So what are the contribution limits?

| Age | Maximum Annual Contribution |

| 40 | $139,000 |

| 41 | $144,000 |

| 42 | $149,000 |

| 43 | $154,000 |

What is the 415C limit?

The 415 (c) limit is 54,000 (for anyone earning at least $54,000) but the $6,000 catch-up is not part of the 415 (c) limit. So if you have employee over age 50 who deferred the maximum $24,000 (including catch-up) then the remaining allocation to reach the 415 (c) limit is technically $54,000 - $18,000 = $36,000.

How to calculate 415 limits?

The types of contributions subject to the limit include:

- elective contributions (pre-tax or Roth) made to 401 (k), and salary reduction SEP plans;

- after-tax employee contributions;

- employer matching contributions;

- employer profit-sharing contributions; and

- any employer contributions.

What are 415 limits?

This limit (also known as the “annual additions limit” or “415 limit”) regulates the amount of ALL contributions (pre-tax deferrals, Roth contributions, after-tax contributions, and employer matching and profit sharing contributions) that can be made to ANY single plan in any year.

What is section 415 limit?

This limit on these “Annual Additions'' is set forth in IRC Sec. 415. The 415 Annual Additions limit is equal to the lesser of 100% of the participant’s annual compensation (up to the limit on the compensation of $285,000 for 2020 or $290,000 for 2021) or an annually adjusted dollar amount. For 2020, the dollar amount was $57,000.

What is the maximum Defined Benefit Plan contribution 2021?

Defined contribution limits for 2021 and 2022. The limit on contributions, other than catch-up contributions, for a participant in a defined contribution plan is $58,000 for 2021 and increases to $61,000 for 2022.

What is the maximum defined contribution limit?

$20,500Employees can contribute up to $19,500 to their 401(k) plan for 2021 and $20,500 for 2022.

How much can you contribute to a defined contribution plan?

Currently, the maximum amount an employee can contribute to a plan is $19,500 per year. If you are age 50 or older, you can add up to an additional $6,500, for a total of $26,000 per year (known as catch-up contributions).

What is the defined contribution limit for 2020?

to $57,000The limitation for defined contribution (DC) plans under § 415(c)(1)(A) is increased in 2020 from $56,000 to $57,000.

What is the contribution limit for 2020?

Highlights of changes for 2020 The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's Thrift Savings Plan is increased from $19,000 to $19,500.

