Annual pension benefits range from about $9,000 per year for a private pension to about $22,000 per year for federal government pensions. How Much Income Do Average Savings Produce? Typically, you can plan to withdraw around 4 percent of your retirement savings each year.

What is the average monthly benefit for a retired worker?

Your full retirement age is dependent on your birthday but is generally between 66-67 years of age. Social Security benefits for 2019 average around $1,461 a month. For most retirees, this isn’t enough to get by comfortably.

What does the average person save for retirement?

Key statistics

- 1 in 10 Brits (9%) have no savings at all.

- In 2020, the average person in the United Kingdom (UK) had £6,757 saved.

- A third of Brits have less than £600 in savings.

- 41% of Brits don’t have enough savings to live for a month without income.

- The number of Adult ISAs in the UK is up from 10 million in 2017-2018 to over 11 million in 2018-2019.

How do you calculate retirement benefits?

Your annuity will be increased for cost-of-living adjustments, if:

- You are over age 62; or

- You retired under the special provision for air traffic controllers, law enforcement personnel, or firefighters; or

- You retired on disability, except when you are receiving a disability annuity based on 60% of your high-3 average salary. ...

How much is a good retirement income?

What’s a Good Retirement Income

- Minimum income standard in retirement. What’s becoming obvious for many is that the UK state pension may not be enough to provide them with a comfortable standard of living in ...

- Comfort and happiness in retirement. ...

- Sustaining your current living standard. ...

- Retirement targets made easy. ...

What is the average retirement benefit?

Average Retirement Income in 2021. According to U.S. Census Bureau data, the median average retirement income for retirees 65 and older is $47,357. The average mean retirement income is $73,228.

How much will Social Security pay me at 65?

If you start collecting your benefits at age 65 you could receive approximately $33,773 per year or $2,814 per month.

How retirement benefits are calculated?

A money purchase monthly retirement benefit is calculated by multiplying your current total contributions (employee- and employer-required contributions, plus accrued interest) by an actuarial factor based on your age when the annuity begins. Your money purchase balance is reported on your annual Statement of Benefits.

What is the average Social Security benefit at age 62?

According to payout statistics from the Social Security Administration in June 2020, the average Social Security benefit at age 62 is $1,130.16 a month, or $13,561.92 a year.

How much Social Security will I get if I make $50 000 a year?

For example, the AARP calculator estimates that a person born on Jan. 1, 1960, who has averaged a $50,000 annual income would get a monthly benefit of $1,338 if they file for Social Security at 62, $1,911 at full retirement age (in this case, 67), or $2,370 at 70.

How much will I get from Social Security if I make $30000?

1:252:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

How much Social Security will I get if I make 60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much will I get from Social Security if I make 20 000?

If you earned $20,000 for half a career, then your average monthly earnings will be $833. In this case, your Social Security payment will be a full 90% of that amount, or almost $750 per month, if you retire at full retirement age.

How much Social Security will I get if I make $40000?

Those who make $40,000 pay taxes on all of their income into the Social Security system. It takes more than three times that amount to max out your Social Security payroll taxes. The current tax rate is 6.2%, so you can expect to see $2,480 go directly from your paycheck toward Social Security.

How much Social Security will I get if I make $100 000 a year?

Based on our calculation of a $2,790 Social Security benefit, this means that someone who averages a $100,000 salary throughout their career can expect Social Security to provide $33,480 in annual income if they claim at full retirement age.

Why retiring at 62 is a good idea?

