What is the difference between unemployment and Social Security?

- US citizen or permanent resident

- Employed for a certain period of time

- Earning a certain amount of money

- Reason for leaving job should not be related to any kind of legal misconduct

- Available and willing to work

Will unemployment benefits affect my Social Security benefits?

Unemployment benefits do not affect or reduce retirement and disability benefits. State unemployment compensation payments are not wages because they are paid due to unemployment rather than employment. However, income from Social Security may reduce your unemployment compensation. Contact your state unemployment office for information on how your state applies the reduction.

Does unemployment affect SSI benefits?

Unemployment benefits would affect SSI because it is counted as unearned income. So, each dollar of unemployment would count against the $733* unearned income limit for SSI. Unemployment benefits do not count toward the substantial gainful activity limit of $1,090* earnings per month because they are not the result of current work activities.

Will my retirement job affect social security?

Working During Early Retirement Can Affect Social Security . If you plan on working part-time during early retirement, you may find your Social Security benefits reduced. The reduction is based on something called the Social Security earnings limit and it only applies if you have not yet reached full retirement age.

Does Social Security benefits count as income?

Social Security benefits do not count as gross income. However, the IRS does count them in your combined income for the purpose of determining if you must pay taxes on your benefits.

What can disqualify you from unemployment benefits in Texas?

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.

Does receiving a pension affect unemployment benefits in California?

The pension is not deductible from the unemployment benefits because the services performed by the claimant after the beginning of the base period neither affected the claimant's eligibility to receive the pension nor increased the award of the pension.

Why did Social Security suspended my benefits?

When Social Security Dependents Benefits May Stop. If you're receiving dependents benefits based on someone else's earnings record, additional changes can cause your benefits to stop, such as getting married (under certain circumstances), turning a certain age, or changing your living arrangements.

What can disqualify you from unemployment benefits?

Here are the top nine things that will disqualify you from unemployment in most states.Work-related misconduct. ... Misconduct outside work. ... Turning down a suitable job. ... Failing a drug test. ... Not looking for work. ... Being unable to work. ... Receiving severance pay. ... Getting freelance assignments.More items...•

How much can I make and still get unemployment in Texas?

You may earn up to 25% of your Weekly Benefit Amount before we reduce your benefits for that week. If you earn more, then we will reduce your benefit payment by the amount that is over 25%. If you earn more than your weekly benefit amount plus 25%, we cannot pay you benefits for that week.

Will withdrawing my 401k affect my unemployment benefits in California?

Under California law, pensions, including 401k benefits, count as income and may reduce an applicant's weekly unemployment benefits. Furthermore, applicants who attain retirement age, cash out their 401k or other pension plans and terminate employment to retire may be ineligible to receive benefits.

Does 401k affect unemployment benefits?

401(k) withdrawals are considered a form of income, and they will affect the benefits you receive from unemployment. Usually, the portion of 401(k) distributions attributable to the employer is deductible from the unemployment benefits you receive.

Can you collect unemployment and a pension at the same time in PA?

A lump-sum pension payment is not deducted from UC, unless the claimant had the option of taking a monthly pension. In addition, a lump-sum pension is not deductible if the claimant "rolls over" the lump-sum into an eligible retirement plan such as an Individual Retirement Account (IRA) within 60 days of receipt.

Can Social Security cancel your benefits?

This is how. Social Security rules are complicated and change often.

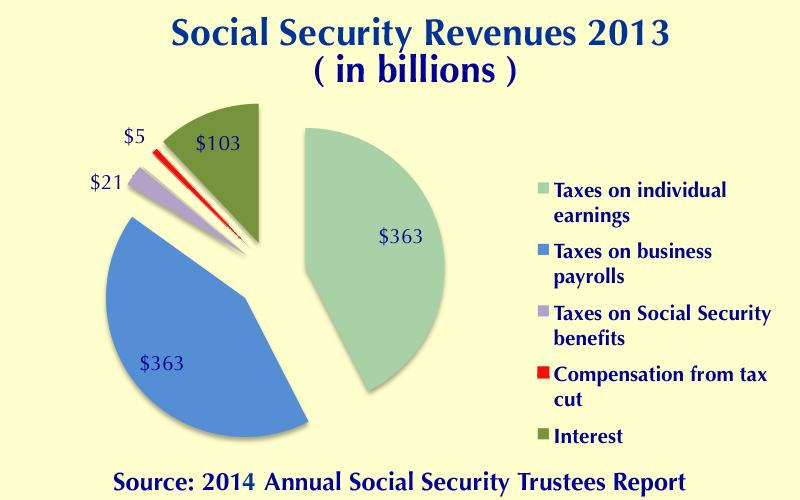

What will happen when Social Security runs out?

