Does social security pay more than disability?

Technically, Social Security Disability is not "more than" Social Security retirement. However, that depends upon the age at which an individual takes their Social Security retirement benefit. Social Security Disability benefits are equal to benefits for full retirement age retirees, which means an individual who takes their Social Security retirement any earlier than their full retirement age would receive less than what their disability benefit amount would be.

Is disability better than social security?

This means that between 62 and your FRA, your disability benefit would be higher. And there’s an additional benefit to taking disability: By electing for disability instead of Social Security, you allow your Social Security benefit to continue growing. This disparity is even greater if you happen to become disabled after you turn, say, 63.

Why is SSDI better than SSI?

Neither?

- STEP ONE: CHECK MEDICAL CRITERIA. SSI and SSDI have the exact same medical criteria. ...

- STEP TWO: CHECK SSDI. You can qualify for SSDI if you worked and paid taxes, but it depends how much you worked and how recently you worked.

- STEP THREE: DON’T GIVE UP TOO EASILY. ...

- STEP FOUR: CHECK SSI. ...

- STEP FIVE: OTHER OPTIONS. ...

What we should do about Social Security disability?

- The nature of your disability;

- How quickly we obtain medical evidence from your doctor or other medical sources; and

- Whether it is necessary to send you for a medical examination in order to obtain evidence to support your claim.

Will my Social Security be the same as my disability?

your disability benefits automatically convert to retirement benefits, but the amount remains the same. If you also receive a reduced widow(er)'s benefit, be sure to contact Social Security when you reach full retirement age, so that we can make any necessary adjustment in your benefits.

Do you get both disability and Social Security?

Yes, you can receive Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) at the same time. Social Security uses the term “concurrent” when you qualify for both disability benefits it administers. However, drawing SSDI benefits can reduce your SSI payment, or make you ineligible for one.

