- Check to see if you meet the requirements to apply online for disability

- Gather the information you need to complete the application

- Go To SSA Online Services

- Enter your information for your claim

- Submit your online application with the Federal Social Security Administration

- A disability analyst from the NYS Division of Disability Determinations will review your case and determine whether or not you are disabled according to federal guidelines.

What qualifies for short term disability?

What are the most approved disabilities?

- Arthritis. Arthritis and other musculoskeletal disabilities are the most commonly approved conditions for disability benefits. …

- Heart Disease. …

- Degenerative Disc Disease. …

- Respiratory Illness. …

- Mental Illnesses. …

- Cancer. …

- Stroke. …

- Nervous System Disorders.

How much does short term disability pay in New York?

No, short-term disability does not pay 100% of your income. Each policy has different parameters for the percentage of pay and the maximum monthly benefit. For example, the New York State plan covers 50% of earnings and tops out at $170 per week, while the California program replaces up to 70% and maxes at approximately $1,357 weekly.

Are You entitled to pay from your employer for a short term disability?

While only a handful of states require employers to offer short-term disability benefits, SHRM reports that 80% of companies pay all of the premiums for short-term and long-term disability. Great job, employers! Some employees are eligible for short-term disability insurance as soon as they’re hired.

What are the top 10 conditions that qualify for disability?

- Phenylketonuria (PKU)

- Other inborn errors of metabolism not specified elsewhere that are treated by medically prescribed diet to prevent neurological disability and/or severe organ damage. ...

- Cystic Fibrosis.

Who is eligible for NYS short-term disability?

The employees who are covered by disability include: An individual who is working or has recently worked (and is collecting unemployment) at least four consecutive weeks at a job that is considered to be owned by a "covered employer." Individuals who change from one covered employer to another covered employer.

How much do you get for short-term disability in NY?

You will receive 60 percent of your regular monthly salary up to a maximum of $7,500 per month (this amount is offset by other income such as disability insurance, Workers' Compensation and actual or estimated Social Security benefits).

What qualifies for short-term disability?

To qualify for short-term disability benefits, an employee must be unable to do their job, as deemed by a medical professional. Medical conditions that prevent an employee from working for several weeks to months, such as pregnancy, surgery rehabilitation, or severe illness, can qualify to receive benefits.

How is short-term disability paid?

Who pays for short-term disability? If your company offers short-term disability, it can generally be structured in two ways: Self-funded or self-administered: Your employer provides and funds this benefit themselves. Insurance: Your employer works with an insurance company to provide this benefit.

How long does it take to get NYS disability?

Main Takeaways: If your initial application is accepted, it will take between three and six months after your application is filed to get a decision on your claim. If your initial application is denied, it will take 12 to 16 months for your appeal papers to be processed and a hearing date scheduled.

Can you collect unemployment and disability at the same time in NY?

If you are receiving Unemployment Insurance benefits and become disabled between four and 26 weeks after ending employment, you may be eligible for disability benefits from the first day of disability. However, you cannot receive Unemployment Insurance benefits and disability benefits at the same time.

How much do you get for disability in New York State?

Disability benefits are equal to 50 percent of the employee's average weekly wage for the last eight weeks worked, with a maximum benefit of $170 per week (WCL §204). If counting the last week in which the disability began lowers the benefit rate, it is not included in determining average weekly wage.

How do you qualify for state disability?

Be unable to do your regular or customary work for at least eight days. Have lost wages because of your disability. Be employed or actively looking for work at the time your disability begins. Have earned at least $300 from which State Disability Insurance (SDI) deductions were withheld during your base period.

What is the benefit of short term disability?

Short Term disability (STD) pays between 40 to 70% of your base salary, for non-work related illness or injury that prevents you from working for a set-period of time. Work related injuries are covered by workers compensation. The benefit eligibility period generally lasts between 3 to 6 months.

How long can you stay on short term disability?

How Long Does Short Term Disability Provide Income Replacement? STD provides income replacement for up to a period of 17 or 26 weeks. Employees still unable to return to work at the end of the STD period may be eligible to transition to Long Term Disability (LTD) Insurance if they are covered for this benefit.

How do I get paid while on FMLA?

Though the FMLA itself is unpaid, it is sometimes possible – under certain specific circumstances – to use paid leave that you've accrued on the job as a way to get paid during your FMLA leave. The types of paid leave that might be considered include vacation days and sick days, as well as other types of paid leave.

Is short term disability taxable?

Employer-paid short-term disability or long-term disability premiums are not taxable benefits. But any short- or long-term disability benefits you receive in the future from your employer will be taxable.

Who Is Eligible For New York Short-Term Disability Benefits?

In order to be eligible for short-term disability benefits, you must have become injured or ill while not at work but must be employed, or recently...

What Agency Handles Short-Term Disability Benefits in New York?

The New York State Workers’ Compensation Board, under the New York State Department of Labor, oversees short-term disability benefits. New York Sta...