Reduced Benefits If no changes are made before the fund runs out, the most likely result will be a reduction in the benefits that are paid out. If the only funds available to Social Security in 2033 are the current wage taxes being paid in, the administration would still be able to pay around 75% of promised benefits.

What is the maximum Social Security benefit?

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364. If you retire at age 70 in 2022, your maximum benefit would be $4,194.

Can you deduct unemployment if you receive Social Security?

In addition, the formerly widespread practice of states deducting money from unemployment benefits if a recipient also received Social Security has been all but eliminated nationwide. In the early 2000s, 20 states and the District of Columbia had such “Social Security offset” laws, according to the National Employment Law Project (NELP).

Can you draw unemployment and SSDI in Minnesota?

It is legally permissible to draw Social Security Disability Insurance (SSDI) and unemployment benefits, and neither affects the amount of the other. (Minnesota is the exception in this case as well. The state’s partial offset also applies to SSDI.)

Does income from work count against earnings test?

Only income from work counts against the earnings test . In addition, the formerly widespread practice of states deducting money from unemployment benefits if a recipient also received Social Security has been all but eliminated nationwide.

Can I collect unemployment if I have SSI?

You also can collect unemployment and Supplemental Security Income (SSI), the other Social Security-run program that pays benefits to disabled people, but the same caveats apply regarding approval of claims — and in the case of SSI, getting unemployment can reduce your benefit payment. If you are receiving one of these benefits ...

Can you get disability if you are unable to work?

To get disability, you must be largely unable to work. Social Security officials weighing disability claims can take into account any receipt of or application for unemployment compensation, and you’ll have to show why the two are not in conflict.

What states have a 50 percent unemployment rate?

Illinois, Louisiana, Minnesota and Utah reduce unemployment benefits by 50 percent for claimants who receive Social Security payments. Minnesota waives the 50-percent reduction if the claimant earned wage credits for unemployment benefits eligibility while already qualified for Social Security payments. South Dakota and Virginia impose a 50-percent reduction for Social Security recipients, depending on the amount of money in the state unemployment fund. South Dakota, for example, ceases imposing a reduction if the unemployment trust fund balance at the end of a calendar quarter is $30 million or more.

Which states allow disability claimants to receive unemployment benefits?

These states are Alaska, Delaware, Hawaii, Idaho, North Dakota, Nevada, Massachusetts, Maryland, Tennessee and Vermont. Advertisement. references & resources.

Does Social Security affect unemployment?

The effect of Social Security payments on unemployment benefits is different from the effect of Social Security Disability Insurance or Supplemental Security Income . In most states, any form of disability payments might disqualify a claimant for failing to meet the requirement to be able to take a full-time job.

Does South Dakota have a reduction in Social Security?

South Dakota and Virginia impose a 50-percent reduction for Social Security recipient s, depending on the amount of money in the state unemployment fund. South Dakota, for example, ceases imposing a reduction if the unemployment trust fund balance at the end of a calendar quarter is $30 million or more. Advertisement.

Can older people collect unemployment?

Elderly people usually can receive both Social Security payments and unemployment benefits. In hard economic times, more and more older people might seek to work past traditional retirement age. If they lose their jobs and do not have enough in the way of Social Security payments and other retirement income, they could try to collect unemployment ...

Do you get Social Security if you retire?

If the payments are for work that you completed before retirement, they generally do not affect your social Security benefits. This can include bonus, accumulated vacation or sick pay, severance pay, commissions, back pay, and some other additional types. If you were self-employed, then net income after the first year you retire counts as a special payment if you performed the services before your Social Security benefit entitlement.

Can 401(k) contributions be used for unemployment?

Distributions from a company pension or 401 (k) are not the same as Social Security benefits and do count as income when it comes to unemployment eligibility. Every state has its own unique requirements, but generally your distributions cannot exceed a set amount. If you withdraw more than that amount, then your unemployment payments may be reduced. If it reaches a separate point, you may be disqualified from unemployment altogether.

Does unemployment affect Social Security?

