Can a defined benefit pension be rolled over to an IRA?

Defined Benefit Pension Rollover to an IRA: How It’s Possible The short answer to this question is yes or more accurately, usually. Some states have switched from defined benefit pensions to 401(k) plans for their public school teachers and do not allow a pension rollover to an IRA.

Can I rollover a defined benefit or cash balance plan to Ira?

This is especially true for Cash Balance Plans. If the single sum option is available and elected by the participant, they may continue tax deferral by rolling over the Defined Benefit or Cash Balance Plan distribution to an IRA.

Can I roll over an ERISA defined-contribution plan to an IRA?

All ERISA-qualified defined-contribution plans are eligible to roll over into an IRA. No contribution limits exist on the amounts rolled over from a qualified ERISA defined-contribution plan to an IRA.

Should I roll over my defined benefit distribution?

By rolling over the Defined Benefit distribution, income tax is deferred; amounts not rolled over, on the other hand, are immediately subject to federal income tax. What’s more, participants under age 59-1/2 are generally subject to an additional 10% excise tax for any amount not rolled over. However, the excise tax doesn’t apply in all instances.

Can you rollover a defined benefit pension plan?

When you leave an employer that offers a defined benefit plan, or you work for an employer that terminates its defined benefit plan, then you will be eligible to roll your plan over into an IRA or another employer-sponsored retirement plan such as a 401(k) plan.

Can I transfer my defined benefit plan?

You can usually transfer a defined benefit pension to a new pension scheme at any time up to one year before the date when you're expected to start taking your pension. When you start taking your pension, you can't usually move your pension elsewhere.

Can I rollover a defined benefit plan to a Roth IRA?

If you have a traditional defined-benefit pension plan where you work, you may have the option of taking the money as a lump sum when you leave your job or retire. One of the things that you can do with the money is roll it over into a Roth individual retirement account (Roth IRA).

Can you roll a DCP into an IRA?

If you are interested in saving in a Roth IRA, you can move your DCP after-tax balance to a Roth IRA through a conversion rollover.

What is one disadvantage to having a defined benefit plan?

The main disadvantage of a defined benefit plan is that the employer will often require a minimum amount of service. Although private employer pension plans are backed by the Pension Benefit Guaranty Corp up to a certain amount, government pension plans don't have the same, albeit sometimes shaky guarantees.

What happens to my defined benefit plan if I leave the company?

If the plan you are leaving is a defined benefit plan, you would be notified of the amount that your reduced pension benefit would be.

How do you close a defined benefit plan?

To terminate a defined benefit plan voluntarily in a standard termination, the company must fully fund the plan and pay out all benefits, either by distributing lump sum payments (if permitted and elected by participants) or by purchasing annuities to secure participants' benefits.

What should I do with my pension lump sum?

A lump sum amount can be rolled over to an Individual Retirement Account (IRA) and avoid taxation when you receive the lump sum. However, any distributions from the IRA will be taxed as ordinary income. If the money isn't rolled over, you'll pay ordinary income tax on the amount of the lump sum.

Can pension plans be rolled over to 401k?

A pension can be rolled into a 401(k) or an IRA so long as the pension is classified as a "qualified employee plan." Additionally, you must have the company, or your company must be planning on terminating the pension plan in order before rolling over the funds to a 401(k).

What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA functions like the defined benefit plan in that all taxes are deferred until money is disbursed in retirement. A Roth IRA represents after-tax money . Once tax is paid on conversion, the funds are deposited in the Roth IRA account and is subject to the holding period rule.

How long does it take for a company to terminate a plan?

From a mere practical standpoint, the IRS will generally not question a plan termination when a plan has been in place for at least 10 years. However, a company that terminates a plan that was started at least 5 years prior to termination will not typically receive any inquiry from the IRS.

How long can a tax plan be terminated?

But it is typically acceptable to the IRS to terminate the plan as long as it is in existence for at least a “few years.”. However, the tax code is somewhat vague. It doesn’t specifically define what a “few years” means. The IRS states that the plan can only be terminated if ...

Can you roll over a lump sum into an IRA?

Alternatively, you are allowed to take the lump sum balance and roll it over into an IRA. Please note that partial distributions or partial rollovers are not allowed. Because any funds in a defined benefit plan are pre-tax, you can elect to deposit or transfer the funds to a traditional IRA. If you then choose, you can convert ...

Can you roll over a defined benefit plan to an IRA?

You can take money out of the defined benefit plan as a complete lump sum distribution. Alternatively, you are allowed to take the lump sum balance and roll it over into an IRA.

Can a defined benefit plan be rolled over?

The defined benefit plan rollover. But circumstances often change. People get concerned that when they set up a defined benefit plan are not allowed to change the plan or even terminate it. As the IRS sees it, the plan is permanent in nature and cannot be randomly terminated for an invalid reason. The IRS simply assumes ...

When is a business necessity most likely to exist?

A business necessity most likely exists when the company has lower cash flows or profits, there is a significant change in ownership, or there is a material event that prevents or inhibits its ability to fund the plan on an ongoing basis.

