Differences Between Defined Benefit and Defined Contribution Plans

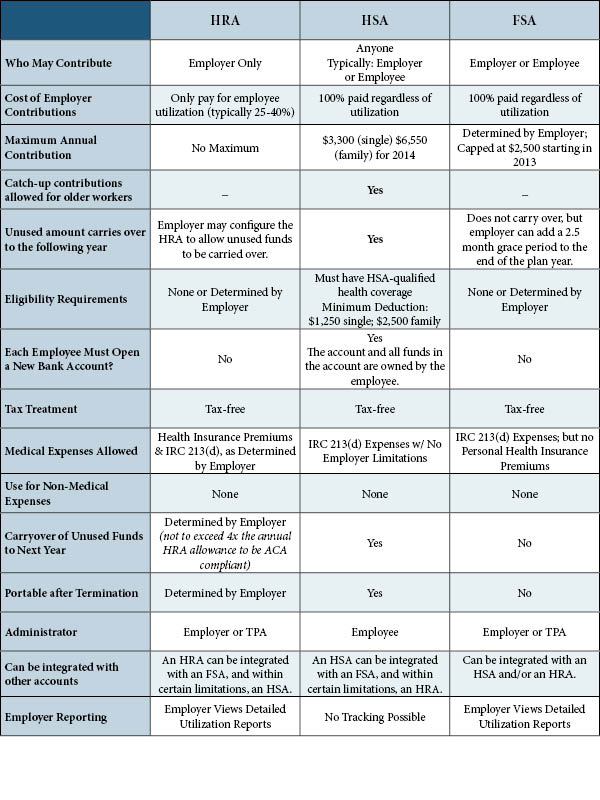

| Defined contribution plan | Defined benefit plan | |

| Investment risk | Defined contribution plan Born by the em ... | Defined benefit plan Born by the employe ... |

| Contributions | Defined contribution plan Made by employ ... | Defined benefit plan Made by the employe ... |

| How is the benefit determined? | Defined contribution plan The employee’s ... | Defined benefit plan The employee’s bene ... |

| How do participants take their benefits? | Defined contribution plan Money can be w ... | Defined benefit plan Typically benefits ... |

How much can I contribute in a defined benefit plan?

- Client's age - In general, the older the client then the larger the annual contribution that can be made into the plan.

- Client's income - The calculation is based on the average of the client's highest 3 years of income. ...

- Planned retirement age - In general, at least 5 years from the year the plan is adopted.

How is a defined benefit plan contribution calculated?

- Substantial benefits (read money) can be provided and accrued within a short time – even with early – retirement

- Employers may contribute (and deduct) more than is permissible under other retirement plans such as Defined Contribution Plans

- Plan provides a predictable and guaranteed benefit, and the benefits are not dependent on asset returns

What are the advantages of a defined contribution plan?

A Status Report on Private Equity in Defined Contribution Plans

- An Important Letter. Before the DOL’s letter, the topic of PE in DC plans was dead, Collins says. ...

- PE and Excess Returns. Recent research has largely supported PE’s potential role in plan participants’ portfolios. ...

- PE Questions Remains. ...

- Some Considerations and Conclusions. ...

- The Role of Trendsetters. ...

Is defined contribution plan a taxable benefit to the employer?

Defined Benefit Plan Contributions Are Tax-deductible. As mentioned, when pre-funding the Defined Benefit Plan, employer contributions up to the maximum annual limit are tax-deductible. Moreover, employees are not taxed on the employer contributions that are made on their behalf. In fact, employees are not taxed until the distribution of their benefits.

What's better defined benefit or defined contribution?

As the names imply, a defined-benefit plan—also commonly known as a traditional pension plan—provides a specified payment amount in retirement. A defined-contribution plan allows employees and employers (if they choose) to contribute and invest in funds over time to save for retirement.

