- Review Retirement Benefits Basics. You can start your retirement benefits as early as age 62 or as late as age 70. ...

- Understand The Application Process. Gather the information and documents you need to apply. Complete and submit your application. ...

- Gather Information You Need to Apply. Dates of current and previous marriages, and where you were married. ...

What is the current age to collect Social Security retirement?

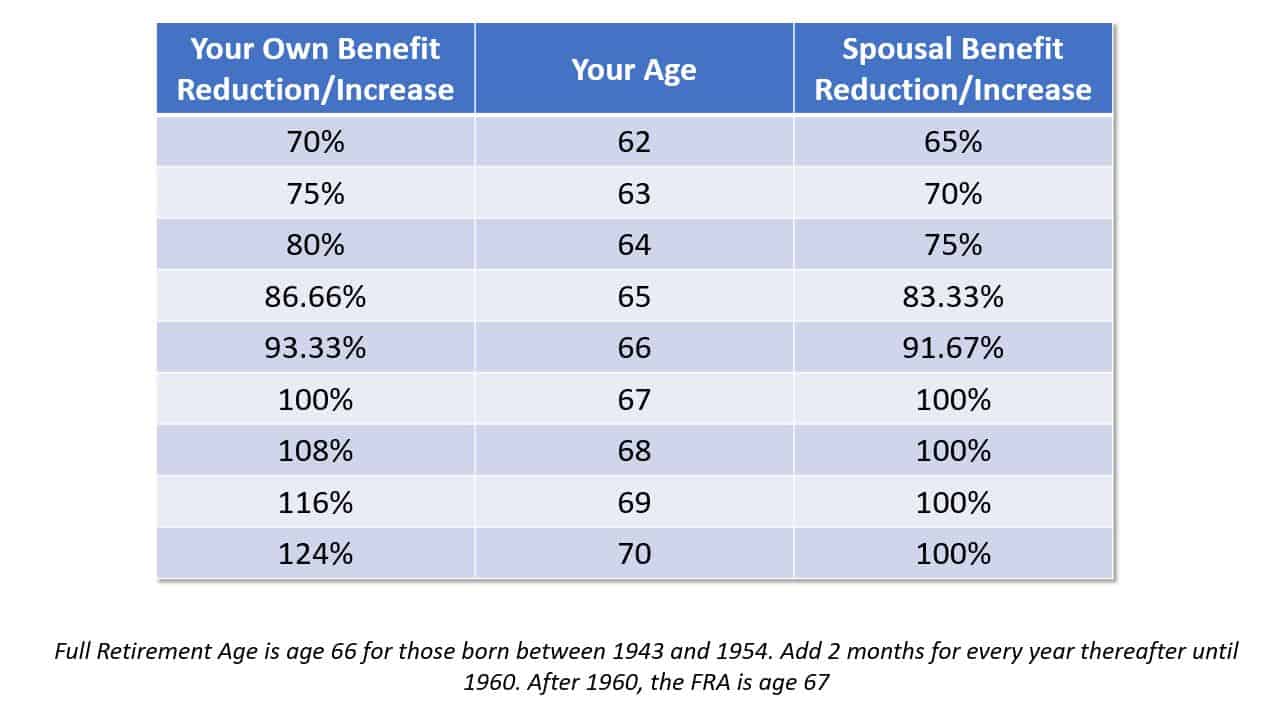

- The Social Security retirement age is between 66 and 67, depending on your birth year.

- Your "full retirement age" is when you can begin claiming 100% of your Social Security benefit.

- You can claim Social Security as early as age 62 but your benefit will be reduced by up to 30%.

- Visit Personal Finance Insider for more stories.

When you should file early for Social Security?

Key Takeaways

- You can collect Social Security as early as age 62, but your benefits will be permanently reduced. ...

- The longer you can afford to wait after age 62 (up to 70), the larger the monthly benefit. ...

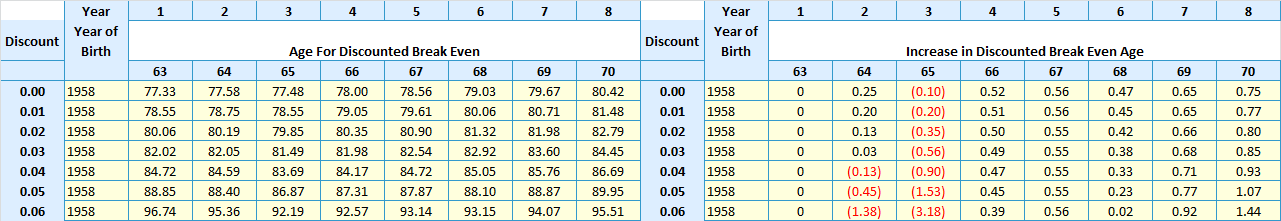

- Doing a breakeven analysis can help you determine when you would come out ahead by delaying benefits.