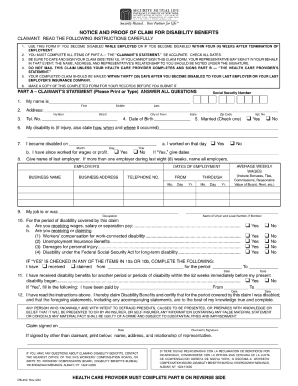

How Do I File A Claim For Short-Term Disability?

It is very important to note that if you become disabled and qualify for short-term disability insurance, you must file your claim within 30 days o...

How Much Can I Expect to Receive in Benefits?

Disability benefits will pay 50% of your average wages (calculated over the prior eight weeks) up to a maximum of $170 per week.Benefits will begin...

What is SSI payment?

SSI benefits also are payable to people 65 and older without disabilities who meet the financial limits.

How to save my SSA disability application?

You can save your application as you go. Check to see if you meet the requirements to apply online for disability. Gather the information you need to complete the application. Go To SSA Online Services. Enter your information for your claim.

How long does it take to get Social Security Disability?

Social Security Disability Insurance benefits are paid starting six months from the onset date of the disability, but no more than 12 months prior to application. A claimant receives monthly benefits deposited directly into their bank account or on a SSA Direct Express Card.

What is disability insurance?

Social Security Disability Insurance pays benefits to you and certain members of your family if you are "insured," meaning that you worked long enough and paid Social Security taxes. The amount of your monthly benefit is based on your lifetime average earnings covered by Social Security.

What are the rules for Social Security?

Social Security program rules assume that working families have access to other resources to provide support during periods of short-term disabilities, including workers' compensation, insurance, savings and investments. Visit SSA’s website to see how they decide if you are disabled. Next Section.

Does Social Security pay for partial disability?

Social Security pays only for total disability. No benefits are payable for partial disability or for short-term disability. "Disability" under Social Security is based on your inability to work. We consider you disabled under Social Security rules if: You cannot do work that you did before;

Can you do work that you did before?

You cannot do work that you did before; We decide that you cannot adjust to other work because of your medical condition (s); and. our disability has lasted or is expected to last for at least one year or to result in death. This is a strict definition of disability.

How long can you get short term disability in New York?

New York employees can receive up to 26 weeks of paid short-term disability benefits per year. If you are injured or you become ill while not on the job, you may be eligible for New York State short-term disability benefits under its Disability Benefits Law (DBL).

What is short term disability?

Individuals who change from one covered employer to another covered employer. As long as your employment was continuous, coverage for short-term disability starts on your first day of work. Domestic workers who work 40 hours or more for one employer. An example of this would be a nanny or personal assistant. Individuals who are not employed by ...

What to do if NYSIF is not your employer's insurance provider?

If NYSIF is not your employer's insurance provider, contact the Worker's Compensation Board. If you are unemployed and have been collecting unemployment benefits for longer than four weeks at the time you become disabled, you will file a DB-300 form.

How long do you have to provide medical evidence for disability?

Medical evidence regarding your disability may be required for the entire period you are requesting benefits. For those who are employed or unemployed for less than four weeks, there is an additional section that must be filled out by your employer.

How many weeks are covered by disability?

The employees who are covered by disability include: An individual who is working or has recently worked (and is collecting unemployment) at least four consecutive weeks at a job that is considered to be owned by a "covered employer.". Individuals who change from one covered employer to another covered employer.

How long do you have to file a DB-450?

It is very important to note that if you become disabled and qualify for short-term disability insurance, you must file your claim within 30 days of becoming disabled. If you are working -- or are unemployed and have been collecting unemployment benefits for less than four weeks -- at the time your disability began, you will file a DB-450 form.

Can you self-insure with NYSIF?

NYSIF may be contacted directly if the insurance fund is your employer's insurer. Another option that is available to employers is the ability to apply to the Board for an exemption that allows them to self-insure, meaning they would pay short-term disability benefits themselves instead of paying for insurance to do so.

What is NYS disability?

New York State (NYS) disability benefits cover temporary and long-term medical conditions that prevent you from working and earning an income. Unfortunately, the two plans have huge holes. You will find that the short-term payment amounts are too small and do not last very long – if you have the coverage. Social Security benefits are slightly ...

How long does short term disability last in New York?

The mandated policy pays claims temporarily (26 weeks) when an eligible medical condition prevents you from working and earning an income.

What is the number to file a claim in New York?

The second contact phone number belongs to the New York Worker’s Compensation Board. Call (877) 632-4996 for assistance in identifying the issuing insurance company.

How much is short term disability in NY?

Complete a debt relief application. With the tiny short-term disability NY amount of $150 weekly, it is too easy to fall behind on your bills. People who know that their medical condition is temporary often find that a settlement program helps reduce financial stress.

What is a C-3 form?

Complete temporary disability NY claim form C-3 if you suffered an on-the-job accident or illness. Workers Compensation covers occupational medical conditions, provides a much higher benefit level. It also may pay for medical care that helps you recover and return to the job.