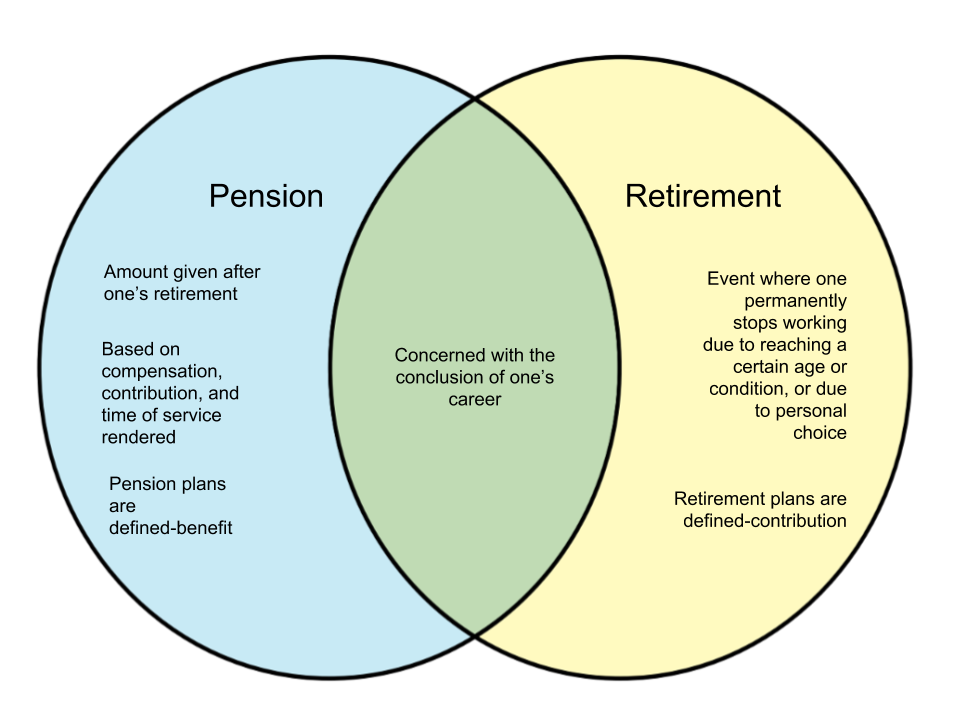

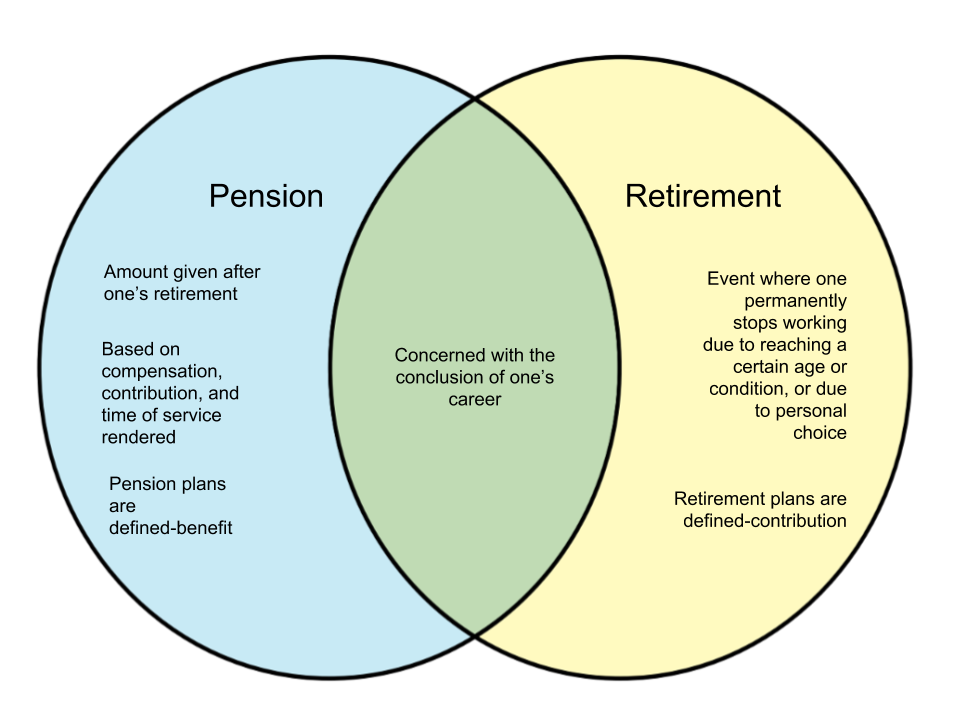

What is the difference between a defined benefit and defined contribution pension?

A defined contribution (DC) pension scheme is based on how much has been contributed to your pension pot and the growth of that money over time. It may be set up by you or an employer. A defined benefit (DB) plan is always set up by an employer and offers you a set benefit each year after you retire.

What is the difference between defined benefit and defined contribution UK?

defined contribution - a pension pot based on how much is paid in. defined benefit - usually a workplace pension based on your salary and how long you've worked for your employer.

