age or older—100% of your benefit amount. Widow or widower, age 60 to full retirement age—71½ to 99% of your basic amount. A child under age 18 (19 if still in elementary or secondary school) or has a disability—75%.

When my husband dies do I get his Social Security and mine?

Many people ask “can I collect my deceased spouse's social security and my own at the same time?” In fact, you cannot simply add together both a survivor benefit and your own retirement benefit. Instead, Social Security will pay the higher of the two amounts.

How do you qualify for widow's benefits?

Who is eligible for this program?Be at least age 60.Be the widow or widower of a fully insured worker.Meet the marriage duration requirement.Be unmarried, unless the marriage can be disregarded.Not be entitled to an equal or higher Social Security retirement benefit based on your own work.

Does a widow get 100 of her husband Social Security?

Widow or widower, full retirement age or older — 100% of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99% of the deceased worker's basic amount. Widow or widower with a disability aged 50 through 59 — 71½%.

Should I take widows benefits at 60?

If both payouts currently are about the same, it may be best to take the survivor benefit at age 60. It's going to be reduced because you're taking it early, but you can collect that benefit from age 60 to age 70 while your own retirement benefit continues to grow.

What is the difference between survivor benefits and widow benefits?

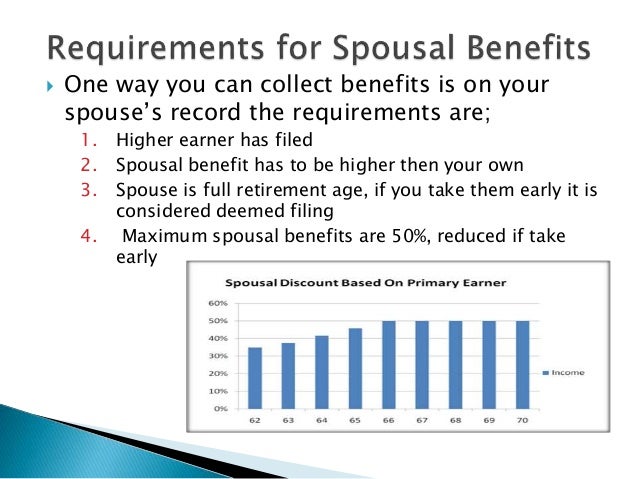

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

Can I collect widows benefits and still work?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced.

How long are you considered a widow?

two yearsRead on to learn more about the qualified widow or widower filing status. Qualifying Widow (or Qualifying Widower) is a filing status that allows you to retain the benefits of the Married Filing Jointly status for two years after the year of your spouse's death.

When can a widow receive Social Security?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor. If the benefits start at an earlier age, they are reduced a fraction of a percent for each month ...

What age can you collect a $1000 survivor benefit?

Generally, if the person who died was receiving reduced benefits, we base the survivors benefit on that amount. Year of Birth 1. Full (survivors) Retirement Age 2. At age 62 a $1000 survivors benefit would be reduced to 3. Months between age 60 and full retirement age.

What are the pros and cons of taking survivors benefits before retirement age?

Pros And Cons. There are disadvantages and advantages to taking survivors benefits before full retirement age. The advantage is that the survivor collects benefits for a longer period of time. The disadvantage is that the survivors benefit may be reduced.

How much is the 62 survivors benefit?

It includes examples of the age 62 survivors benefit based on an estimated monthly benefit of $1000 at full retirement age . If the worker started receiving retirement benefits before their full retirement age, we cannot pay the full retirement age benefit amount on their record. Generally, if the person who died was receiving reduced benefits, ...

Can you use the retirement estimate to determine the amount of a spouse's retirement benefits?

You cannot use the Retirement Estimator to determine benefit amounts for a surviving spouse. However, if you know what the worker's yearly lifetime earnings were, you can use our Online Calculator to get a rough estimate of what the benefits would be for the surviving spouse at full retirement age.

What to do if you are not getting survivors benefits?

If you are not getting benefits. If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

Can you get survivors benefits if you die?

The Basics About Survivors Benefits. Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

What happens to Social Security when a spouse dies?

En español | When a Social Security beneficiary dies, his or her surviving spouse is eligible for survivor benefits. A surviving spouse can collect 100 percent of the late spouse’s benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age. (Full retirement age for survivor benefits differs from that for retirement and spousal benefits; it is currently 66 but will gradually increasing to 67 over the next several years.)

