Pandemic Unemployment Assistance (PUA): Expanded Unemployment Eligibility During the Coronavirus Emergency. Pandemic Unemployment Assistance (PUA) provides benefits for NJ workers who are: not eligible for unemployment benefits in any state, including self-employed workers (independent workers, “gig” workers) otherwise able and available to work except that they are unemployed, partially unemployed, or unable or unavailable to work due to a COVID-19 qualifying reason, and.

Are you eligible for Pua?

To be eligible for PUA, you must have met the three following qualifications: 1. Y ou must not be eligible for unemployment benefits in any state, including self-employed workers (independent workers, “gig” workers) Your claim is invalid due to self-employment, your employer is exempt (for example, a church), or you have insufficient work history.

How do I apply for Pua in NJ?

The first step to receiving PUA is to apply for state unemployment benefits here - myunemployment.nj.gov -- and be denied. If you have already applied for state unemployment, you do not need to do anything else right now.

What do self-employed workers need to know about PUA in New Jersey?

Here is what New Jersey’s self-employed workers, independent contractors and others who may be eligible for PUA need to know: The first step to receiving PUA is to apply for state unemployment benefits and be denied. If you have already applied for state unemployment, you do not need to do anything else right now.

When will I receive my Pua benefits?

In other words, PUA claims are processed separately from regular unemployment claims, therefore certifying information must be completed separately. The initial group of PUA-eligible claimants will be notified today of their time slot to certify for benefits on Friday. They will receive payment on Tuesday, May 5.

Are individuals eligible for PUA if they quit their job because of the COVID-19 pandemic?

There are multiple qualifying circumstances related to COVID-19 that can make an individual eligible for PUA, including if the individual quits his or her job as a direct result of COVID-19. Quitting to access unemployment benefits is not one of them.

Are self-employed, independent contractor and gig workers eligible for the new COVID-19 unemployment benefits?

See full answerSelf-employed workers, independent contractors, gig economy workers, and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed, partially unemployed or unable or unavailable to work for one of the following COVID-19 reasons:You have been diagnosed with COVID-19, or have symptoms, and are seeking a medical diagnosis.A member of your household has been diagnosed with COVID-19.You are caring for a family member of a member of your household who has been diagnosed with COVID-19.A child or other person in your household for whom you have primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of COVID-19 and the school or facility care is required for you to work.

Will I still receive benefits if my employer files an appeal of my unemployment claim in New Jersey?

If you were determined eligible for benefits, you will continue to receive your benefits as long as you meet all eligibility requirements. If the decision is in favor of the employer, you may be required to repay all or part of the unemployment insurance benefits that have been paid to you.

What is the Pandemic Emergency Unemployment Compensation Program for COVID-19?

See full answerTo qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic. The PUA program provides up to 39 weeks of benefits, which are available retroactively starting with weeks of unemployment beginning on or after January 27, 2020, and ending on or before December 31, 2020.The amount of benefits paid out will vary by state and are calculated based on the weekly benefit amounts (WBA) provided under a state's unemployment insurance laws.

How do I answer 'Did you work between mm-dd-2020 and mm-dd-2020' while certifying for weekly unemployment benefits?

See full answerIf you did any work (or received any payment for work previously completed) between the designated dates, answer YES and report what you earned.IF YOU ARE RECEIVING PUA, to avoid payment delay, use ONLY question 7B – “Other than self-employed income" – to report ALL types of wages/commissions you received this week (even if the earnings were in self-employment). In 7A, choose “NO.”If you know you will not have work the following week, immediately (no later than Saturday of the week in which you are claiming) follow steps to REOPEN/REASSERT THE CLAIM. If you received holiday/vacation/sick pay from your employer during this week, report that information here.

Who is considered to be essential worker during the COVID-19 pandemic?

Essential (critical infrastructure) workers include health care personnel and employees in other essential workplaces (e.g., first responders and grocery store workers).

How long does it take to schedule hearing in New Jersey after I filed my appeal for unemployment benefits?