How long before you can rollover a defined benefit plan to an IRA?

In other words, any employer that has established a defined benefit or cash balance plan should not attempt to rollover any defined benefit plan assets to an IRA prior to at least three years, but probably not before five years just to be safe.

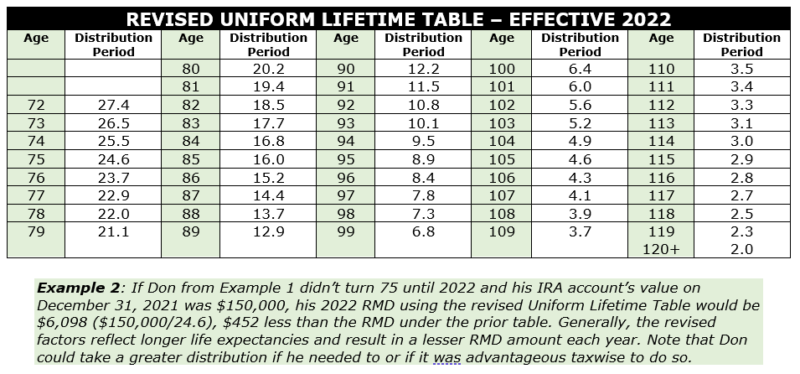

How much money is rolled into an IRA?

Rollovers are the most popular way of funding an IRA. In 2018, there was approximately $480 billion rolled into IRA accounts. Under the IRS rollover rules, one can rollover any pre-tax defined contribution or defined benefit plan assets tax-free to a pre-tax, or traditional, IRA. The same rules apply to the Roth portion ...

How long do you have to keep a defined benefit plan open?

The IRS has not issued any formal rulings as to the number of years a defined benefit plan must be kept open to satisfy the permanent requirement, however, most tax professionals suggest that a defined benefit or cash balance plan be opened at least three to five years to be safe.

What is a cash balance plan?

The cash balance plan is the most popular type of defined benefit plan. The primary advantage of a defined benefit plan is that it will allow a business owner to supercharge their annual tax-deductible contributions as well as potentially generate millions in tax-deferred wealth. The establishment of a defined benefit or cash balance plan is ...

What are the benefits of rolling over a defined benefit plan?

Therefore, there are numerous benefits of rolling over a defined benefit plan. Key Points. Defined Benefit plans allow for guaranteed income at retirement. A Self-Directed IRA allows for alternative investments and greater diversity. Once the defined benefit plan has generated all its permitted benefits, it’s time for a rollover!

What is the best retirement plan for small business?

The defined benefit/cash balance plan is probably the best and most underrated retirement plan for a small business owner. The ability to generate huge annual tax deductions as well as accumulate significant tax-deferred retirement wealth makes it such an attractive retirement plan. Since most defined benefit plans contain meaningful retirement ...

What is the interest rate for actuaries?

Most actuaries use a 4% interest rate to get to an interest credit for cash balance/defined benefit credit calculation purposes. Actuaries typically use a conservative annual interest rate to offer business owners more flexibility in order to best protect against lower plan returns as a result of a down market.

How long do you have to rollover a pension to a Roth IRA?

The Five-Year Rule. One thing to pay close attention to before you do a pension rollover to a Roth IRA is the five-year rule. With this rule, you can’t take any qualified distributions from your account until five years have passed since you made the first contribution to that plan.

What is the difference between a rollover and a transfer?

transfer because a transfer has the plan move the money to another plan or IRA, requiring no intervention from you to deposit it. You’ll need to set up an account and provide the information to the plan administrator, but they’ll take things from there. If your employer issues a lump-sum ...

Why does my pension plan end?

In some cases, a pension plan ends because a company closes or is acquired by another company. Before you start the process, you’ll need to understand an IRA rollover vs. transfer. They both essentially accomplish the same goal, but they’re handled differently. With an IRA rollover, you’ll deposit the money into another retirement plan ...

What is defined contribution plan?

A defined-benefit plan issues a specific pension amount at retirement, while a defined-contribution plan lets you and your employer invest money over time to ensure you’re taken care of when you retire. You can roll over a defined-contribution pension plan to an individual retirement arrangement, but you’ll pay taxes unless it goes ...

How long does it take to roll over lump sum distribution?

If your employer issues a lump-sum distribution, it’s important to drop it into a retirement account within 60 days. Otherwise, you’ll pay the taxes due on the amount you kept. Rolling over or transferring the funds continues to defer taxes until you pay them, as long as you roll them into another tax-deferred account.

How long do you have to pay taxes on a rollover?

There will be no taxes due at the time of the rollover, as long as you do it within 60 days of distribution, and you’ll continue to earn interest tax-free until retirement, at which point you’ll pay taxes on each withdrawal from the plan.

What is the penalty for not rolling money into an account?

Failure to roll that money into an account within the 60-day limit will result in taxes plus a 10-percent early withdrawal penalty, assuming you’re under the age of 59-1/2. In addition to that 10 percent, you’ll also be hit with taxes on the money you took.

What is defined benefit plan?