What is the difference between a defined benefit and a defined contribution quizlet?

What is the difference between defined benefit plans and defined contribution plans? Defined benefit plans guarantee payments to retirees while defined contribution plans make contributions to retiree account without making guarantees.

What are the 3 main types of pensions?

The three types of pensionDefined contribution pension. Sometimes called a 'money purchase' pension or referred to as a pension pot, these schemes are very common today. ... Defined benefit pension. This type of pension scheme has declined in popularity. ... State pension.

What is one disadvantage to having a defined benefit plan?

The main disadvantage of a defined benefit plan is that the employer will often require a minimum amount of service. Although private employer pension plans are backed by the Pension Benefit Guaranty Corp up to a certain amount, government pension plans don't have the same, albeit sometimes shaky guarantees.

Is a defined benefit pension plan good?

Easier to plan for retirement – defined benefit plans provide predictable income, making retirement planning much more straightforward. The predictability of these plans takes the guesswork out of how much income you will have at retirement.

Is a DB pension better than DC?

DB schemes have been the gold standard for pensions as they are much more secure and generally more generous than DC pensions and pay an income that increases in line with inflation. However, as people live longer DB pensions have become too expensive for companies and their numbers have dwindled.

Can I take my defined benefit pension as a lump sum?

Taking your defined benefit pension as a lump sum You might be able to take your whole pension as a cash lump sum. If you do this, up to 25% of it will be tax-free, and you'll have to pay Income Tax on the rest.

What is the best option for your retirement plan?

To optimize your retirement accounts, experts recommend investing in both a 401(k) and an IRA in the following order: Max out your 401(k) match: The 401(k) is your top choice if your employer offers any kind of match. Once you receive this maximum free money, consider investing in an IRA.

What are the main differences in the management of a defined benefit pension plan compared with the management of a defined contribution pension plan?

A defined-contribution plan allows employees and employers (if they choose) to contribute and invest funds to save for retirement, while a defined-benefit plan provides a specified payment amount in retirement. These crucial differences determine whether the employer or employee bears the investment risks.

How are defined benefit plans different from defined contribution plans How are they similar quizlet?

How are they similar? As the name suggests, defined benefit plans spell out the specific benefit the employee will receive on retirement. In contrast, defined contribution plans specify the maximum annual contributions that employers and employees may contribute to the plan.

Why are defined contribution plans more attractive?

Defined contribution plans are also typically more attractive to employees who want to feel like they have more control over their retirement money. If you are considering switching your pension plan, it is always best to speak with a qualified financial adviser who specialises in your particular pension scheme.

What is defined contribution plan?

Under a defined contribution plan, both the employer and employee provide funding into the latter’s account. Employer contributions are guaranteed and formula-derived, yet income levels at retirement for the employee are dependent upon the fund’s performance. Under a defined benefit plan, the employer provides all contributions to ...

Can an employer contribute to a pension plan?

Under a defined contribution plan, employees and the employer are allowed to contribute money towards the pension plan. An example of how this might work follows. An employer might contribute towards an employee’s pension pot based on the latter’s age, salary, and years of service with the business. As such, a new, relatively-young employee might ...

Do defined benefit plans provide income security?

The big allure of defined benefit plans is the income security it provides people in old age, meaning you do not have to really worry about saving for a comfortable retirement.

Do you know what your retirement income will be?

They do not know for sure what their retirement income will be once they retire, because it will depend on how their investments have performed. A defined benefit plan, however, has some important differences to the above. First of all, this plan provides employees with a predetermined retirement benefit.

Can an employee calculate their contributions each year?

They can calculate their contributions each year, and provided they follow their obligations in this respect, they can more or less rest easy. From the employee’s perspective, however, there is some uncertainty.

Is there a defined benefit plan in the UK?

In the UK private sector (and also the US), there has been a notable supplanting of defined benefit plans by defined contribution plans. The reasons for this are controversial and up for debate, but there are few plausible explanations. First of all, people across the western world are getting older.

What is the difference between defined contribution and defined benefit pension?

The difference between defined benefit pension and defined contribution pension mainly depends on who funds the plan. While defined benefit pension is a plan usually funded by the employer, defined contribution pension is based on the contributions made by both employer and employee . Defined contribution pension is more flexible compared to defined benefit pension since it gives the investor a wide variety of options to choose from. However, both types of plans are initiated to fulfill a similar objective, which is to ensure the availability of a lump sum at the retirement period.