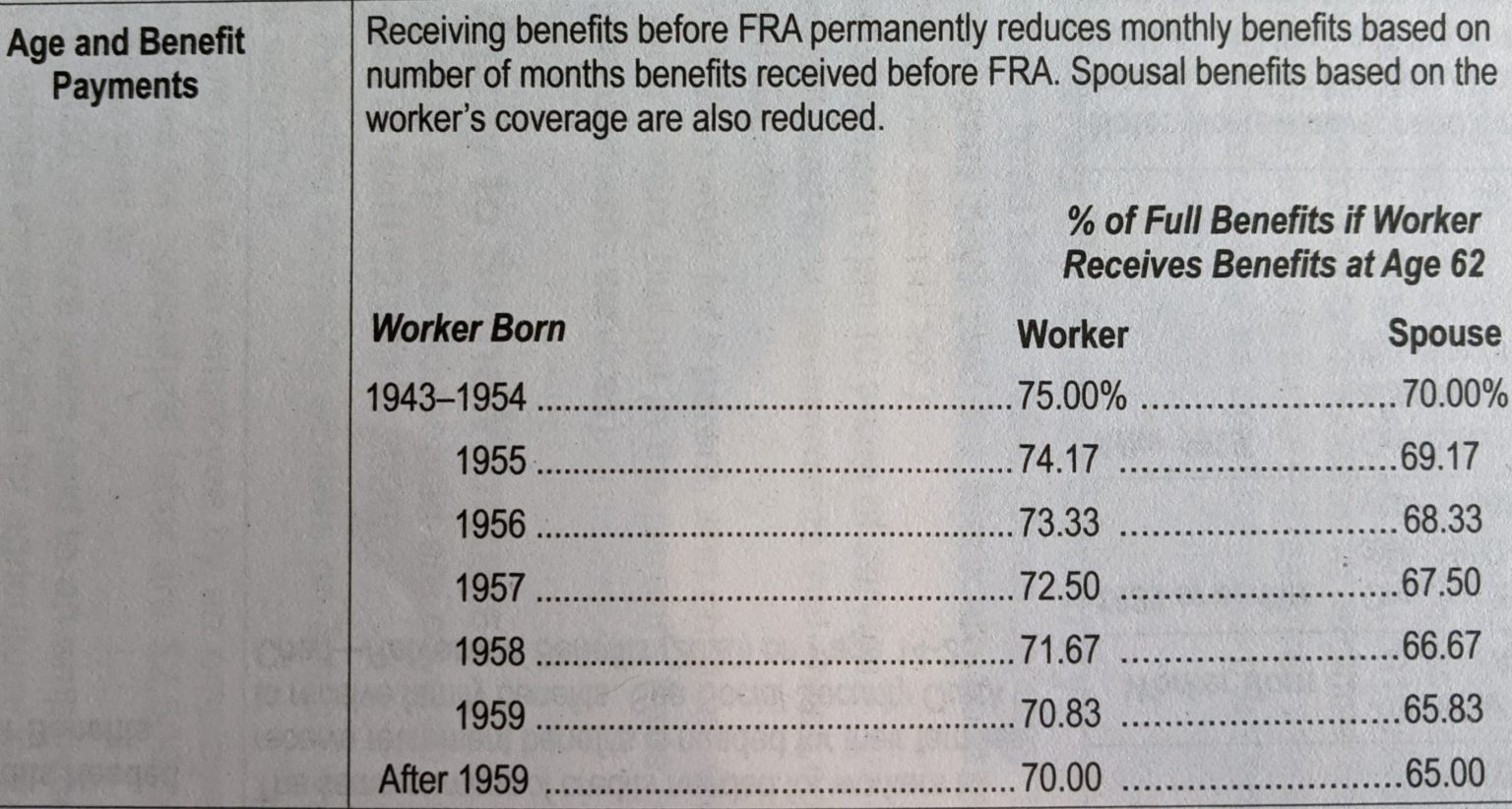

Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower.

Can I retire at 55 and collect Social Security?

Can you retire at 55 to receive Social Security? Unfortunately, the answer is no. The earliest age you can begin receiving Social Security retirement benefits is 62.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

How does Social Security work?

Social Security is a program run by the federal government. The program works by using taxes paid into a trust fund to provide benefits to people who are eligible. You’ll need a Social Security number when you apply for a job. Find how to apply for a Social Security number or to replace your Social Security card .

How much of your pre-retirement income should you replace with retirement?

Current savings. The worksheet assumes that you’ll need to replace about 80 percent of your pre-retirement income. Social Security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring. This leaves approximately 40 percent to be replaced by retirement savings.

What does Social Security provide?

Social Security provides you with a source of income when you retire or if you can’t work due to a disability. It can also support your legal dependents (spouse, children, or parents) with benefits in the event of your death.