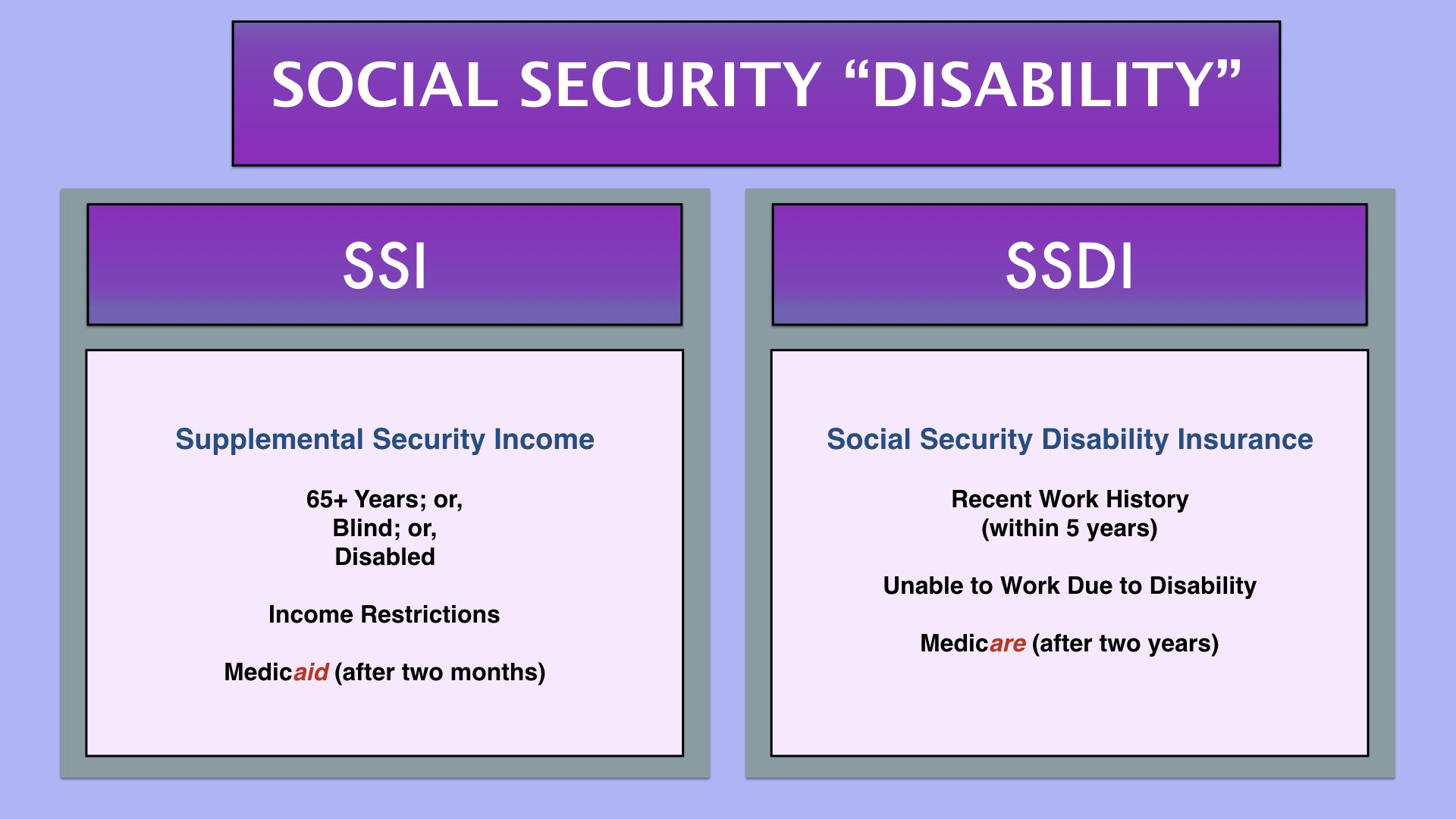

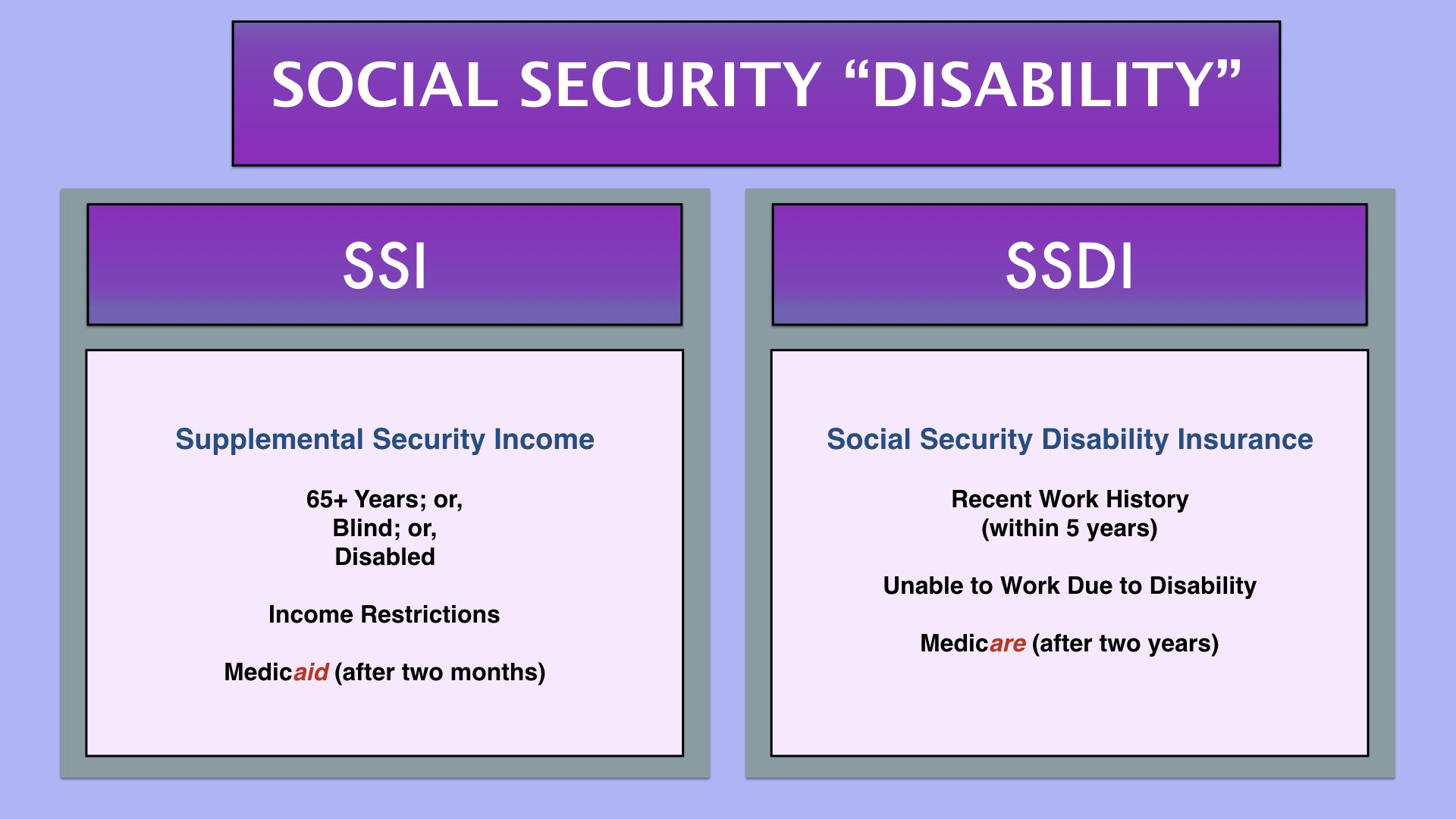

What is the difference between Social Security and SSI?

Social Security benefits may be paid to you and certain members of your family if you are “insured” meaning you worked long enough and paid Social Security taxes. Unlike Social Security benefits, SSI benefits are not based on your prior work or a family member's prior work.

Which pays more Social Security or disability?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

What is the monthly amount for Social Security disability?

SSDI payments range on average between $800 and $1,800 per month. The maximum benefit you could receive in 2020 is $3,011 per month. The SSA has an online benefits calculator that you can use to obtain an estimate of your monthly benefits.

At what age does disability become Social Security?

At full retirement age — which is 66 and 4 months for those born in 1956 and is gradually rising to 67 over the next several years — your SSDI payment converts to a retirement benefit.

What are the 3 types of Social Security?

Social Security Benefits: Retirement, Disability, Dependents, and Survivors (OASDI)

How long can you collect Social Security Disability?

To put it in the simplest terms, Social Security Disability benefits can remain in effect for as long as you are disabled or until you reach the age of 65. Once you reach the age of 65, Social Security Disability benefits stop and retirement benefits kick in.

Who Can Apply For Adult Disability Benefits Online?

You can use the online application to apply for disability benefits if you: 1. Are age 18 or older; 2. Are not currently receiving benefits on your...

How Do I Apply For Benefits?

Here is what you need to do to apply for benefits online: 1. Print and review the Adult Disability Checklist It will help you gather the informatio...

