What percentage of Social Security does a widow receive?

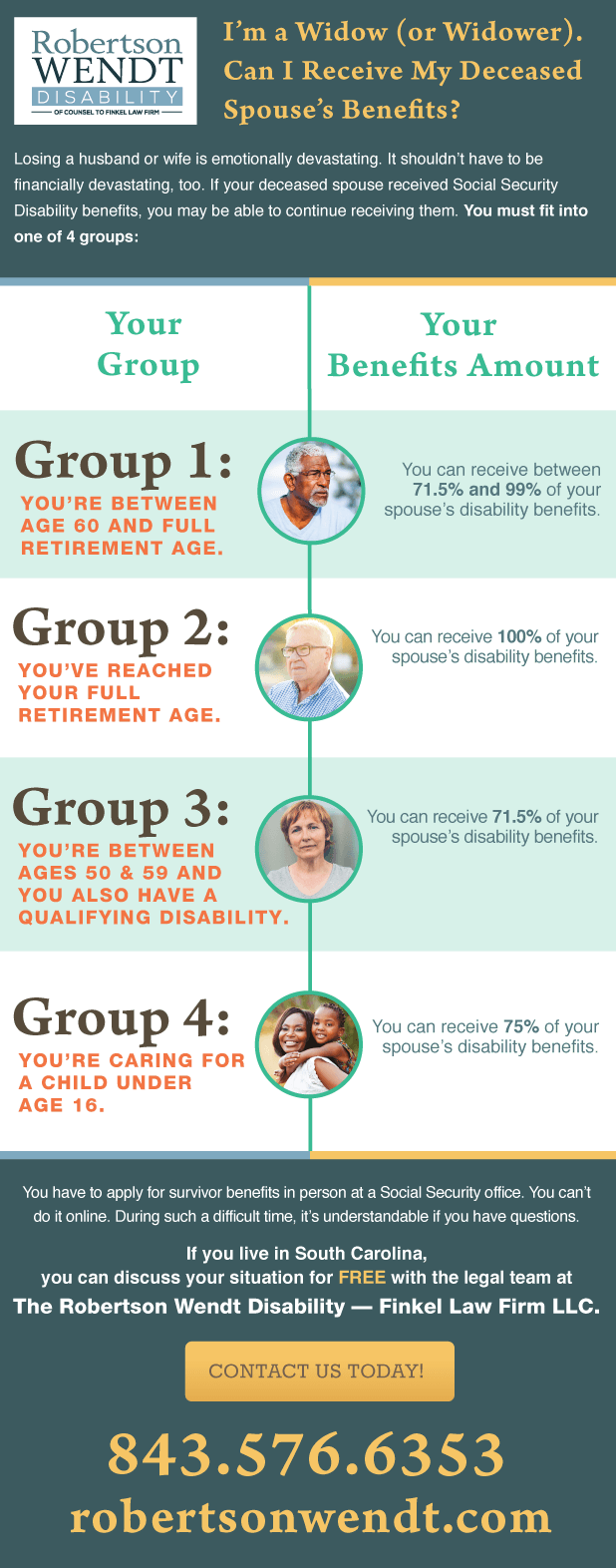

- A widow or widower over 60.

- A widow or widower over 50 and disabled.

- Surviving divorced spouses, assuming the marriage lasted at least ten years.

- Widow or widower who is caring for a deceased child who is either under 16 or disabled.

Do widows get Social Security benefits?

Widows and widowers can integrate Social Security worker and survivor benefits. The rules for widows and widowers are complex but worthy of understanding. Don’t forget the Earnings Test may apply if a surviving spouse is earning income. It is commonly known that a widow or widower entering retirement is entitled to claim Social Security benefits based on his or her own work record (the worker benefit) or on the work record of his or her deceased spouse (the survivor benefit).

Are widows benefits considered social security?

Social Security's Widow(er)’s Insurance Benefits are federally funded and administered by the U.S. Social Security Administration (SSA). These benefits are paid to the widow or widower of a deceased worker who had earned enough work credits. Determine your eligibility for this benefit

What are widows Social Security benefits?

