Limited plans can help pay for:

- Hospitalization

- Diagnostic tests

- Routine exams and office visits

- Emergency room visits

- Prescriptions

What is the difference between POS and PPO insurance?

POS plans allow out-of-network care, but there’s usually paperwork that members have to file, which doesn’t happen in a PPO. POS plans often have higher deductibles than PPOs. POS plans require that you choose a primary care provider; PPOs don’t demand that.

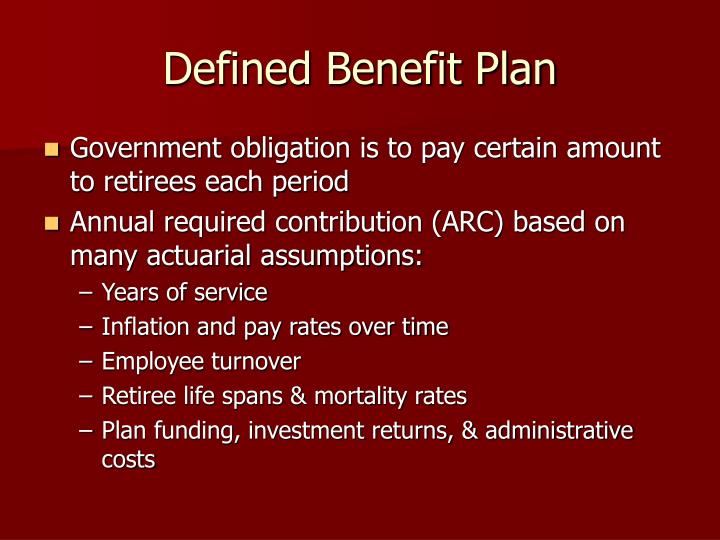

What are the advantages of a defined benefit plan?

What Are the Advantages of a Defined Benefit Plan?

- Guaranteed Benefits. Unlike most other retirement schemes, a defined benefit plan allows you to determine exactly how much you’ll receive at retirement.

- Reduce Your Tax Liability. Introducing a defined benefit plan to your business can significantly reduce your tax liabilities. ...

- Spouses Can be Employees. ...

Which pension plan is the best plan?

Those include:

- Railroad employee benefits

- Thrift Savings Plans (TSP)

- Defined benefit pension plans

What is a limited benefit hospital indemnity plan?

Limited-benefit plans are medical plans with much lower and more restricted benefits than major medical insurance, but with lower premiums.Limited-benefit plans include critical illness plans, indemnity plans (policies that only pay a pre-determined amount, regardless of total charges), and “hospital cash” policies.

What does limited benefit plan mean?

Limited-benefit plans are medical plans with much lower and more restricted benefits than major medical insurance, but with lower premiums. Limited-benefit plans include critical illness plans, indemnity plans (policies that only pay a pre-determined amount, regardless of total charges), and “hospital cash” policies.

What does a limited benefit plan cover?

Common limited benefit plans include fixed indemnity plans, critical illness plans, disease-only plans, accident-only plans, accidental death and dismemberment, and hospital cash policies.

What are limited benefit plans quizlet?

Limited-benefit plan. a medical expense plan that generally provides first-dollar coverage for certain medical expenses but has significantly lower benefits for catastrophic expenses than do other types of medical expense plans.

What is a limited health care plan?

Limited Medical is supplemental insurance that pays you fixed benefits to help with every day medical expenses. You can use its benefits alone or in addition to your primary insurance to give you extra help with those unavoidable out-of-pocket expenses and other costs major medical doesn't cover.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

What is a benefit limit?

BENEFIT LIMIT means the total benefit allowed under this plan for a covered healthcare service. The benefit limit may apply to the amount we pay, the duration, or the number of visits for a covered healthcare service.

When determining the monthly benefit amount for disability income policy the factor that limits the amount a prospective insured may purchase is?

When determining the monthly benefit amount for a Disability Income policy, the factor that limits the amount a prospective insured may purchase is income. After the 30-day Elimination period has been satisfied, the total benefit paid on this claim is $1,250 ($500+$500+$250).

What are the six types of health insurance for individuals who participate in individual group or pre paid plans quizlet?

In this ArticleHealth Maintenance Organization (HMO)Preferred Provider Organization (PPO)Exclusive Provider Organization (EPO)Point-of-Service Plan (POS)Catastrophic Plan.High-Deductible Health Plan With or Without a Health Savings Account.

How long is a benefit period for a major medical expense plan?

one to three yearsA period of time typically one to three years during which major medical benefits are paid after the deductible is satisfied. When the benefit period ends, the insured must then satisfy a new deductible in order to establish a new benefit period.

What is limited service policy?

Limited Policy coverage is a basic type of insurance policy that only pays benefits in the event of certain occurrences or specific events as specified in the contract.

What is a benefit insurance?

Benefit: A general term referring to any service (such as an office visit, laboratory test, surgical procedure, etc.) or supply (such as prescription drugs, durable medical equipment, etc.) covered by a health insurance plan in the normal course of a patient's healthcare.

How do I choose the best health insurance plan?

Here are a few tips to help you find the right plan.1 - Figure out where and when you need to enroll. ... 2 - Review plan options, even if you like your current one. ... 3 - Compare estimated yearly costs, not just monthly premiums. ... 4 - Consider how much health care you use. ... 5 - Beware too-good-to-be-true plans.More items...•

Is health insurance employer based?

Despite various movements to overhaul health care delivery and funding in the US, the standard for providing health insurance is still employer-based. If you do not have “traditional” health coverage through your employer, you may be eligible to elect coverage under a limited benefit medical plan.

Is a limited benefit medical plan a major medical plan?

A Limited Benefit Medical plan is not a comprehensive major medical plan, nor is it intended to replace a major medical plan. The plan is intended to provide you, and your covered dependents, with basic insurance coverage that is capped at specific amounts for specific services.