Can you take your benefits before full retirement age?

The earliest age to file for benefits is 62, and you can claim your full monthly benefit based on your personal earnings history at age 66, 67, or somewhere in between at a point known as full retirement age (FRA). You'll also be rewarded for delaying your Social Security claim beyond FRA.

When do Tier 3 members reach full retirement benefits?

retirement benefits and need to reach the age of 65 before receiving the vested retirement ... after 25 years full escalation of benefits currently applicable to tier 3 police/fire members. ... members in tier 3 in order to give them modified Tier 3 police/fire benefits.

What age is considered early for retirement?

How to prepare for early retirement

- Make a savings budget. Saving for retirement is a lifelong investment. ...

- Determine your anticipated age of retirement. While assessing your finances, it's ideal to factor in the age you want to retire. ...

- Consider your partner or spouse's plan for retirement. ...

- Develop a plan for health care. ...

How to calculate full retirement date?

Use this tool to check:

- when you’ll reach State Pension age

- your Pension Credit qualifying age

- when you’ll be eligible for free bus travel

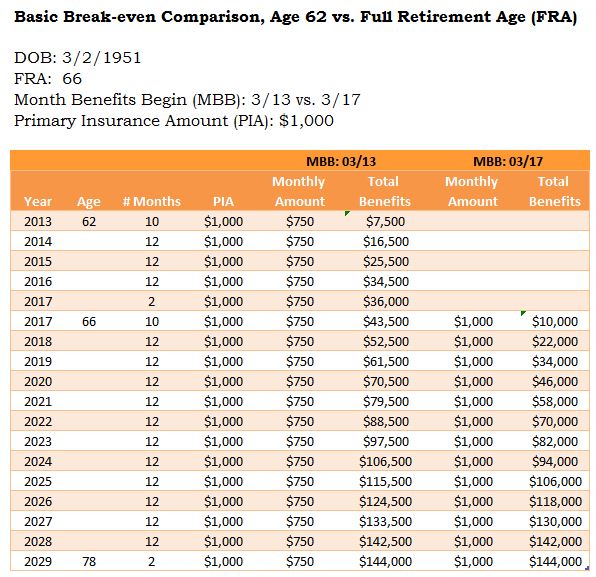

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

Is full retirement age the month you turn 66?

If you were born between 1955 your full retirement age is 66 and 2 months (En español) If you start receiving benefits at age 66 and 2 months you get 100 percent of your monthly benefit. If you delay receiving retirement benefits until after your full retirement age, your monthly benefit continues to increase.

Is the full age of retirement still at 65 or what?

The 1983 Amendments phased in a gradual increase in the age for collecting full Social Security retirement benefits. The retirement age will increase from 65 to 67 over a 22-year period, with an 11-year hiatus at which the retirement age will remain at 66.

How soon should I apply for Social Security before my 66th birthday?

You can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December. If you want your benefits to start in December, you can apply in August.

Can I retire on my 66th birthday?

Men and women from the UK, born between 6 October 1954, and 5 April 1960 will start receiving their state pension on their 66th birthday. This is scheduled to rise to age 67 between the years 2026 and 2028. However, UK residents can retire and access their private pension currently from age 55.

Can you collect Social Security at 66 and still work full time?

When you reach your full retirement age, you can work and earn as much as you want and still get your full Social Security benefit payment.

What is the average Social Security benefit at age 62 in 2021?

At age 62: $2,364. At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

Is it better to collect Social Security at 66 or 70?

If you start receiving retirement benefits at age: 67, you'll get 108 percent of the monthly benefit because you delayed getting benefits for 12 months. 70, you'll get 132 percent of the monthly benefit because you delayed getting benefits for 48 months.

When did the full retirement age change?

Although full retirement age once was 65 for everyone, Congress passed a law in 1983 that gradually increased it to age 67, because people were living longer. 3 . Year you were born. Full retirement age. 1937 or earlier. 65.

What is the retirement age for 1955?

According to the Social Security Administration, full retirement age for 1955 as a birth year would be 66 and 2 months, therefore that is their retirement age, even though they were actually born in 1956.

What is the FRA age?

Full retirement age (FRA) is the age at which you are eligible to receive full, unreduced Social Security benefits. Figuring your full retirement age will depend on the day and a year of your birth. Therefore, people born on January 1 should use the prior year to calculate their FRA.

What age do you use FRA?

66 and 10 months. 1960 or later. 67. Not only does FRA depend on the year you were born, but it also depends on the day, because Social Security considers you to have attained an age the day before your birthday. 4 Therefore, if you were born on January 1, you would use the FRA for the year before your year of birth.

Can you get Social Security at 65?

Once you reach FRA, you can earn as much as you like and your Social Security benefit will not be reduced. Social Security is separate from Medicare. Although age 65 is frequently referenced when referring to Medicare, your full retirement age may be something different.

Can you get survivor benefits if you are married?

8 If you're married, be sure to coordinate your claiming decision to put the two of you in the most secure position.

When can retirement plans distribute benefits?

When Can a Retirement Plan Distribute Benefits? Unless you elect otherwise, benefits under a qualified plan must begin within 60 days after the close of the latest plan year in which you: terminate service with the employer.