What Information Do I Need to Apply For Benefits?

We suggest that you have the following information at hand. It will make completing the application much easier.

Information About Your Work

1. The amount of money earned last year and this year 2. The name and address of your employer(s) for this year and last year 3. A copy of your Soc...

What Documents Do I Need to provide?

We may ask you to provide documents to show that you are eligible, such as: 1. Birth certificate or other proof of birth; 2. Proof of U.S. citizens...

What Are The Advantages of Applying Using Our Online Disability Application Process?

Our online disability application process offers several advantages. You can: 1. Start your disability claim immediately. There is no need to wait...

What Happens After I Apply?

After we receive your online application, we will: 1. Provide confirmation of your application- either electronically or by mail. 2. Review the app...

What Other Ways Can I Apply?

You can also apply: 1. By phone - Call us at 1-800-772-1213 from 7 a.m. to 7 p.m. Monday through Friday. If you are deaf or hard of hearing, you ca...

How are disability and retirement benefits funded?

Both disability and retirement benefits are funded by contributions made by payroll deductions. Social Security disability and retirement benefits are funded by a FICA tax of 15.3% of the worker’s gross earnings, which includes contributions for both Social Security and Medicare. The Social Security withholding applies to earnings below $128,400 in ...

How long does it take to get disability benefits?

Assuming you have enough work credits earned based on your age, disability benefits are available long before retirement age. Disabled workers under age 24, for example, only need six work credits earned in the three years prior to their disability. Social Security disability benefits are available up until the full age of retirement.