Widows and widowers typically get Social Security survivor benefits when their spouse dies. LGBTQ+ widows and widowers were historically denied survivor benefits, but they are now available as of February 2022. Mention emergency message codes EM-21007 SEN ...

How Work Affects Your widow benefits?

No, the effect that working has on benefits is only on the benefits of the person who is actually working. It will have no effect on the benefits received by other family members. Learn more about survivors benefits for spouses and survivors benefits for divorced spouses, including the eligibility requirements.

What is the earnings limit for widow's benefits?

There's no earnings limit beginning with the month you reach full retirement age. Also, your earnings will reduce only your benefits, not the benefits of other family members. What if I remarry? Usually, you can't get widow's or widower's benefits if you remarry before age 60 (or age 50 if you're disabled).

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

Are widows benefits considered income?

If your combined taxable income is less than $32,000, you won't have to pay taxes on your spousal benefits. If your income is between $32,000 and $44,000, you would have to pay taxes on up to 50% of your benefits. If your household income is greater than $44,000, up to 85% of your benefits may be taxed.

How long are you considered a widow?

two yearsRead on to learn more about the qualified widow or widower filing status. Qualifying Widow (or Qualifying Widower) is a filing status that allows you to retain the benefits of the Married Filing Jointly status for two years after the year of your spouse's death.

How can I maximize my widow's Social Security benefits?

Another way to maximize is to wait to claim your own benefits. As a widow or widower you can claim benefits on your deceased spouse as early as 62 – while allowing your own benefit to grow. You can then switch over to your own benefit at a later date, which will result in a larger monthly check.

Can I get survivor benefits and still work?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn't truly lost.

What percentage of a husband's Social Security does a widow get?

Widow or widower, full retirement age or older—100% of your benefit amount. Widow or widower, age 60 to full retirement age—71½ to 99% of your basic amount. A child under age 18 (19 if still in elementary or secondary school) or has a disability—75%.

Should I take widows benefits at 60?

If both payouts currently are about the same, it may be best to take the survivor benefit at age 60. It's going to be reduced because you're taking it early, but you can collect that benefit from age 60 to age 70 while your own retirement benefit continues to grow.

Does a widow on Social Security have to file taxes?

About 40% of all people receiving Social Security benefits have to pay taxes on their benefits. You'll have to pay taxes on your benefits if you file a federal tax return Page 5 3 as an individual, and your total income is more than $25,000.

What is the widow's penalty?

Also known as Widow's Tax Penalty, taxes increase for most when they become widowed. Tax implications of filling taxes as single instead of married filing joint often leave the surviving spouse worse off financially. In addition to a loss of social security income, what income remains hits higher tax brackets.

Do I have to pay taxes on my survivor benefits?

The IRS requires Social Security beneficiaries to report their survivors benefit income. The agency does not discriminate based on the type of benefit -- retirement, disability, survivors or spouse benefits are all considered taxable income.

How do you qualify for widow's benefits?

Who is eligible for this program?Be at least age 60.Be the widow or widower of a fully insured worker.Meet the marriage duration requirement.Be unmarried, unless the marriage can be disregarded.Not be entitled to an equal or higher Social Security retirement benefit based on your own work.

What is the Social Security earnings limit for 2021?

The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000. The earnings limit for workers who are younger than "full" retirement age (see Full Retirement Age Chart) will increase to $19,560. (We deduct $1 from benefits for each $2 earned over $19,560.)

How long do widow Social Security benefits last?

for lifeWidows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

How much is widow's benefit when you are working?

Claiming Benefits While You Are Working. While you're working, your widow (er)'s benefit amount will be reduced only until you reach your full retirement, which is age 66 for those born between 1945 to 1956. If you are under full retirement age when you start getting your widow (er)'s benefits, $1 in benefits will be deducted for each $2 you earn ...

How much is deducted from widow's benefits?

If you are under full retirement age when you start getting your widow (er)'s benefits, $1 in benefits will be deducted for each $2 you earn above the annual limit.

What happens if you get your retirement benefits increased?