What is a defined benefit pension plan?

Full accrued benefit -- the plan will set a normal retirement age, which is when you will be eligible to receive (or begin to receive, in the case of annuity or installment payments) your full accrued benefit.

What is a 401(k) plan?

401 (k), profit-sharing, and stock bonus plans. Employee elective deferrals (and earnings, except in a hardship distribution) -- the plan may permit a distribution when you: terminate employment (by death, disability, retirement or other severance from employment); suffer a hardship.

You Can Receive Benefits Before Your Full Retirement Age

You can start receiving your Social Security retirement benefits as early as age 62, but the benefit amount will be lower than your full retirement benefit amount.

Working While Receiving Benefits

You may work after you start receiving benefits, which could mean a higher benefit for you in the future. We may withhold some of your benefits if you earn more than the yearly earnings limit. Sometimes people who retire in mid-year already have earned more than the annual earnings limit. However:

How long can you delay your retirement?

Delayed retirement credits can be earned until age 70 , after which time there is no financial benefit to delaying your claim. Delayed retirement credits cannot be earned if you are claiming either spousal or survivor benefits.

What is the retirement age for a person born in 1954?

Your PIA is the standard amount you can expect to receive based on your inflation-adjusted average wages earned throughout your career. Full retirement age is 66 for those born in 1954 and 67 for those born in 1960 or later -- it varies depending on your birth year. It is important to know your full retirement age, ...

How much of Social Security is taxable?

For single filers with provisional income above $34,000 and married filers above $44,000, up to 85% of Social Security benefits will be taxable.

How old do you have to be to get Social Security?

For Social Security income, the youngest age you can apply is 61 years and nine months old. You’d then receive your first Social Security check four months later—the month after your 62nd birthday. While it typically takes several weeks to process a new application, some may be approved in the same month that you apply.

When do you get your Social Security check?

The earliest you can apply for Social Security benefits is at age 61 and nine months, and you can expect to receive your first payment four months later—the month after your birthday. 1 Typically, Social Security benefits are paid the month after they are due, or must be specified.

How long does it take to apply for Social Security?

The application itself takes about 10 to 30 minutes and can be saved at any point for future completion. In addition, this application can also be used to apply for Medicare. 6. It is generally recommended that you apply ...

Is Social Security open for appointment?

As of November 2020, all local Social Security offices are open by appointment only, and only for “dire need situations,” due to the COVID-19 pandemic.

Can you calculate your full retirement age based on your birthday?

Every individual can calculate their own "full retirement age" based on their specific birthday, in order to consider locking in the maximum amount of Social Security benefits.

What is the maximum amount you can earn before retirement in 2021?

If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is $50,520. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

What is the maximum amount you can earn in 2021?

For 2021 that limit is $18,960. In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before the month you reach your full retirement age. If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is ...

Can you report a change in earnings after retirement?

If you need to report a change in your earnings after you begin receiving benefits: If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away. You cannot report a change of earnings online.

How much will Social Security decrease at age 62?

Opting to receive benefits at age 62 will reduce their monthly benefit by 28.4% to $716 to account for the longer time they could receive benefits, according to the Social Security Administration. That decrease is usually permanent. 7 . If that same individual waits to get benefits until age 70, the monthly benefit increases to $1,266.

How are Social Security benefits calculated?

Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years). First, all wages are indexed to account for inflation. Wages from previous years are multiplied by a factor based on the years in which each salary was earned and the year in which the claimant reaches age 60. 5 .

What is the maximum Social Security benefit for 2021?

The maximum monthly Social Security benefit that an individual can receive per month in 2021 is $3,895 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,113, and for someone aged 62, the maximum amount is $2,324.

How much will Social Security pay in 2021?

According to the Social Security Administration (SSA), the maximum monthly Social Security benefit that an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is as follows: $3,895 for someone who files at age 70. $3,113 for someone who files at full retirement age (FRA)

Distributable Events

- The law permits a plan to distribute an account after certain events (distributable events). Different distributable events apply to different types of plans, and different types of contributions or accounts within those plans. The plan is not required to allow distributions for every possible distributable event. The plan document must clearly state when a distribution will be made. Con…

Profit-Sharing, and Stock Bonus Plans

- Employee elective deferrals(and earnings, except in a hardship distribution) -- the plan may permit a distribution when you: 1. terminate employment (by death, disability, retirement or other severance from employment); 2. reach age 59½; or 3. suffer a hardship. Employer profit-sharing or matching contributions-- the plan may permit a distribution of your vested accrued benefit when …

Defined Benefit and Money Purchase Pension Plans

- Full accrued benefit-- the plan will set a normal retirement age, which is when you will be eligible to receive (or begin to receive, in the case of annuity or installment payments) your full accrued benefit. Early or phased retirement-- the plan may permit earlier distributions when you: 1. turn age 59 1/2 (even if still employed); or 2. terminate...

Sep and Simple Ira Plans

- These plans use IRAs to hold participants’ retirement savings. You can withdraw money from your IRA at any time. A 10% additional taxgenerally applies if you withdraw IRA or retirement plan assets before you reach age 59½, unless you qualify for another exception to the tax.

Additional Resources