How much does Social Security pay?

Social Security pays benefits that are generally equal to about 40 percent of your pre-retirement earnings. The Social Security Administration helps you estimate your benefits. Learn from Investor.gov how you can boost your retirement savings. If you have a financial advisor, talk to them about your plans.

What percentage of your salary should you save for 401(k)?

If, for example, you are in a 401 (k) plan in which you contribute 4 percent of your salary and your employer also contributes 4 percent, your saving rate would be 8 percent of your salary. By using the worksheet, you’ve figured out your target savings rate. It gives you a rough idea –a savings goal.

How to save for retirement?

Use automatic deductions from your payroll or your checking account. Make saving for retirement a habit. Be realistic about investment returns. If you change jobs, keep your savings in the plan or roll them over to another retirement account. Don’t dip into retirement savings early.

How long can a 65 year old woman live in retirement?

How long will you live in retirement? Based on current estimates, a 65 year old man can expect to live approximately 18 years in retirement, and a 65 year old woman can expect to live about 20 years , but many people live longer. Planning to live well into your 90s can help you avoid outliving your income.

How to maximize retirement savings?

Have multiple retirement savings accounts. Maximize your benefits by having multiple pre-tax and tax-free retirement savings accounts. Maximize catch up contributions. If you’re over 50, take advantage of the extra contributions you can add to your retirement savings each year.

How is Social Security calculated?

Your Social Security income is calculated using 2 factors: 1 Age. When you chose to retire affects how much you receive in Social Security benefits. You can collect Social Security as early as age 62 or as late as age 70. However, the earlier you start collecting, the less you receive in benefits. According to the SSA website, if you turn 62 in 2020 and start collecting your Social Security benefits, your benefits would be about 28.3% lower than if you waited until full retirement age (66 years and 8 months). 2 Earnings. The SSA averages your monthly earnings over the 35 years that you earned the most. Higher lifetime earnings translates into higher Social Security benefits. If you’re married, then the amount each spouse receives depends on their work history.

What is a simple IRA?

Simple IRAs are an employer-provided retirement account designed for employees without a traditional 401 (k). Both employers and employees can both make contributions to Simple IRA accounts and in 2020, Simple IRA contributions increased to $13,500 annually ($16,500 if you are over 50). 3.

What is 401(k) contribution?

A 401 (k) is a defined contribution plan . A defined contribution plan is an employer-sponsored retirement savings plan that allows employees to save and invest some of their paycheck before taxes are taken out. Employers can either match employees’ contributions or contribute partially. Contributions are invested and the retirement benefits an employee has access to for income reflects their investment’s gains or losses. Unlike a pension plan, a defined contribution plan like a 401 (k) doesn’t guarantee payment in retirement. There also are limits to how much you can contribute to a 401 (k). In 2020, 401 (k) contribution limits rose to $19,500 per year.

What are the different types of IRAs?

There are two types of IRAs: Simple IRAs and Traditional IRAs. Both tax-deferred retirement plans. You contribute pre-tax money, allowing for tax-deferred growth, then pay taxes years later when you withdraw. Ideally at a lower tax rate than you are currently paying. Like a 401 (k), there are annual contribution limits to IRA accounts.

What percentage of retirement income is Social Security?

Your income in retirement will come from three sources. 1. Social Security Benefits. According to the Social Security Administration (SSA), more than 85% of people 65 and older receive Social Security benefits. Of that, 38% depend on Social Security for the majority of their retirement income.

How is pension determined?

Typically, a pension amount is determined by factors such as salary, length of service, and years of enrollment. Pension plans guarantee retirees a certain income each month regardless of how their investments performed. Pension plans are becoming a less common source of retirement income.

What is Elizabeth's savings factor?

Elizabeth is planning to retire at age 67 and her goal is to maintain her lifestyle in retirement, so her savings factor is 10x. Sean sees retirement as an opportunity to travel extensively, so it may make sense for him to save more and plan for a higher level of retirement spending. His savings factor is 12x at age 67.

Why is it important to postpone retirement?

That's because delaying gives your savings a longer time to grow, you'll have fewer years in retirement, and your Social Security benefit will be higher. Consider some hypothetical examples (see graphic).