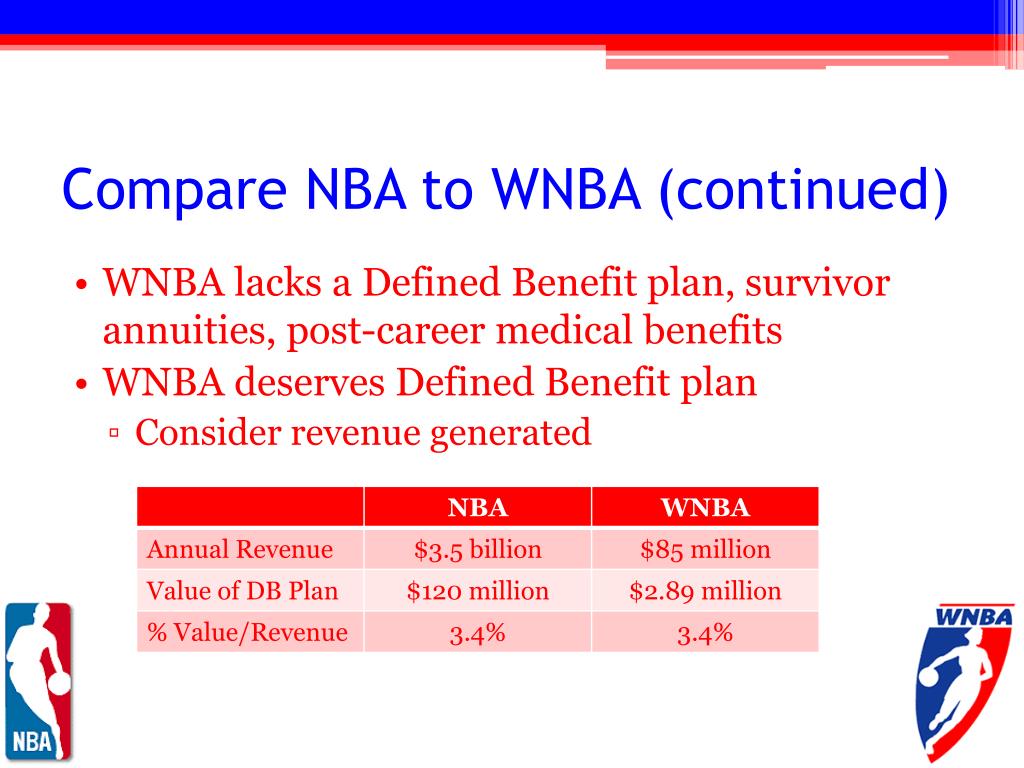

Can you contribute to a defined benefit plan?

Employers are normally the only contributors to the plan. But defined benefit plans can require that employees contribute to the plan. You may have to work for a specific number of years before you have a permanent right to any retirement benefit under a plan.

Can I contribute 100% of my salary to my 401k?

The maximum salary deferral amount that you can contribute in 2019 to a 401(k) is the lesser of 100% of pay or $19,000. However, some 401(k) plans may limit your contributions to a lesser amount, and in such cases, IRS rules may limit the contribution for highly compensated employees.

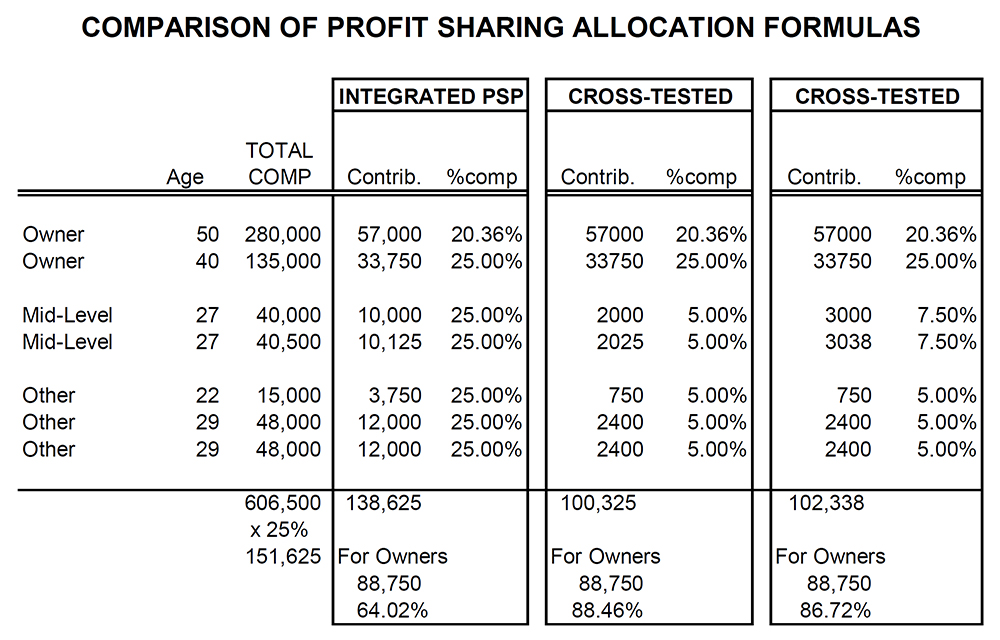

How are the annual contributions limits determined in a Defined Benefit Plan?

Calculating the annual dollar amount that can be contributed requires a mathematical calculation performed by an actuary involving the following fa...

How does investment performance impact the required annual contributions for each type of Defined Be...

Fully InsuredWith a fully insured defined benefit plan contributions are made to an annuity which earns an annual interest rate guaranteed by an in...

I am self employed with no employees and in 2020 will have $230,000 of net income for my sole propri...

Calculating the annual dollar amount that can be contributed to a Defined Benefit Plan requires a mathematical calculation performed by an actuary....

I am self employed, age 45 with no employees and I had an income windfall this year and anticipate o...

No probably not. In order for a defined benefit plan to be a good option, the business owner should feel confident about being able to make the req...

>Can a Defined Benefit Plan be amended if my income changes?

Yes. In general, you can amend the plan to increase or decrease the benefit formula. By amending the plan it will increase or decrease the annual c...