How many work credits are needed for Social Security?

Both Social Security disability and retirement benefits use work credits to determine eligibility. In most cases, a total of 40 work credits are required for full benefits. For disability benefits, 20 of the 40 work credits must be earned in ...

How much does Social Security pay at 62?

At age 62, Social Security retirement benefits only pay 75% of the full benefit.

How old do you have to be to get Social Security?

Social Security retirement benefits can be affected by your age, when you begin to draw benefits, and the average of your 35 highest-earning working years. There’s also a cap on how much can be received as a retirement benefit. Partial benefits can be paid at age 62, with full benefits available at age 65 to 67, depending on your birth year.

How many people will receive Social Security in 2021?

April 19, 2021. About one in six people in the United States collect some form of Social Security benefits each month, a total of nearly 60 million recipients. We often think of Social Security as a well-known retirement benefit, but Social Security is an expansive program with many types ...

Can you get SSDI if you have never worked?

A third option, Supplemental Security Income (SSI), is available to low-income individuals who have a disability and haven’t earned sufficient work credits to qualify for SSDI, including those who have never worked. Unlike Social Security disability and retirement benefits, SSI is not funded by payroll deductions.

How much does Social Security increase after FRA?

After you reach your FRA, your Social Security benefit amount increases by 0.8% for every month you hold off on electing. This continues until you reach 70, at which point your benefit reaches its maximum. In this situation, your monthly Social Security benefit would be larger than your monthly Disability benefit.

Is disability higher than Social Security?

However, if you’re wondering if Disability would pay more, just ask yourself where you are relative to your full retirement age. If you’re under it, disability will be higher. If you’re above it, Social Security will be higher. Just like with any other Social Security issue, the way you can optimize your experience is by thoroughly understanding all of your options.

When will Social Security be replaced with Social Security?

And if you haven’t yet reached early or full retirement age and you’re receiving SSDI, those benefits will be replaced with Social Security income once you reach age 62. But exceptions apply to those who take early retirement before being approved for SSDI benefits. Tips for Getting Retirement Ready.

How old do you have to be to get Social Security?

Also known as Supplemental Security Income (SSI), you can receive Social Securityretirement benefits as long as you’re at least 62 years old and have at least 40 work credits.

Can you get both disability and early retirement?

The Exception to the Rule. You may be able to get both benefits if you opted for early retirement before you received disability benefits. These are also known an concurrent benefits. This exception would be applicable in a situation where an individual retired early due to serious medical conditions.

Where does Social Security disability come from?

Social Security disability comes from the federal government and receives its funding from federal payroll taxes. State disability, as its name indicates, operates at the state level — and only in certain states. States that offer disability programs do so on a short-term basis.

How long does a disability last?

This makes them an ideal stopgap measure for people who are not disabled long enough to qualify for Social Security disability, which requires you to have a medical condition that lasts or is expected to last 12 months or longer. Most state programs provide benefits ...

How long can you be on short term disability in New York?

New York. New York has a disability benefits law that requires all employers in the state to provide short-term disability to employees who have been with the company at least four weeks. If you get approved for short-term disability in New York, you can receive 50% of your average weekly income for up to 26 weeks.

How long does a short term disability last in Rhode Island?

Rhode Island. Rhode Island offers up to 30 weeks of short-term disability to employees who qualify for benefits. The state has complex rules used to determine who is eligible, and if you get approved, the formula to calculate your benefit amount is also arcane and complicated.

What is the purpose of Social Security?

Social Security is a federal government entitlement program that provides benefits to disabled workers as well as people with limited financial means. There are two federal programs: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI), both of which operate under the purview of the Social Security Administration (SSA).

How long do you have to work to get disability in Hawaii?

Hawaii. Hawaii provides up to 26 weeks of short-term disability benefits. To qualify, you must have worked for your current employer for at least 14 weeks and earned an average of $400 per week. If you meet these requirements, you can receive up to 58% of your average salary during your disability period.

What is the number to call for Social Security Disability?

For a free case evaluation with a member of our team, call 865-566-0800.

What is the difference between SSDI and SSDI?