How long do you have to be married to receive survivor benefits?

In most cases, a widow or widower qualifies for survivor benefits if he or she is at least 60 and had been married to the deceased for at least nine months at the time of death. But there are a few exceptions to those requirements: 1 If the late beneficiary’s death was accidental or occurred in the line of U.S. military duty, there’s no length-of-marriage requirement. 2 You can apply for survivor benefits as early as age 50 if you are disabled and the disability occurred within seven years of your spouse’s death. 3 If you are caring for children from the marriage who are under 16 or disabled, you can apply at any age.

Can a deceased spouse receive survivor benefits?

If you are the divorced former spouse of a deceased Social Security recipient, you might qualify for survivor benefits on his or her work record. If you are below full retirement age and still working, your survivor benefit could be affected by Social Security's earnings limit.

How old do you have to be to get a widower's pension?

Widows and Widowers. A widow or widower can receive benefits: At age 60 or older. At age 50 or older if disabled. At any age if they take care of a child of the deceased who is younger than age 16 or disabled. Divorced Widows and Widowers.

What age can you get disability benefits?

Younger than age 18 (or up to age 19 if they are attending elementary or secondary school full time). Any age and were disabled before age 22 and remain disabled. Under certain circumstances, benefits also can be paid to stepchildren, grandchildren, stepgrandchildren, or adopted children. Dependent parents.

How much is a death benefit for dependent parents?

Parents age 62 or older who received at least one-half support from the deceased can receive benefits. One-time lump sum death payment. A one-time payment of $255 can be made only to a spouse or child if they meet certain requirements.

How to report a death to Social Security?

To report a death or apply for survivors benefits, use one of these methods: Call our toll-free number, 1-800-772-1213 (TTY 1-800-325-0778 ). Visit or call your local Social Security office. More Information. If You Are The Survivor. Survivors Benefits.

Can you get Social Security if you die?

When you die, members of your family could be eligible for benefits based on your earnings. You and your children also may be able to get benefits if your deceased spouse or former spouse worked long enough under Social Security.

When can Lisa draw her survivor benefit?

However, Lisa should consider her other options before making a decision. With the second strategy, Lisa could draw her $1,500 worker benefit at age 62, and then switch over to the full survivor benefit of $2,400 at age 66.

How much is Lisa's survivor benefit?

Lisa is entitled to receive a full survivor benefit of $2,400 per month at age 66 (her Full Retirement Age), or a reduced survivor benefit of $1,716 per month at age 60. Lisa has also earned her own worker benefit of $1,500 per month at age 62, or $2,000 per month at age 66.

What is the full retirement age for 2020?

In every year leading up to the year Full Retirement Age is reached, $1 in benefits will be withheld for every $2 earned above the limit for that year ($18,240 in 2020).

What is survivor benefit?

A survivor benefit is 100% of the deceased spouse’s Primary Insurance Amount, which is based on contributions the deceased paid into the Social Security system during his or her lifetime. Like the worker benefit, the survivor benefit amount is permanently reduced if started prior to Full Retirement Age. If an individual is widowed and has not ...

When can Lisa take the $1,716?

Using the first strategy, Lisa could choose to take the $1,716 reduced survivor benefit at age 60. On the surface, it might appear that this is the best option because not only is $1,716 higher than the $1,500 worker benefit Lisa is entitled to at age 62, but she can also start it two years earlier.

Can a widow claim Social Security if she is a survivor?

Don’t forget the Earnings Test may apply if a surviving spouse is earning income. It is commonly known that a widow or widower entering retirement is entitled to claim Social Security benefits based on his or her own work record (the worker benefit) or on the work record of his or her deceased spouse (the survivor benefit).

Is a widower's survivor benefit reduced?

Any “ optimal strategy” depends on the sizes of the widow’s or widower’s own worker benefit and the survivor benefit, as well as the individual’s own health and financial situation. Another point worth noting is that, depending upon how much an individual earns, a worker or survivor benefit may be subject to a reduction.

How long can a widow collect Social Security?

That's because a surviving spouse can collect 100% of the deceased's benefit as long as the survivor has reached Full Retirement Age (which is between 66 and 67 these days). The earliest you can file for Social Security retirement benefits is normally 62, although for widows and widowers it's 60. But for every 12 months you delay claiming up ...

How much is a Social Security bonus for widows?