How long do you have to file a DB-450 in NY?

Complete this paperwork if you were working no less than four weeks before the start date of your medical event to apply for benefit payments.

Do you have to have a medical cause to file a claim in NYS?

NYS Eligibility. NYS short-term disability eligibility requirements fall into two main categories: you have to have the coverage in force, and have a valid medical cause to file a claim. Many employee classes and organizations are exempt from the statutory contribution requirement. However, employers can elect to participate voluntarily.

How to complete a Social Security application?

To complete your application, provide documentation of your situation along with your application forms through the Social Security Administration (SSA). Have the following documents on hand before you begin the application process: – Social Security number.

What are the requirements to get disability?

To be eligible for disability benefits, you must have a medical condition that makes it impossible for you to do the work you did before your illness or injury. You must also have paid into Social Security through a previous employer and earned enough work credits.

How many weeks of disability can you collect?

is paid for a maximum of 26 weeks of disability during any 52 consecutive week period (WCL §205). You cannot collect disability benefits and Paid Family Leave benefits at the same time. The total combined disability leave and Paid Family Leave in any 52-week period may not exceed 26 weeks. Note that the PFL does not provide for the payment ...

How long do you have to wait to file for disability if you have not received a notice of rejection?

If you have received less than 26 weeks of benefits and you are still disabled and you have not received a Notice of Rejection you should submit further medical evidence to request additional benefits.

How long do you have to wait to collect unemployment?

If you have been unemployed for less than four weeks. your disability benefits are provided by your last employer's disability benefits insurance carrier, and. the seven-day waiting period applies. If you have been unemployed for more than four weeks and are collecting unemployment insurance benefits.

What is a day of disability?

A "day of disability" is a day on which you were prevented from performing work because of disability and for which you have not received regular wages or remuneration. You are ineligible for disability benefits if you perform any type of work for which you receive wages or profit, even if performed at home.

How long does it take to get a notice of rejection from disability?

If your claim is rejected or not paid, you will receive a Notice of Rejection from your employer, insurance carrier or the Special Fund for Disability Benefits within 45 days of its receipt of your claim.

How much can you contribute to your unemployment if you have more than one job?

If you have more than one job at the same time, with combined wages of more than $120 per week, you may request each of your employers to adjust your contributions in proportion to the earnings of each employment. The combined contributions may not exceed 60 cents per week.

Can you collect unemployment if you are disabled?

If you get injured or become disabled while you are eligible for or are collecting unemployment benefits, and if your injury or disablement results in you being ineligible for unemployment benefits, you are eligible for disability benefits .

How long does a short term disability last in California?

California’s SDI policy covers claimants for up to 52 weeks — the longest period for any state-managed short-term disability benefits program. Once approved, you may receive up to $1,300 in weekly cash payments, though other factors may change your approved amount. Learn more helpful information about how California’s SDI program works.

How to apply for TDAP benefits?

To qualify, you must submit a complete medical report from a licensed physician to your Local Department of Social Services. You can apply for TDAP benefits in person, by mail or fax. Eligible TDAP applicants may receive cash short-term disability benefits for 12 months only in a 36-month period. If your disability should last more ...

How long does it take to file a TBDL claim in New Jersey?

If you’re unable to work due to an illness or injury that isn’t work-related, you can file a TBDL claim. Be sure to file your claim within 30 days after your first missed day of work, though.

How many hours can you work in Hawaii to qualify for disability?

Hawaiians working at least 20 hours for 14 out of the last 52 weeks may qualify for temporary disability benefits. In addition, applicants must be currently employed when filing a Hawaii Temporary Disability Insurance (TDI) claim in order to qualify.

Does temporary disability go through employer?

Important: Any short-term disability benefits you receive through your state’s temporary assistance program don’t go through your employer. Your employer’s insurance provider is responsible for paying any workers’ comp or short-term disability benefits once your claim is approved. If you believe your workers’ compensation claim was wrongly denied ...

Can I get disability if I have a job?

Yes — if your job’s benefits package includes that specific type of insurance coverage and you’re currently an eligible employee. However, some U.S. states also provide temporary or short-term disability benefits for permanent residents, provided you meet their program requirements. California, Hawaii, Maryland, New Jersey, ...

Can I get SSI if I die?

Unfortunately, the Social Security Administration (SSA) doesn’t have any programs that provide either temporary or short-term disability benefits. If your disability’s expected to last for at least 12 months or result in death, apply for SSI or SSDI. Your disability must prevent you from working for one year to get monthly Supplemental Security ...

Rental Assistance Program

Find out how you can get help with past due rent under the Emergency Rental Assistance Program (ERAP).

P-EBT and SNAP COVID-19

New York State continues to distribute Pandemic EBT food benefits to all households with eligible children who receive free school lunch under the National School Lunch Act.

Home Energy Assistance Program

The Home Energy Assistance Program (HEAP) helps low-income people pay the cost of heating their homes.