Appeals are scheduled in the order they are received, with the oldest appeals being scheduled first. The time you have to wait will depend on the Appeal Tribunal backlog. You will be notified through the mail when your hearing is scheduled.

Can I remain on unemployment if my employer has reopened?

No. As a general matter, individuals receiving regular unemployment compensation must act upon any referral to suitable employment and must accept any offer of suitable employment. Barring unusual circumstances, a request that a furloughed employee return to his or her job very likely constitutes an offer of suitable employment that the employee must accept.

Can I get unemployment assistance if I am partially employed under the CARES Act?

A gig economy worker, such as a driver for a ride-sharing service, is eligible for PUA provided that he or she is unemployed, partially employed, or unable or unavailable to work for one or more of the qualifying reasons provided for by the CARES Act.

How often can you take Paxlovid?

“With Paxlovid, you take three pills, twice a day, for a total of five days," says Rachel Kenney, a pharmacist at Henry Ford Health. "It helps your body fight off the virus, preventing it from replicating before it becomes serious.”

What if an employee refuses to come to work for fear of infection?

Your policies, that have been clearly communicated, should address this.Educating your workforce is a critical part of your responsibility.Local and state regulations may address what you have to do and you should align with them.

What kinds of relief does the CARES Act provide for people who are about to exhaust regular unemployment benefits?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation (PEUC) program.

How much do I need to earn to get unemployment in 2020?

To be eligible for Unemployment Insurance benefits in 2020, you must have earned at least $200 per week during 20 or more weeks in covered employment during the base year period, or you must have earned at least $10,000 in total covered employment during the base year period.

How long is the base year for unemployment?

Your regular base year period consists of 52 weeks and is determined by the date you apply for Unemployment Insurance benefits, as outlined in the chart below: If your claim is dated in:

Can you get PUA if you have unemployment?

If your need to provide care to a loved one is related to COVID-19, and your earnings or employment history do not qualify you or Family Leave During Unemployment, or you exhausted your regular unemployment benefit entitlement, you may qualify for Pandemic Unemployment Assistance (PUA).

Can you get PUA if you have a disability?

If your illness, injury, or disability is related to COVID-19, and your earnings or employment history do not qualify you for Disability During Unemployment, or you exhausted your regular unemployment benefits, you may qualify for Pandemic Unemployment Assistance (PUA).

When is the first week of PUA eligibility?

The first week of potential eligibility is the week ending February 8, 2020. You may be required to produce income records for 2018 and 2019.

Do you have to certify your PUA claim?

However, they must certify their PUA claim for each week they are claiming benefits, even if they previously certified their regular unemployment claim for the same week.

How long is the PUA in New Jersey?

26, then extended under the Continued Assistance to Unemployed Workers Act through March 13, 2021. The maximum eligibility for PUA is now 57 weeks.