Even though Supplemental Security Income is not technically Social Security, it is administered by the SSA. Unemployment payments directly affect Supplemental Security Income (SSI) because there is an unearned income limit in order to qualify. This is because SSI is a program that is based on the needs of the recipients. The unearned income limit for SSI is a separate amount from the substantial gainful activity limit. Both limits change each year, but the unearned income limit for 2021 is $814 for an individual and $1211 for a couple.

Can I draw unemployment and SSDI?

You can legally draw Social Security Disability Insurance (SSDI) and unemployment benefits simultaneously. Additionally, the amounts of each will not affect each other. However, getting approved for both SSDI and unemployment is not always easy.

Can you collect unemployment and Social Security?

Jobless benefits are not earned wages; therefore, they do not count towards Social Security’s annual earnings limit. The federal government has no issue with you collecting both Social Security and unemployment.

Is unemployment a federal or state program?

Unemployment is administered by the state in which you reside, but it is a joint state-federal program. Although it depends on the State’s guidelines for eligibility, some of the qualification factors are:

What age can I claim Social Security?

Unemployed and eligible for Social Security? Here’s what you need to know 1 More than 16 million Americans have lost their jobs in the last three weeks. 2 People age 62 and up may decide to start collecting Social Security retirement benefits early to plug the income gap. 3 If you’re unemployed and weighing whether to claim now, here’s what you need to know before you make your decision.

How much will Social Security be reduced?

According to Social Security rules, your benefits will be reduced by $1 for every $2 you earn over $18,240. Another strategy is to claim your retirement benefits early and then suspend those checks when you reach your full retirement age. That way, you can let your benefits grow up until age 70, when the Social Security Administration would ...

How many people have lost their jobs in the last three weeks?

More than 16 million Americans have lost their jobs in the last three weeks. People age 62 and up may decide to start collecting Social Security retirement benefits early to plug the income gap. If you’re unemployed and weighing whether to claim now, here’s what you need to know before you make your decision.

How long do you have to withdraw a check?

If you start receiving checks now and later change your mind, you have up to one year to withdraw your application. There are restrictions, however. For example, you cannot do this 12 months after you made your decision. And you can only do this once.

What does it mean when you receive Social Security Disability?

Of note, if you are receiving Social Security disability benefits, it means you are too disabled to work and therefore ineligible for unemployment benefits, said Gary Burtless, senior fellow in economic studies at the Brookings Institution, a think tank.

When can I start receiving Social Security checks again?

That way, you can let your benefits grow up until age 70, when the Social Security Administration would automatically begin sending you checks again. You can request to start payments again at any time.

Does unemployment insurance count as income?

The answer is yes. Generally, unemployment insurance doesn’t count Social Security retirement benefits in its income calculations, said Demetra Nightingale, institute fellow at the Urban Institute, a nonpartisan think tank. Other sources of income, such as annuities or investment income, also typically don’t count.

Receiving Both Unemployment Benefits and Social Security

In most states today, workers can collect unemployment insurance benefits at the same time that they are drawing Social Security. It wasn't always this way, though.

Collecting Unemployment and Social Security Disability Benefits Simultaneously

Contrary to what you might think, it is possible to collect Social Security disability insurance (SSDI) and unemployment benefits at the same time. Of course, it is rather difficult to qualify for both of these benefits at the same time because the eligibility criteria are fundamentally at odds.

How does unemployment affect my disability application?

Many claimants are receiving unemployment benefits and want to know if they can also file for Social Security Disability Insurance (SSDI). If you are receiving unemployment benefits when you file for Social Security Disability Insurance this can be a problem. Consider the issues:

Can I get Unemployment and apply for Social Security Disability Insurance?

Claimants can apply for Social Security Disability Insurance while they are receiving unemployment benefits. In fact, the Social Security Administration has issued a statement,

Why does it take so long to get Disability Benefits?

Claimants who have applied for either Social Security Disability Insurance or Supplemental Security Income often wonder why the process is so long. There has been a substantial increase in SSDI and SSI applicants in the last few years, especially as the unemployment rate has soared. Last year alone there were over 2 million disability applicants.

Is unemployment a positive or negative?

So, in the final analysis, getting unemployment benefits is really just a positive. The only potential negative is if the benefits are taxed in your state, according to Clark.

Does Social Security count unemployment?

The good news it that Social Security does not count unemployment compensation as earnings. Therefore, it has no impact on your Social Security benefit. But even if it did count unemployment, most people still wouldn’t have cause for concern, according to money expert Clark Howard. “The way Social Security is calculated, ...