What is a message (Optional)?

Message (Optional) Important legal information about the e-mail you will be sending. By using this service, you agree to input your real e-mail address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. All information you provide will be used by Fidelity solely for ...

What are the 3 A's of saving?

The 3 A’s for saving success. Amount, account, and asset mix are important when saving for retirement. Important legal information about the e-mail you will be sending. By using this service, you agree to input your real e-mail address and only send it to people you know.

Can you choose when you retire?

Of course, you can't always choose when you retire —health and job availability may be out of your control. But one thing is clear: Working longer will make it easier to reach your savings goals. See footnote at the end of the article for more information. 2. How you want to live in retirement.

Why do people underestimate how much they need to save for retirement?

Inflation is one of the reasons why people tend to underestimate how much they need to save for retirement. Although inflation does have an impact on retirement savings, it is unpredictable and mostly out of a person's control.

How to save for retirement?

What may seem like the most obvious way to save for retirement is through personal savings such as checking, savings, or money market accounts ; after all, it is the first place where surplus disposable income accumulates for most people before something is done with it. However, it may not exactly be the best method to save for retirement over the long term, mainly due to inflation. In the U.S., personal savings such as cash, checking accounts, savings accounts, or other forms of liquid assets normally offer little or no interest. With income tax accounted for, the returns rarely beat inflation.

What is the most popular way to save for retirement?

401 (k), 403 (b), 457 Plan. In the U.S., two of the most popular ways to save for retirement include Employer Matching Programs such as the 401 (k) and their offshoot, the 403 (b) (nonprofit, religious organizations, school districts, governmental organizations). 401 (k)s vary from company to company, but many employers offer a matching ...

How much of a person's income is Social Security?

In the U.S., Social Security was designed to replace approximately 40% of a person's working income. Yet, approximately one-third of the working population and 50% of retirees expect Social Security to be their major source of income after retirement.

What is the standard of living after retirement?

Another popular rule suggests that an income of 70% to 80% of a worker's pre-retirement income can maintain a retiree's standard of living after retirement. For example, if a person made roughly $100,000 a year on average during his working life, this person can have similar standard of living with $70,000 - $80,000 a year of income after retirement. This 70% - 80% figure can vary greatly depending on how people envision their retirements. Some retirees want to sail a yacht around the world, while others want to live in a simple cabin in the woods.

What is passive income?

Passive Income. Just because other investments don't have tax benefits doesn't mean they should automatically be ruled out. Passive income is one of them . During retirement, they can come in forms such as rental income, income from a business, stock dividends, or royalties.

Why do people invest in retirement?

In general, investments are used as a method to grow wealth, but people who have maxed out their tax-advantaged retirement plans and are searching for other places to put retirement funds can also use investments in order to reach their retirement goals.

Retirement Calculator

Scroll down for more information on how to use our retirement calculator, plus insight into the data that goes into different calculator fields. In addition, we’ll answer your frequently asked questions about retirement planning.

How to Use the Retirement Calculator

To get the most out of Forbes Advisor’s retirement calculator, we recommend that you input data that reflects your financial situation and your long-term retirement goals. If you don’t have this sort of information in hand, we offer default assumptions.

Retirement FAQs

How much you need to retire depends on how much you plan to spend in retirement. How much will you want to shell out on travel? What about saving for medical expenses? These considerations and more make planning your retirement paycheck difficult for many people, especially when they’re decades from retirement.

What is the most common retirement goal?

For example, the most common retirement goal among Americans is a $1 million nest egg. But this is faulty logic. Image source: Getty Images.

Is there a perfect way to calculate retirement savings?

There is no perfect method of calculating your retirement savings target. Investment performance will vary over time, and it can be difficult to accurately project your actual income needs. Furthermore, it's worth mentioning other considerations. For one thing, not all retirement plans are equal when it comes to income.

Is Social Security a good source of income?

The good news is that, if you're like most people, you'll get some help from sources other than your savings. For example, Social Security replaces about 40% of the average American's pre-retirement income all by itself. The percentage is typically lower than this for higher-income retirees, but, for most people, Social Security is a significant income source.