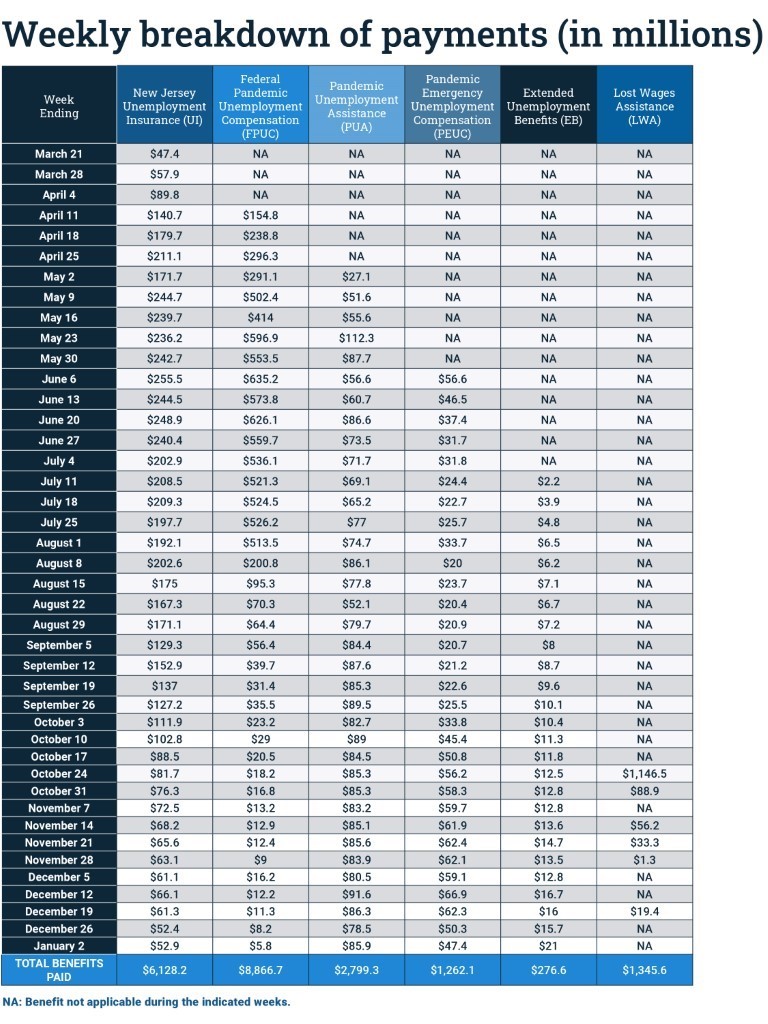

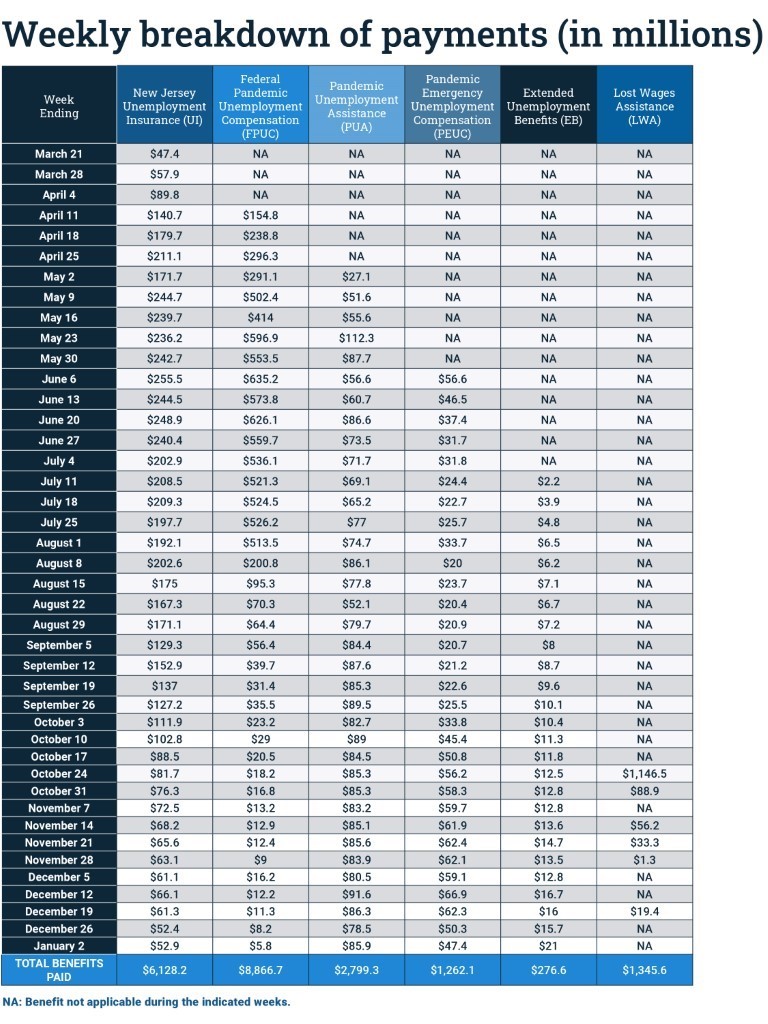

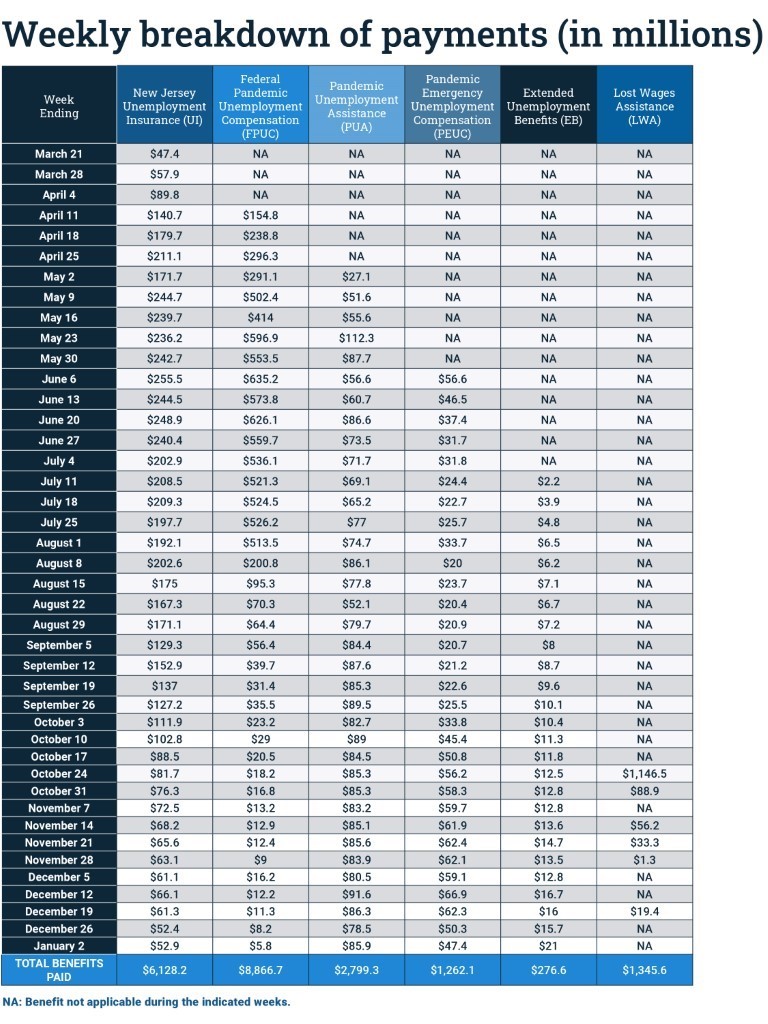

How long is the EB for unemployment?

Extended benefits (EB) adds a final 20 weeks of benefits. The renewed FPUC benefit is a $300/week unemployment supplement for anyone collecting unemployment in any amount; the original program, which provided $600/week in supplemental benefits, expired in July.

When will the 300 unemployment benefit end?

The first allowable week of the $300 supplemental benefit is the week ending Jan. 2, 2021.

What is PUA in unemployment?

PUA is a new program authorized by Congress as part of the Coronavirus Aid, Relief and Economic Security (CARES) Act to provide unemployment benefits to workers not eligible for regular unemployment.

Do you have to certify your PUA claim?

However, they must certify their PUA claim for each week they are claiming benefits, even if they previously certified their regular unemployment claim for the same week.

How long does it take to terminate a PUA?

All states and territories, including Washington, D.C., have agreed to participate in the PUA program. However, either the DOL or a state may give thirty days written notice to terminate the PUA Agreement.

Has the PUA been extended?

The only update is that the program has been extended until September 6, 2021. For more information on Pandemic Unemployment Assistance:

When does PUA expire in NJ?