Should you file for Social Security at full retirement age?

or if you reach your full retirement age later in the year, you should probably just wait until your FRA to file for your Social Security benefits. I know these rules are complicated, and the math ...

How much will I get from social security when I retire?

How much will i get from social security at retirement? The maximum benefit — the most an individual retiree can get — is $3,345 a month for someone who files for Social Security in 2022 at full retirement age (FRA), the age at which you qualify for 100 percent of the benefit calculated from your earnings history.

How long before receiving benefits should I apply for Social Security?

You can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December, and apply in August. Even if you are not ready to retire, you still should sign up for Medicare three months before your 65th birthday.

Does it matter what month you retire for Social Security?

If you start your benefits before your full retirement age, your benefits are reduced a fraction of a percent for each month before your full retirement age. You can get Social Security retirement benefits and work at the same time before your full retirement age.

Do I need to notify Social Security when I retire?

If you receive benefits from Social Security, you have a legal obligation to report changes, which could affect your eligibility for disability, retirement, and Supplemental Security Income (SSI) benefits.

How much money can you have in the bank on Social Security retirement?

$2,000You can have up to $2,000 in cash or in the bank and still qualify for, or collect, SSI (Supplemental Security Income).

How do I apply for Social Security for the first time?

You can apply:Online; or.By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. ... If you do not live in the U.S. or one of its territories, you can also contact your nearest U.S. Social Security office, U.S. Embassy or consulate.

What should I do 1 year before retirement?

Finally, to prepare emotionally, figure out what you plan to do with your time in retirement.Create or Update Your Retirement Budget.Adjust Your Portfolio for Income.Learn How Medicare Works.Refinance Your Mortgage (Maybe)Decide When to Claim Social Security Benefits.Determine How You'll Spend Your Time.More items...

What should I do when I first retire?

Here are some of our ideas for what to do when you are first retired:Move Somewhere New: Have you ever wanted to live in the country? ... Travel the World: ... Get a Rewarding Part-Time Job: ... Give Yourself Time to Adjust to a Fixed Income: ... Exercise More:

What do I need to do before I retire?

Saving Matters!Start saving, keep saving, and stick to.Know your retirement needs. ... Contribute to your employer's retirement.Learn about your employer's pension plan. ... Consider basic investment principles. ... Don't touch your retirement savings. ... Ask your employer to start a plan. ... Put money into an Individual Retirement.More items...

When do you get your Social Security check?

The earliest you can apply for Social Security benefits is at age 61 and nine months, and you can expect to receive your first payment four months later—the month after your birthday. 1 Typically, Social Security benefits are paid the month after they are due, or must be specified.

How old do you have to be to get Social Security?

For Social Security income, the youngest age you can apply is 61 years and nine months old. You’d then receive your first Social Security check four months later—the month after your 62nd birthday. While it typically takes several weeks to process a new application, some may be approved in the same month that you apply.

How long does it take to apply for Social Security?

The application itself takes about 10 to 30 minutes and can be saved at any point for future completion. In addition, this application can also be used to apply for Medicare. 6. It is generally recommended that you apply ...

Is Social Security open for appointment?

As of November 2020, all local Social Security offices are open by appointment only, and only for “dire need situations,” due to the COVID-19 pandemic.

Can you calculate your full retirement age based on your birthday?

Every individual can calculate their own "full retirement age" based on their specific birthday, in order to consider locking in the maximum amount of Social Security benefits.

What does it mean to delay retirement benefits?

If you are the higher earner, delaying starting your retirement benefit means higher monthly benefits for the rest of your life and higher survivor protection for your spouse, if you die first.

Is it important to decide when to start receiving Social Security?

Choosing when to start receiving your Social Security retirement benefits is an important decision that affects your monthly benefit amount for the rest of your life. Your monthly retirement benefit will be higher if you delay claiming it.

How long do you have to wait to get Medicare if you are 65?