If some of your retirement benefits are withheld because of excessive earnings, your benefits will be increased starting at your full retirement age to take into account those months in which benefits were withheld. If you live into your 80s, you will generally recover everything that was initially withheld.

Can you recover your benefits if you live into your 80s?

If you live into your 80s, you will generally recover everything that was initially withheld. If you live into your late-80s or 90s, you will more than recover what was withheld. So, while the benefit reduction may look like a tax on earnings, over the long run that view turns out not to be correct for many people.

Age restrictions

Full retirement age is an important marker in the SSA systems, and it ranges from 66 to 67 depending on a person’s birth year. If the surviving spouse has not reached that point yet, then he or she can work and receive benefits, but the payments may be smaller if the income exceeds certain limits.

Income restrictions

A surviving spouse who has not reached full retirement age will have an amount deducted from benefits for every increment over the limit he or she earns. Income includes wages for those with an employer and net earnings for those who are self-employed.

Other factors

A surviving spouse who is taking care of a dependent who is under the age of 16 or who has a disability will receive the full amount of benefits at any age regardless of income.

What happens if you apply for widow's survivor benefits?

If you apply for a widow’s survivor benefit before reaching your full retirement age, the earnings test will be in effect. Its exact impact on your benefits depends on how much wage income you earn and on how big your benefit would be.

When can I file for survivor benefits?

One possibility I’d suggest you consider is to wait until you turn 66 (your full retirement age) to file for the survivor benefit. This will avoid the earnings test and provide you your maximum survivor benefit. If you can afford it, delay filing for your own retirement until age 70.

How much is the federal government withholding for a 66 year old?

During the year in which you turn 66, but before your birthday, it will withhold $1 in benefits for every $3 of earnings in excess of the higher exempt amount.

Does Part A charge Social Security premiums?

Part A charges no premiums for people who qualify for Social Security. While your client does not qualify for premium-free Part A on her own earnings record, she would qualify on her ex-husband’s record if she also qualifies for Social Security divorce benefits.

Can a widow receive child benefits if she passed away?

And because he passed away, a widow’s benefit is the benefit in question, not an ex-spousal benefit. Child benefits are only available to children aged 19 or younger, unless they are disabled. If your daughters are older than this and not disabled, they would not be eligible for benefits.

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

When can I switch to my own Social Security?

If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62 .

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

How much can a family member receive per month?

The limit varies, but it is generally equal to between 150 and 180 percent of the basic benefit rate.

Can I apply for survivors benefits now?

You can apply for retirement or survivors benefits now and switch to the other (higher) benefit later. For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

Can a widow get a divorce if she dies?

If you are the divorced spouse of a worker who dies, you could get benefits the same as a widow or widower, provided that your marriage lasted 10 years or more. Benefits paid to you as a surviving divorced spouse won't affect the benefit amount for other survivors getting benefits on the worker's record.

Can a minor receive Social Security?

Minor Or Disabled Child. If you are the unmarried child under 18 (up to age 19 if attending elementary or secondary school full time) of a worker who dies, you can be eligible to receive Social Security survivors benefits. And you can get benefits at any age if you were disabled before age 22 and remain disabled.

Do you lose Social Security if you work?

Generally, your benefits are not permanently lost when Social Security decreases the amount you receive due to work. The money that you are not receiving will be added to your benefit when you reach your full retirement age. However, the money you lost due to working will be added back to your monthly benefits gradually over a period of years.

Does working affect disability benefits?

No, the effect that working has on benefits is only on the benefits of the person who is actually working. It will have no effect on the benefits received by other family members. Learn more about survivors benefits for spouses and survivors benefits for divorced spouses, including the eligibility requirements. Talk to a Disability Lawyer.

Can you work on a child who is on survivors benefits?

The work limitation can be applied to any individual who is receiving survivors benefits. While it is less likely that a child who is enrolled in school full time will exceed the annual limit, it is possible that an elderly parent who is not of full retirement age might.

Can I work before retirement to lower my SSDI?

Working before retirement age may lower your SSDI-based widow's benefits. By Lorraine Netter, Contributing Author. Can you work and receive a spouse's survivors benefits based on your deceased spouse's SSDI disability benefits? The simple answer to this question is: It depends.