PUA benefits can be paid retroactively for periods of unemployment beginning on or after February 2, 2020 and are currently set to expire September 4, 2021. Individuals who receive PUA may also be eligible for Federal Pandemic Unemployment Compensation (FPUC), which provides an additional $300 per week from January 2021 through September 4, 2021, and those who exhaust their PUA benefits may be eligible for additional weeks.

When does PUA pay expire?

PUA benefits can be paid retroactively for periods of unemployment beginning on or after February 2, 2020 and are currently set to expire September 4, 2021.

What is accrued sick leave in NJ?

Can use accrued Earned Sick Leave: NJ employers of all sizes must provide full-time, part-time, and temporary employees with up to 40 hours of earned sick leave per year.

How many hours of sick leave can you use in NJ?

Can use accrued Earned Sick Leave: NJ employers of all sizes must provide full-time, part-time, and temporary employees with up to 40 hours of earned sick leave per year. The Earned Sick Leave law states, in part: “Time during which the employee is not able to work because of a closure of the employee's workplace, or the school or place of care of a child of the employee, by order of a public official due to an epidemic or other public health emergency, or because of the issuance by a public health authority of a determination that the presence in the community of the employee, or a member of the employee's family in need of care by the employee, would jeopardize the health of others.”

Does NJDOL determine TDI?

Wage records available to NJDOL would determine the amount of TDI benefits . It is against the law for employers to retaliate against employees for taking or seeking to take TDI benefits. In addition, some NJ workers are eligible for job-protected medical leave under the Federal Family and Medical Leave Act (FMLA).

Can NJDOL determine the amount of family leave?

Wage records available to NJDOL would determine the amount of benefits. It is against the law for employers to retaliate against employees for taking or seeking to take Family Leave benefits. In addition, many NJ workers are eligible for job-protected family leave under the NJ Family Leave Act (NJFLA).

Can you receive more than one NJFLA?

You cannot receive pay or benefits from more than one program/law at the same time. The New Jersey Division on Civil Rights enforces the NJ Family Leave Act and U.S. DOL enforces the Family and Medical Leave Act (FMLA). See NJCivilRights.gov for more information about NJFLA or to file a complaint.

Who is eligible for PUA?

Pandemic Unemployment Assistance (PUA) extends unemployment benefits to eligible self-employed workers, including: 2. Freelancers and independent contractors. Workers seeking part-time work. Workers who don't have a work history long enough to qualify for state unemployment insurance benefits. Workers who otherwise wouldn't qualify ...

What is PUA in unemployment?

Pandemic Unemployment Assistance (PUA) is a program that temporarily expands unemployment insurance (UI) eligibility to self-employed workers, freelancers, independent contractors, and part-time workers impacted by the coronavirus pandemic. PUA is one of the programs originally established by the Coronavirus Aid, Relief, ...

What are the new programs under the Cares Act?

In addition to the PUA program, the CARES Act extended unemployment benefits through two other initiatives: the Pandemic Emergency Unemployment Compensation (PEUC) program and the Federal Pandemic Unemployment Compensation (FPUC) program.

When was PUA created?

PUA is one of the programs originally established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion coronavirus emergency stimulus package that President Donald Trump signed into law on March 27, 2020. The act expanded states' ability to provide unemployment insurance to many workers affected by COVID-19, ...

What is the FPUC?

FPUC is a flat amount given to people who receive unemployment insurance, including those who get a partial unemployment benefit check. It applies to people who receive benefits under PUA and PEUC. The original amount of $600 was reduced to $300 per week after the program was extended in August 2020.

How long does it take to get unemployment benefits after being exhausted?

Extends benefits up to an extra 53 weeks after regular unemployment compensation benefits are exhausted. Federal Pandemic Unemployment Compensation (FPUC) Provides a federal benefit of $300 a week through Sept. 6, 2021. Provided $600 a week through July 31, 2020.

What are some examples of PUA?

Examples of the types of workers targeted by the PUA program include freelancers, part-time “gig workers,” and those who are self-employed. To qualify, workers must certify they are unable to work due to one or several conditions related to COVID-19.