A defined benefit plan is a qualified retirement plan in which annual contributions are made to fund a chosen level of retirement income at a predetermined future retirement date. Factors such as a client's age, income, length of time before retirement and rate of return of the investment portfolio impact the required annual contribution amount.

How much can I contribute to my retirement plan in 2020?

In 2020 the annual benefit payable at retirement can be as high as $230,000 per year. As a result, annual contributions into a defined benefit plan can be even larger ...

Is it abusive to amend a defined benefit plan?

It may be viewed as abusive by the IRS if too many amendments are made. As a result, amendments should be infrequent. Here is a case study of an attorney who setup a defined benefit plan with the intent to maximize annual contributions in year 1 due to unusually high income and then amend the plan in year 2 to reflect his normal income.

Can you terminate a retirement plan before retirement?

However, the actuary will run calculations and if there is a shortfall then additional contributions may be necessary before the plan is terminated. When the plan is terminated the lump sum value can be rolled over to an IRA.

Can you roll an IRA at 62?

At retirement, at reaching age 62, or upon plan termination, IRS rules generally allow you to roll the assets into an IRA. In an IRA assets continue to grow tax-deferred. Another option is to purchase an annuity and start receiving periodic distributions. Income taxes must be paid when distributions are received.

Can I add a 401(k) to a defined benefit plan?

Yes. You can potentially add a 401k and profit sharing plan to a defined benefit plan. Adding a 401k and profit sharing plan can increase annual contributions and tax deductions.

Is a 100% contribution tax deductible?

100% of the contributions are made by the employer. Contributions are generally 100% tax deductible (within IRS limits). Small business owners with employees must make contributions for eligible employees. Employees do not contribute to a defined benefit plan. When a defined benefit plan is setup eligibility requirements can be established such as ...

How long do you have to wait to rollover a pension to an IRA?

If you do a pension rollover to an IRA, you will have to wait until you are 59.5 to take a penalty -free distribution. The penalty is 10% if you take a distribution before 59.5. There are exceptions to this rule. If you have qualified education expenses, medical expenses or if you are a first-time homebuyer, you may be able to make ...

What is the second condition of leaving a pension plan?

The second condition is that you must be leaving the company, through either retirement or other circumstance, or your company must be closing its pension plan. To be safe, contact your plan administrator before you initiate any transfer of funds.

Can you roll over a qualified pension plan?

According to the IRS, you can roll over a qualified pension plan to any type of retirement account. But, even if your rollover meets the considerations of being a qualified plan and if you are leaving the company or the company is closing its pension plan, there are other factors you should consider when deciding whether to roll over your pension ...

Can you rollover a defined benefit pension to an IRA?

Some states have switched from defined benefit pensions to 401 (k) plans for their public school teachers and do not allow a pension rollover to an IRA .

Is it wise to check with a financial advisor before rolling a pension into an IRA?

It would be wise to check with a financial advisor before doing anything. Finding a financial advisor doesn’t have to be hard.

Can IRA funds be confiscated?

Check your individual state governments to see what their rules are regarding how much of your IRA can be confiscated.

Is a qualified employee pension plan a qualified employee plan?

The first is that the pension plan you are currently under must be a “ qualified employee plan ” that conforms to Internal Revenue Service (IRS) rules. If your contributions to the plan have been tax-deferred, then the chance is good that it is. The second condition is that you must be leaving the company, through either retirement ...

What are the alternatives to 401(k)?

Are there other retirement savings plans other than a 401 (k) plan? Alternatives to 401 (k) plans include traditional IRAs, Roth IRAs, pension plans (if your employer offers one), and 403 (b) retirement plans for employees of non-profit organizations.

What is a traditional 401(k)?

The traditional 401 (k), named after the relevant section of the IRS code, has been around since 1978. With this plan, any contributions you make to the 401 (k) account will reduce your income taxes for that year and will be taxed when they are withdrawn.

What does 401(k) mean?

401 (k) Meaning. The 401 (k) retirement savings account got its name from the Revenue Act of 1978, where an addition to the Internal Revenue Services (IRS) code was added in section 401 (k). Consequently, 401 (k) does not stand for anything except for the section of IRS tax code it was created in.

What does it mean when an employer offers an employee a pension?

If an employer offers an employee a pension, it means that they are promising to pay out a set amount of money to the employee at the time of their retirement. There is typically no option to grow this amount, but it also does not require any financial investment from the employee.

What is defined contribution plan?

401 (k)s, which are also called defined-contribution plans, take some of the financial pressure off of an employer, while also allowing employees to potentially earn a larger retirement package than they would have with a pension.

When did Roth 401(k)s start?

Roth 401 (k)s, named after former senator William Roth of Delaware, were introduced in 2006. Unlike a traditional 401 (k), all contributions are made with after-tax dollars and the funds in the Roth 401 (k) account accrue tax free. Typically, employees can take advantage of both plans at the same time, which is recommended ...

Can an employer contribute to a Roth 401(k)?

However, employers are only able to contribute to a traditional 401 (k), not a Roth 401 (k) plan.