The Social Security Administration (SSA) also cautions that even if you delay receiving Social Security benefits until after age 65, you might still need to apply for Medicare benefits within three months of turning 65 to avoid paying higher premiums for life for Medicare Part B and Part D.

How much is a month of benefits at 62?

If, for example, you’d get $1,500 a month starting at age 62 or $2,000 a month starting at age 66, you will have received roughly the same amount in total benefits by age 77 or so. At that point the higher monthly benefits you’d get as a result of waiting will begin to pay off.

How much tax do you pay if you are married filing jointly?

If you’re married filing a joint return, and your combined income is $32,000 to $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, you may have to pay tax on up to 85% of your benefits. 11 .

How much extra insurance do you get at 70?

If you wait until you’re 70 to start claiming benefits, you’ll get an extra 8% per year , or, in total, 132% of your primary insurance amount ($2,640 per month in the example above) for the rest of your life.

How much is my unemployment check at 62?

In other words, you’ll get 25% less per month, and your check will be $1,500. 1 .

Can a spouse get Social Security if they don't work?

Spouses who don’t qualify for their own Social Security. Spouses who didn’t work at a paid job or didn’t earn enough credits to qualify for Social Security on their own are eligible to receive benefits starting at age 62 based on their spouse’s record.

Do marginal tax rates affect Social Security?

At today’s marginal tax rates, they may not have much of an impact on most people. Still, tax rates and income thresholds can change, so it’s worth remembering that you will lose less of your Social Security to taxes if you are in a lower marginal tax bracket when you begin to collect.

What is the retirement age for Social Security?

Source: Social Security Administration. While the full retirement age used to be 65 , changes to the program have increased that age. For example, those born in 1955 now have to wait an extra two months beyond age 66 to claim their full benefit.

How much will Social Security be less if you were born in 1961?

Those are big hits for waiting just a few extra years. For example, if you were born in 1961 and file for benefits at age 62, your monthly benefit will be 30 percent less than if you had filed at your full retirement age of 67.

How much do you get a check for retirement in 2020?

If you reach full retirement age in 2020, the administration deducts $1 of your monthly check for every $3 you earn above $48,600 until the month you reach retirement age. You’ll also owe Social Security and Medicare tax on your earnings, even if you’re already receiving benefits.

How much will my retirement check increase?

So if your full retirement age is 66, then if you can wait two more years and claim benefits at age 68, you’ll increase your monthly check by 16 percent .

When will Social Security pay you a bonus?

In fact, Social Security will pay you a bonus if you wait until after full retirement age to claim your benefits. So there’s extra incentive to wait, if you can. Here’s what you need to know about taking Social Security and the trade-offs between claiming an early benefit and your full benefit.

Is there an age limit for Social Security?

When it comes to calculating a start date for Social Security benefits, however, there’s not an age that’s appropriate for everyone. Consider your own financial need, health and other retirement plans before making the call.

Can you get a reduction in your retirement if you have too much?

Earning too much at a job after you begin collecting your benefit can reduce your payout, but only if you have yet to hit full retirement age. However, when you hit full retirement age, your benefit will increase to account for any benefit that was withheld earlier due to working.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

When can I collect Social Security if I was born on the first day of the month?

For example, if you were born on Oct. 1 or 2, 1959, Social Security considers you to be 62 as of Sept. 30 or Oct. 1, 2021.

What happens if you file for Social Security at 62?

By filing at 62, or any time before you reach full retirement age, you forfeit a portion of your monthly benefit. If you were born in 1960 or later, for instance, filing at 62 could reduce your monthly payment by as much as 30 percent. AARP’s Social Security Benefits Calculator can provide more details on how filing early reduces benefits.

When will I get my unemployment benefits if I was born in October?

There is a one-month lag in the benefit payment. If your birthday is Oct. 1 or 2, you qualify for an October benefit and it will be paid in November. If you were born later in October, your first benefit month is November and you will be paid in December.

When will Social Security start in 2021?

For example, if you were born on Oct. 1 or 2, 1959, Social Security considers you to be 62 as of Sept. 30 or Oct. 1, 2021. Your benefits will start in October 2021; you can apply for benefits in June. But if you were born between Oct. 3 and 31, your first full month at 62 is November. If you want to start your benefits as soon as possible, ...

When will unemployment start in 2021?

Your benefits will start in October 2021; you can apply for benefits in June. But if you were born between Oct. 3 and 31, your first full month at 62 is November. If you want to start your benefits as soon as possible, you can apply in July. There is a one-month lag in the benefit payment.