What is a disabled widow's benefit?

These benefits are called disabled widow (er)'s benefits (DWB). The deceased spouse must have worked enough years paying Social Security taxes into the system for the widow or widower to be eligible for Social Security benefits.

How long can a widow be disabled?

This exception can greatly lengthen the time an individual is eligible to apply for disabled widow or widower's benefits.) If a widow became disabled immediately after her spouse's death but did not reach the age of fifty within seven years of her spouse's death, she will not be eligible for benefits until age 60.

How much SSDI can I get if I don't have children?

Assuming you don't have children collecting benefits on your husband's record, you can receive 71.5% of your husband's SSDI benefit amount. That said, Social Security must find you have a disability that prevents you from doing substantial amount of work.

How long do you have to be disabled to receive Social Security?

If you are at least 50 years old and disabled, and your disability started within seven years of your spouse's death, you can receive Social Security benefits based on your husband's earnings record. This seven-year period is known as the prescribed period.

Does Social Security automatically find you disabled?

Social Security must automatically find you disabled if you: have a severe impairment.

Can a widow collect Social Security?

Answer: It's true that as a widow, you can normally collect survivors benefits based on your spouse's earning record with Social Security once you turn 60. However, if you're disabled, you can collect survivors benefits earlier.

What is the difference between spousal benefits and survivor benefits?

Spousal benefits are based on a living spouse or ex- spouse’s work history. Survivor benefits are based on a deceased spouse or ex- spouse’s work history. The benefit is based on the worker’s FRA benefit and is not enhanced by delayed retirement credits. Age 62 is the earliest a spouse can claim a spousal benefit .

How long does a widow receive survivor benefits?

Widows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit .

What is disabled widow benefits?

Social Security’s Disabled Widow (er)’s Insurance Benefits are federally funded and. administered by the U.S. Social Security Administration (SSA). These benefits are. paid to the disabled widow or widower of a deceased worker who had earned. enough Social Security credits.

How much of my SS will my wife get when I die?

When a retired worker dies , the surviving spouse gets an amount equal to the worker’s full retirement benefit. Example: John Smith has a $1,200-a-month retirement benefit. His wife Jane gets $600 as a 50 percent spousal benefit. Total family income from Social Security is $1,800 a month.

Can I collect Social Security benefits and survivor benefits at the same time?

Social Security allows you to claim both a retirement and a survivor benefit at the same time , but the two won’t be added together to produce a bigger payment; you will receive the higher of the two amounts. You would be, in effect, simply claiming the bigger benefit .

Does my wife get the house if I die?

In general, if there’s a spouse , then they will get the entire estate except in two situations: The deceased had children, but not with the spouse . The deceased owned property as a joint tenant with someone else.

When can a widow receive Social Security?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor. If the benefits start at an earlier age, they are reduced a fraction of a percent for each month ...

What are the pros and cons of taking survivors benefits before retirement age?

Pros And Cons. There are disadvantages and advantages to taking survivors benefits before full retirement age. The advantage is that the survivor collects benefits for a longer period of time. The disadvantage is that the survivors benefit may be reduced.

What age can you collect a $1000 survivor benefit?

Generally, if the person who died was receiving reduced benefits, we base the survivors benefit on that amount. Year of Birth 1. Full (survivors) Retirement Age 2. At age 62 a $1000 survivors benefit would be reduced to 3. Months between age 60 and full retirement age.

How much is the 62 survivors benefit?

It includes examples of the age 62 survivors benefit based on an estimated monthly benefit of $1000 at full retirement age . If the worker started receiving retirement benefits before their full retirement age, we cannot pay the full retirement age benefit amount on their record. Generally, if the person who died was receiving reduced benefits, ...

Can you use the retirement estimate to determine the amount of a spouse's retirement benefits?

You cannot use the Retirement Estimator to determine benefit amounts for a surviving spouse. However, if you know what the worker's yearly lifetime earnings were, you can use our Online Calculator to get a rough estimate of what the benefits would be for the surviving spouse at full retirement age.