The main difference between Social Security Disability (SSDI) and Supplemental Security Income (SSI) is the fact that SSDI is available to workers who have accumulated a sufficient number of work credits, while SSI disability benefits are available to low-income individuals who have either never worked or who haven't earned enough work credits to qualify for SSDI.

Why are SSDI rates higher than SSI?

There are a number of possible reasons for this. First, SSDI are more likely than SSI applicants to have a higher income and insurance coverage, which means they're more likely to have seen a doctor for their medical problems.

How is SSDI funded?

What Is SSDI? Social Security Disability Insurance is funded through payroll taxes. SSDI recipients are considered "insured" because they have worked for a certain number of years and have made contributions to the Social Security trust fund in the form of FICA Social Security taxes.

How long does it take to get Social Security benefits after you become disabled?

There is a five-month waiting period for benefits, meaning that the SSA won't pay you benefits for the first five months after you become disabled. The amount of the monthly benefit after the waiting period is over depends on your earnings record, much like the Social Security retirement benefit.

What is SSI income?

What Is SSI? Supplemental Security Income is a program that is strictly need-based, according to income and assets, and is funded by general fund taxes (not from the Social Security trust fund).

How much income do you need to qualify for SSI?

To meet the SSI income requirements, you must have less than $2,000 in assets (or $3,000 for a couple) and a very limited income. Disabled people who are eligible under the income requirements for SSI are also able to receive Medicaid in the state they reside in.

Can a disabled person get Medicare?

After receiving SSDI for two years, a disabled person will become eligible for Medicare. Under SSDI, a disabled person's spouse and children dependents are eligible to receive partial dependent benefits, called auxiliary benefits. However, only adults over the age of 18 can receive the SSDI disability benefit.

Can I Receive Both Disability and Retirement Benefits From Social Security?

In most cases, the answer is no. The benefits you receive through Social Security Disability Insurance, also known as SSDI, are the same amount that you would receive in regular Social Security benefits at your full retirement age.

What Is Full Retirement Age?

The current full retirement age instituted by the SSA is between 66 and 67 years. At this point, retirees can claim 100% of the benefits they have earned during their lifetime.

An Exception to the Rule

While most people will see little or no difference in the amount of monthly payment they receive after their disability benefits convert to retirement benefits, there is one important exception.

A Note About Spousal Benefits

According to the SSA, spousal and family benefits for those receiving SSDI payments are capped at 50% of your benefits per individual and about 180% for an entire family. These spousal and family benefits are available in specific situations that may not apply to you.

How is SSDI funded?

SSDI is funded by Social Security payroll taxes, so in order to be considered insured, you must have worked long enough, recently enough, and you must have paid Social Security taxes on your earnings. Once you qualify for disability, your benefits will continue unless your disability improves or until you reach retirement age.

How much is SSDI based on lifetime earnings?

This is because the SSA calculates your SSDI benefits as though you have already reached full retirement age, which is equal to 100% of your maximum benefit based on your lifetime earnings.

What age can I collect Social Security?

Once you have amassed enough work credits, paid into Social Security through federal taxes, and reached age 62, you can begin collecting retirement benefits. The amount of your monthly benefit depends on how much you worked, ...

How long does a disability last?

In addition, the qualifying condition must have lasted or be expected to last for at least one (1) year (or alternatively, to result in that person’s death). Unlike other Social Security programs such as Supplemental Security Income (SSI), qualifying for disability also requires that you have earned enough work credits.

Can I receive Social Security Disability and Retirement at the same time?

In most cases, you cannot receive Social Security disability and retirement benefits at the same time, since SSDI benefits are meant for those who cannot work due to injury or illness. If you’re receiving retirement benefits, it is already implicit that you are no longer working. There is one exception to this rule, however.

Who administers the Social Security program?

Both are administered by the Social Security Administration (SSA), and both are programs designed to provide financial assistance to Americans who can no longer work. Both programs also have specific requirements beneficiaries must meet in order to qualify for benefits.

Do SSDI benefits stay the same?

Once you successfully get approved for disability benefits, your monthly benefits should stay the same unless your disability improves, you start engaging in Substantial Gainful Employment (SGA), or you have a spouse whose income surpasses SSDI threshold levels.