Social Security widows and widowers who have been claiming benefits for 20 years would get a bonus equal to 5% . "The idea is: It's a time when other assets may be exhausted and you may have increased medical expenses, so increase the benefit," says Altman. Whether Congress will agree to these ideas is anybody's guess.

What is the goal of Social Security Survivor Benefits?

Although the survivor rules may be complex, their goal is simple: To maximize the benefit to the surviving spouse since only one Social Security check is coming into the household at that point. The size of the monthly Social Security survivor's benefit is based either on the earnings history ...

What is the first step for married couples to take regarding Social Security?

So, the first critical step for married couples to take regarding Social Security is factoring in potential survivor benefits when making decisions about claiming benefits. "The biggest mistake couples make is not coordinating benefits," says Carlson.

Does survivor benefit increase after full retirement age?

However, the survivor benefit doesn't rise after full retirement age.

Can a widow file for Social Security first?

Typically, the lower-earning spouse files for Social Security first, while the higher-earning spouse with the bigger benefits waits. (You can't qualify for spousal benefits if your spouse hasn't claimed, though.) Once one spouse dies, the widow or widower faces several choices. Both the survivor benefit and the standard retirement benefit increase ...

Does Biden want to increase Social Security benefits for women?

Biden has proposed several reforms which, if enacted, would boost benefits for the surviving spouse, typically women. "Women live longer than men," says Nancy Altman, president of Social Security Works, a Washington D.C.-based advocacy group.

What is the penalty for widows at 60?

First, there is a penalty for taking benefits before full retirement age (FRA). The penalty in this case would be 28.5 percent.

How much will Social Security be reduced in 2019?

In 2019, if you earn more than $17,640, Social Security will reduce your benefit by $1 for every $2 you earn over this amount. To extend the example above, suppose that you are earning $25,000. This is $7,360 above the exemption. So, your annual benefit will be reduced by half this amount, or $3,680.

When do spouses get survivor benefits?

Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

Who can receive Social Security benefits?

Social Security can pay what it calls “mother’s or father’s insurance benefits” to surviving spouses and ex-spouses of any age if they are caring for children or dependent grandchildren of a deceased worker who are younger than 16 or disabled.

Do Social Security benefits have to be paid for life?

These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit. Beneficiaries entitled to two types of Social Security payments receive the higher of the two amounts.

Who is eligible for survivor benefits in 2021?

Most recipients of survivor benefits — two-thirds of them as of May 2021 — are the surviving spouses or surviving divorced spouses of deceased workers. Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. ...

When do child benefits stop?

Generally, benefits for surviving children stop when a child turns 18. Benefits can continue to as late as age 19 and 2 months if the child is a full-time student in elementary or secondary education or with no age limit if the child became disabled before age 22.

Can a child get survivor benefits if they get married?

In almost all instances, getting married will end a recipient child’s survivor benefits, even if the child still qualifies based on age. Surviving stepchildren, grandchildren, step-grandchildren and adopted children also might qualify for survivor benefits, subject to the rules above.

Can a parent receive survivor benefits?

Parents. Parents of a deceased worker can receive survivor benefits, singularly or as a couple, if they are 62 or older and the worker was providing at least half of their support. As with widows and widowers, these benefits are payable for life unless the parent remarries or starts collecting a retirement benefit that exceeds the survivor benefit.

How much is widow's benefit when you are working?

Claiming Benefits While You Are Working. While you're working, your widow (er)'s benefit amount will be reduced only until you reach your full retirement, which is age 66 for those born between 1945 to 1956. If you are under full retirement age when you start getting your widow (er)'s benefits, $1 in benefits will be deducted for each $2 you earn ...

How much is deducted from widow's benefits?

If you are under full retirement age when you start getting your widow (er)'s benefits, $1 in benefits will be deducted for each $2 you earn above the annual limit.

What happens if you get your retirement benefits increased?

If some of your retirement benefits are withheld because of excessive earnings, your benefits will be increased starting at your full retirement age to take into account those months in which benefits were withheld. If you live into your 80s, you will generally recover everything that was initially withheld.

Can you recover your benefits if you live into your 80s?

If you live into your 80s, you will generally recover everything that was initially withheld. If you live into your late-80s or 90s, you will more than recover what was withheld. So, while the benefit reduction may look like a tax on earnings, over the long run that view turns out not to be correct for many people.