What is defined benefit pension?

Defined benefit pension is a pension plan in which an employer contributes with a guaranteed lump-sum on employee’s retirement that is determined based on the employee’s salary history and other factors.

What is pensionable service?

Pensionable service is the number of years the employee had been a part of the pension scheme. Accrual rate is the proportion of earnings for each year the employee will receive as pension (this is generally denominated as 1/60th or 1/80th) Pensionable earnings is the salary at retirement/ salary averaged over the career.

What is a 403b plan?

403 (b) plan is a retirement plan similar to 403 (b) for employees of public schools and tax-exempt organizations. This is also referred to as Tax Sheltered Annuity (TSA) plan. Defined contribution pension plans are also subjected to an early withdrawal tax of 10% if the funds are withdrawn before the age of 59 years.

What is 401(k) investment?

401 (k) plan is an investment plan established by employers to make salary deferral contributions for eligible employees on a pre-tax basis. 401 (k) is generally subjected to high contribution limits, and have limited flexibility

What is an IRA account?

Individual Retirement Account (IRA) With an IRA, the employee invests a certain amount of money for retirement savings in an account set up through the employer, a banking institution or an investment firm. In IRAs, funds are dispersed into different investment options to generate a return.

Is defined benefit taxable?

Defined benefits are fully taxable if no contributions were made by the employee and if the employer did not withhold contributions from employee’s salary. In that case, the funds will be included in the total amount due as income tax.

Defined-Benefit Plan

- Defined-benefit plans provide eligible employees guaranteed income for life when they retire. Employers guarantee a specific retirement benefit amount for each participant that is based on factors such as the employee’s salary and years of service.1 Employees have little control over t…

Defined-Contribution Plan

- Defined-contribution plans are funded primarily by the employee. But many employers make matching contributions to a certain amount.1 The most common type of defined-contribution plan is a 401(k). Participants can elect to defer a portion of their gross salary via a pre-tax payroll deduction to the plan, and the company may match the contribution if it chooses, up to a limit it …

Defined-Benefit Plan vs. Defined-Contribution Plan Example

- Most private-sector employees are offered and take a defined-contribution plan. They carry less risk for the employer as they are not responsible for managing the account themselves, and offer much more flexibility to the employee. If John were to contribute to a defined-contribution plan such as the popular 401(k), he would be able to have access to his funds while making his own i…

Defined Contribution vs. Defined Benefit

Why Are Defined Benefit Plans Declining?

- In the UK private sector (and also the US), there has been a notable supplanting of defined benefit plans by defined contribution plans. The reasons for this are controversial and up for debate, but there are few plausible explanations. First of all, people across the western world are getting older. As such, it has become more financially difficult for businesses to provide the incomes pe…

So, Which Plan Is Better?

- You might be tempted to jump to the conclusion that defined benefit plans are the best. From the employee’s perspective, that’s certainly intuitive. However, it depends on each specific person’s unique goals and circumstances. The big allure of defined benefit plans is the income security it provides people in old age, meaning you do not have to really worry about saving for a comforta…

Defined-Benefit vs. Defined-Contribution Plan: An Overview

- Employer-sponsored retirement plans are divided into two predominant courses: defined-benefit plans and defined-contribution plans. As the names point out, a defined-benefit plan—moreover usually known as an ordinary pension plan—provides a specified price amount in retirement. An outlined-contribution plan permits staff and employers (within the occasion that they choose) t…

Defined-Benefit Plan

- Defined-benefit plans current eligible staff assured earnings for all instances as soon as they retire. Employers guarantee a specific retirement revenue amount for each participant that is based totally on elements akin to the employee’s wage and years of service. Employees have little administration over the funds until they’re obtained in retirement. The agency takes accountabili…

Defined-Contribution Plan

- Defined-contribution plans are funded primarily by the employee. But many employers make matching contributionsto a certain quantity. The commonest form of defined-contribution plan is a 401(okay). Participants can elect to defer a portion of their gross wage by the use of a pre-tax payroll deduction to the plan, and the company would possibly match the contribution if it choos…

Defined-Benefit Plan vs. Defined-Contribution Plan Example

- Most private-sector staff are provided and take a defined-contribution plan. They carry a lot much less risk for the employer as they don’t seem to be liable for managing the account themselves, and supply far more flexibility to the employee. If John have been to contribute to a defined-contribution plan akin to the favored 401(okay), he can be ab...